Irish factory beef prices may be towards the bottom of what is paid to farmers in the countries to which we export most of our beef, but big changes are taking place in other major beef exporting countries.

Of course, it is what happens in the UK, our main export market and then the rest of the EU, that has greatest impact on our beef prices at present but 2020 could see a significant change in the export market for Irish beef.

Currently, the average EU price for R3 young bulls is 356c/kg, a small increase of 3c/kg over the past three weeks. In Ireland, there has been a marginal decrease from 323c/kg for R3 young bulls to 320c/kg.

The biggest improvement in market performance is in the UK

Even the Irish R3 steer price is currently just 344c/kg, 12c/kg behind the EU average price for young bulls and much further behind the prices paid in the UK and main export markets in the EU.

With sterling dipping below 86p to €1 this week, the biggest improvement in market performance is in the UK where R3 steer prices are 13c/kg better than three weeks ago and now 36c/kg better than the Irish price for the R3 grade.

Outside Europe

The impact of the meat supply deficit in China is now having a strong impact on global prices. Within China, live pig prices have surged by 30% in the past month to the equivalent of 487c/kg, with carcase prices now almost double what they were in July at the equivalent of almost 650c/kg.

Import volumes are expected to reach almost 1.5m tonnes by the end of this year

With the pig breeding herd greatly reduced because of African swine fever, demand from China is growing for all types of meat from across the world.

Even without this problem in the pig herd, demand was already growing rapidly for beef in China.

Import volumes are expected to reach almost 1.5m tonnes by the end of this year, up from just over 1m tonnes in 2018.

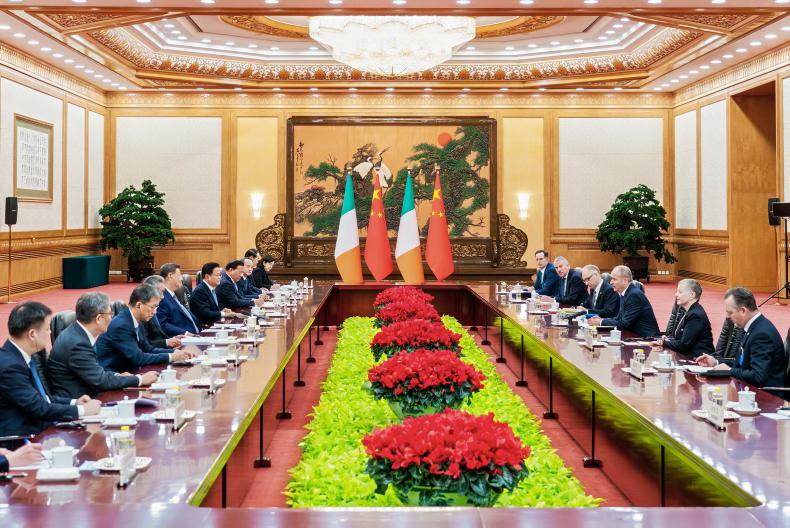

Ireland will now be in a position to grab a slice of this action with 21 locations now approved, as well as one in the north.

However, it isn’t just what Ireland can do with China directly that can affect the beef trade in a positive way in the new year.

Impact of China

China’s demand for beef is primarily met by five major suppliers, Argentina, Brazil, Uruguay, Australia and New Zealand.

While the South American countries have scope to further increase supply, Australia and New Zealand are close to their limit.

This is already having an effect on trade flows between New Zealand and the US, traditionally their biggest export market.

According to Beef and Lamb NZ, exports to the US for the year ending September 2018 amounted to 190,205t but this fell to 133,480t for the year ending September 2019.

In the year ending September 2018, beef exports to China amounted to 93,306t

However, in the same time, there was an equally dramatic change in the export volumes of NZ beef to China.

In the year ending September 2018, beef exports to China amounted to 93,306t but this had jumped to 171,539t in the year ending October 2019.

Similarly, New Zealand is unlikely to fill more than half of its EU quota this year for sheepmeat. Again, China is taking priority.

US market supply

Canada and Mexico have picked up the majority of this supply deficit in the US market, which in the first 10 months of the year imported almost 892,000t of forequarter beef and trimmings, mainly for manufacturing.

Australian supplies remained consistent this year but there are concerns in the US that the first quarter of next year could see a drop in supplies and if there was any reduction in Australian supplies, China is likely to take priority.

This has been reflected by US prices for high-quality lean forequarter beef imports which at 95cl are almost €2/kg higher than a year ago.

Irish exporters are now also in the US market, shipping 4,700t so far this year, a doubling of what was exported for the same period in 2018.

Prices for top steers jumped the equivalent of 13c/kg in the week ending 9 November to the equivalent of 359c/kg

With the current attractive price point and strong futures prices in the US, there is an expectation that this market can grow for Irish exports in the new year.

Something else that will be of interest to Irish farmers is that farm-gate prices in some of the world’s biggest beef exporting countries are now ahead of the EU.

According to Meat and Livestock Australia reports, prices for top steers jumped the equivalent of 13c/kg in the week ending 9 November to the equivalent of 359c/kg.

In the US, prices for top steers are close to €4/kg while in Uruguay – a country that exports 75% of the beef it produces – the price for week ending 2 November was the equivalent of 386c/kg, up from the equivalent of 310c/kg in November 2018. New Zealand prices are also on the increase at 356c/kg equivalent for steers.

SHARING OPTIONS