UK sheep farmers are in a similar position to their Irish counterparts, with producers with hoggets to sell enjoying unusually high farmgate prices for the time of year.

This is being fuelled by a numbers of factors, such as lower volumes of New Zealand sheepmeat in the market and reduced production across Europe.

Another major contributing factor is a significant tightening in the UK’s domestic production.

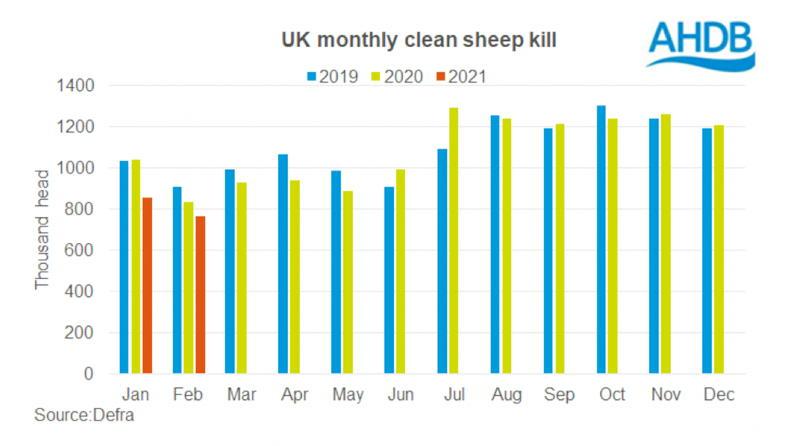

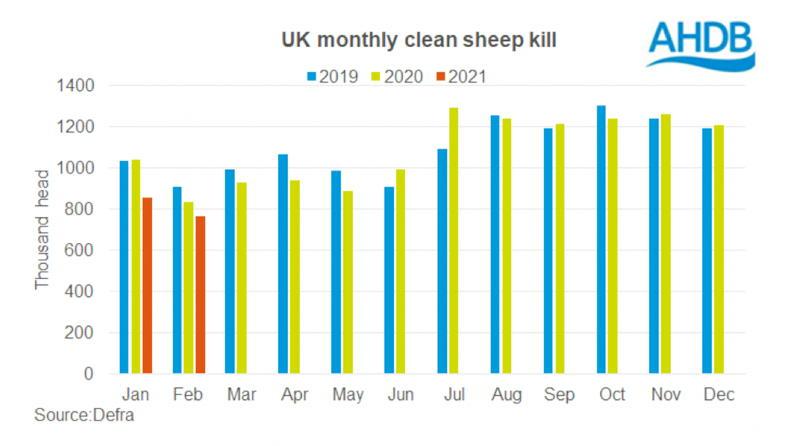

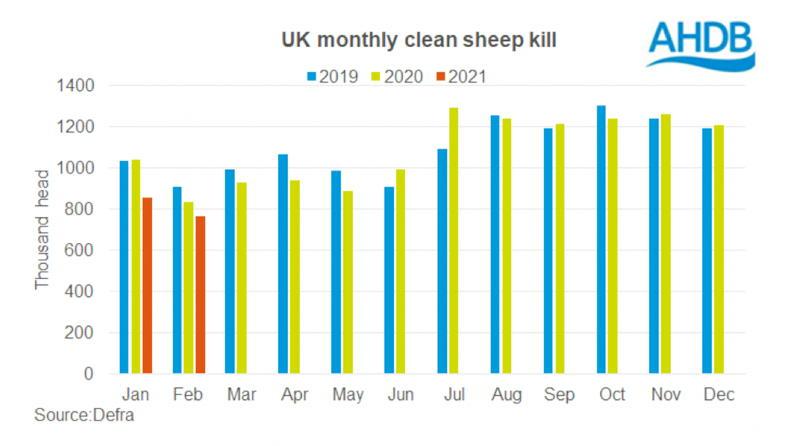

The latest Agriculture and Horticulture Development Board (AHDB) production update released on Thursday shows the number of hoggets slaughtered in February 2021, at 760,000 head, falling by 87,000 head (10%) on throughput levels recorded in January, with the kill down 8% on February 2020. This is detailed in Figure 1.

Figure 1

AHDB livestock analyst Charlie Reeve points out that throughput in February is running some 126,000 head lower than the five-year average.

