Imports of slaughter cattle from the Republic of Ireland into NI have been increasing month on month throughout 2017.

To the end of August, cattle imported from the Republic totalled 8,547 head, putting the figure marginally ahead of 2016 levels.

On current trends, cattle imports from south of the border will finish well ahead of the 10,443 head imported throughout 2016. Most of the animals moving north are understood to be cull cows and plainer cattle suitable for manufacturing beef.

The number of slaughter cattle imported from Britain into NI has also increased significantly this year, whereas cattle numbers moving in the opposite direction have collapsed compared with 2016 levels.

The trend towards higher imports contradicts the messages coming from local processing plants who have cut base quotes by 10p/kg to 15p/kg over the last three weeks.

Meat plants point to an increase in cattle numbers coming on to the market, lower demand for beef and slower sales, yet some have been actively seeking to source more cattle in the Republic of Ireland and Britain.

Importing slaughter cattle is a well-used tactic employed by some processors to control supply and reduce prices.

While local processors also cite mounting pressure from retailers to reduce the price of beef, cattle prices in Scotland and England are holding relatively steady at 390p/kg and 378p/kg, respectively, for R4L animals.

Irish imports

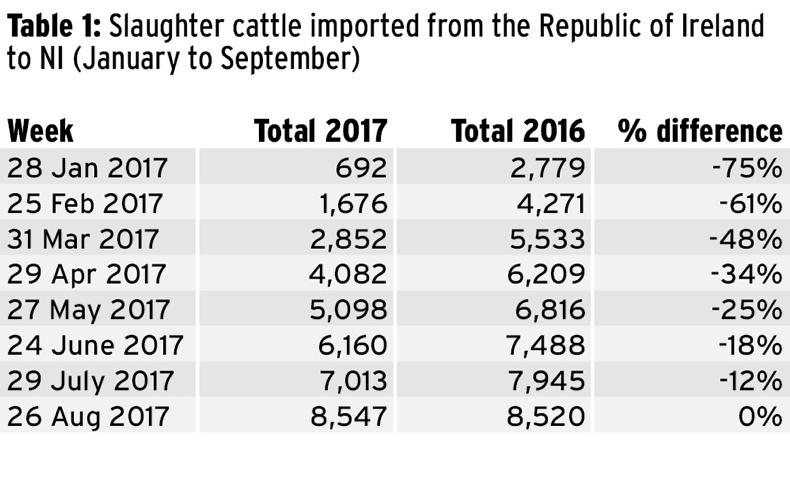

In January, imports of slaughter cattle from the Republic stood at 692 across the entire month. For the same month in the previous year, this figure was almost 2,100 higher (Table 1).

By the end of February 2017, total cattle imports stood at 1,676, down 61% on the previous year. By the end of March, the differential in cattle imports during the first quarter of 2017 was down 48% on the previous year.

The differential in imported cattle numbers continued to close throughout April and May. By late June, cattle imports started to rise sharply week on week, closing the differential on the previous year to 18%.

June also saw sterling starting to weaken against the euro ahead of the UK general election and it has generally continued downward since then.

However, despite the weaker sterling making it more expensive to buy Irish cattle, northern plants continued to source more cattle from the south.

Imports have increased from 200 to over 300 head on a weekly basis.

Despite sterling slumping to €1 = 92p last week, 450 cattle moved north for slaughter, pushing yearly imports marginally ahead of 2016 levels.

Britain

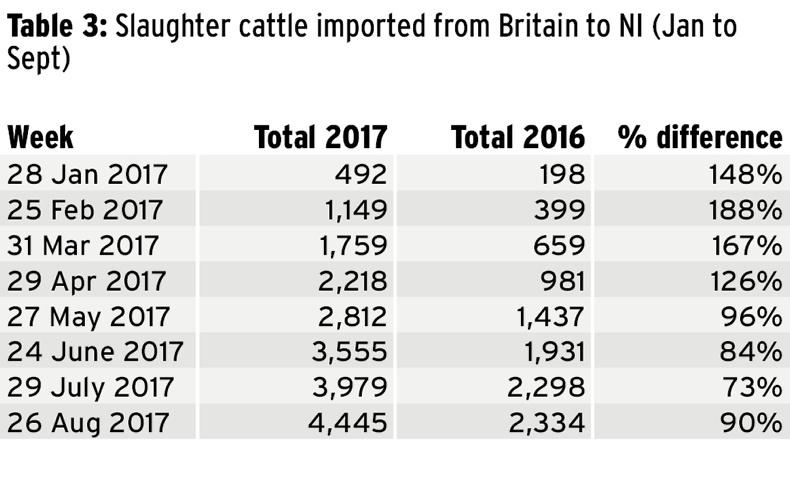

Meanwhile, cattle moving from Britain to be slaughtered at NI plants are almost double that of 2016. Last year, a total of 2,751 cattle were imported from Britain over the full year.

As outlined in Table 3, this figure was surpassed by the end of May 2017. Imports of slaughter cattle stood at 4,445 head by the end of August, which is 90% higher than last year.

Cows make up the majority of these imports.

Exports

While imports are rising, the movement of slaughter cattle from NI to Britain is down 70% on last year.

At the end of August, just 1,134 cattle crossed the Irish Sea for processing compared with 3,794 cattle for the same period last year.

With local plants paying a strong beef price from April to July, there was little incentive to take cattle to Britain for slaughter.

During these months, prices paid in NI often exceeded those in parts of Britain, particularly southern England, and especially for plainer types.

Outlook

It now looks as if local plants are intent on lowering cattle prices ahead of the winter finishing period.

Imports of cattle from the Republic will assist local processors to control prices in the short term. Beef prices there have fallen in euro terms in recent weeks as the prime cattle kill increases to over 35,000 head per week.

The weakening of sterling will also have an effect on sales of Irish beef into their primary market in Britain.

However, with the majority of Northern Irish cattle sold inside the UK, currency is not an issue.

In Britain, the beef trade is solid. Prices in Scotland are holding around the 396p/kg mark for R4Ls, while in England, prices are relatively steady at 376p/kg to 380p/kg.

Supplies of cattle in Britain are tight which is underpinning prices and factory demand is showing signs of increasing.

It is in contrast to the message currently given to producers in NI.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: