Outside of the traditional financing methods, there are other suitable options available, including the Cultivate loan offered by participating credit unions.

Cultivate is an initiative created by a group of 26 credit unions to provide short- to medium-term loan finance built specifically around the growing needs of Irish farmers. In these uncertain times, Cultivate is a farmer-friendly finance option for farmers seeking unsecured funding up to €50,000 over seven years.

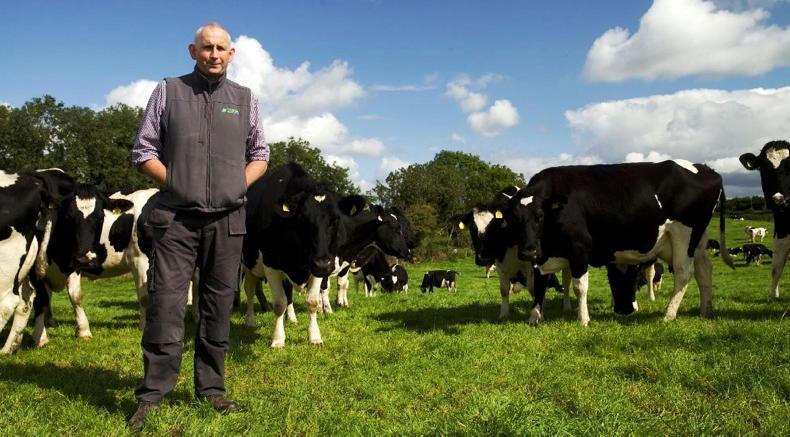

As a full-time dairy farmer, John Finucane was keen to expand his farm. He decided to put in a new bulk tank to take the extra milk from his increased herd and extend the cubicle shed for additional capacity. To support these activities, John turned to his local credit union and availed of their Cultivate loan.

The application process for John worked really well; who said: “I found working with Cultivate very easy. No stress involved in it whatsoever”.

Equally as important for John was the flexibility in repaying the loan in a way that suited him. He says: “They tailored the way I wanted to repay it over the summer months … no problem drawing down the money or anything”.

Once John was approved for the loan, he installed the bulk tank straight away and he is now in the process of putting in the extra cubicles. These changes are making his work on the farm much more manageable, and making "life much easier”.

As a farmer-friendly finance option, loan repayment schedules are available up to a period of seven years, with flexibility to repay at times that make sense for the individual farmer. Cultivate loans are unsecured, and there is no need to be an existing credit union member in order to avail of a loan. Farmers can sign up in their local participating credit union office and be eligible to apply for a Cultivate loan immediately.

Cultivate loans are used by farmers like John for a wide range of investments including:

Stocking or working capital.Upgrading farm buildings and facilities.Purchasing new or second-hand machinery. Undertaking farm improvement works such as fencing and reclamation.Cultivate loans are offered by 26 credit unions in Ireland. A full list of participating credit unions is available here

Normal life may be on hold, but farming life continues. Like farmers, credit unions are here for the long haul. If you need a flexible farmer-friendly loan, call freephone 1800 839 999, pop into your participating local credit union today or visit Cultivate-CU.ie to learn more.

Loans are subject to approval. Terms and conditions apply. If you do not meet the repayments on your loan, your account will go into arrears.

This may affect your credit rating which may limit your ability to access credit in the future. The cost of your repayments may increase. Credit unions in Ireland are regulated by the Central Bank of Ireland.

Outside of the traditional financing methods, there are other suitable options available, including the Cultivate loan offered by participating credit unions.

Cultivate is an initiative created by a group of 26 credit unions to provide short- to medium-term loan finance built specifically around the growing needs of Irish farmers. In these uncertain times, Cultivate is a farmer-friendly finance option for farmers seeking unsecured funding up to €50,000 over seven years.

As a full-time dairy farmer, John Finucane was keen to expand his farm. He decided to put in a new bulk tank to take the extra milk from his increased herd and extend the cubicle shed for additional capacity. To support these activities, John turned to his local credit union and availed of their Cultivate loan.

The application process for John worked really well; who said: “I found working with Cultivate very easy. No stress involved in it whatsoever”.

Equally as important for John was the flexibility in repaying the loan in a way that suited him. He says: “They tailored the way I wanted to repay it over the summer months … no problem drawing down the money or anything”.

Once John was approved for the loan, he installed the bulk tank straight away and he is now in the process of putting in the extra cubicles. These changes are making his work on the farm much more manageable, and making "life much easier”.

As a farmer-friendly finance option, loan repayment schedules are available up to a period of seven years, with flexibility to repay at times that make sense for the individual farmer. Cultivate loans are unsecured, and there is no need to be an existing credit union member in order to avail of a loan. Farmers can sign up in their local participating credit union office and be eligible to apply for a Cultivate loan immediately.

Cultivate loans are used by farmers like John for a wide range of investments including:

Stocking or working capital.Upgrading farm buildings and facilities.Purchasing new or second-hand machinery. Undertaking farm improvement works such as fencing and reclamation.Cultivate loans are offered by 26 credit unions in Ireland. A full list of participating credit unions is available here

Normal life may be on hold, but farming life continues. Like farmers, credit unions are here for the long haul. If you need a flexible farmer-friendly loan, call freephone 1800 839 999, pop into your participating local credit union today or visit Cultivate-CU.ie to learn more.

Loans are subject to approval. Terms and conditions apply. If you do not meet the repayments on your loan, your account will go into arrears.

This may affect your credit rating which may limit your ability to access credit in the future. The cost of your repayments may increase. Credit unions in Ireland are regulated by the Central Bank of Ireland.

SHARING OPTIONS