Retaining sheep

With prices running at such a strong level, there has been a tendency to retain sheep to heavier weights before drafting and this is reflected in the average carcase weight of 20.3kg increasing by 0.3kg on January 2021 levels and 0.2kg on February 2020.

However, this only slightly compensated for the significant fall-off in throughput, with a total sheepmeat production figure of 18,000t for February running 1,300t behind January production figures and 1,800t lower than February 2020.

The production update says this is the lowest monthly production figure reported since May 2013.

January trade data ... should shed some light on how much the UK withdrawal from the EU affected the sheepmeat export trade to Europe

Charlie reports that January trade data will be available in the coming days and that this should shed some light on how much the UK withdrawal from the EU affected the sheepmeat export trade to Europe and also indicate what the availability of New Zealand sheepmeat during January was.

High prices

Supplies have stabilised for the first week of March, with a continued increase in price attracting marginally higher numbers on to the market.

For the week ending 10 March 2021, the AHDB estimated throughput of what is classified as old-season lamb (OSL) (hoggets) at British auction marts rising 2% or 1,800 head on the previous week to reach 106,000 head.

This remains 5% lower than the corresponding week in 2020.

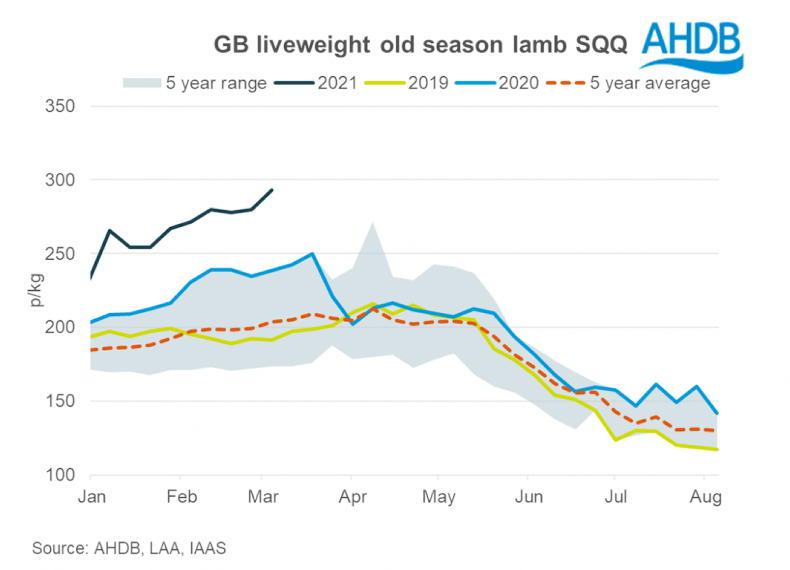

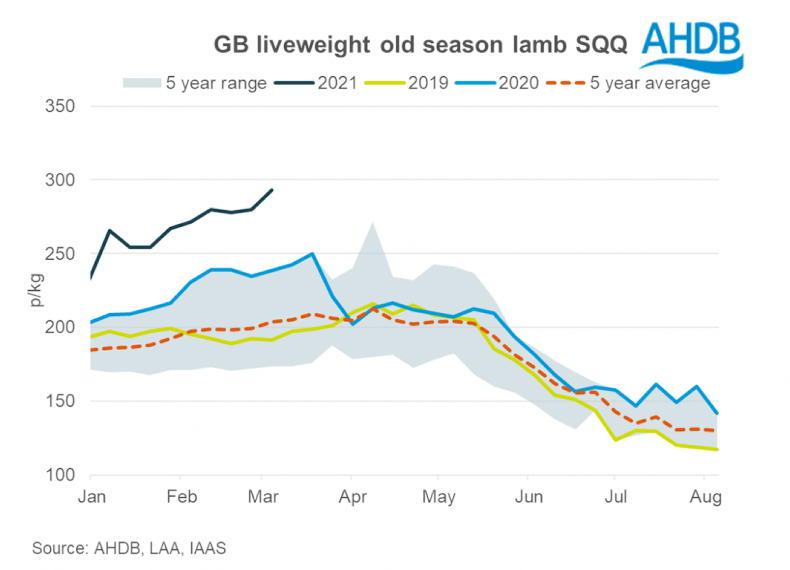

As mentioned, prices continue on a sharp upward trajectory, with the standard quality quotation (SQQ) for OSL increasing 13p/kg on the previous week to average £2.93/kg (€3.44/kg).

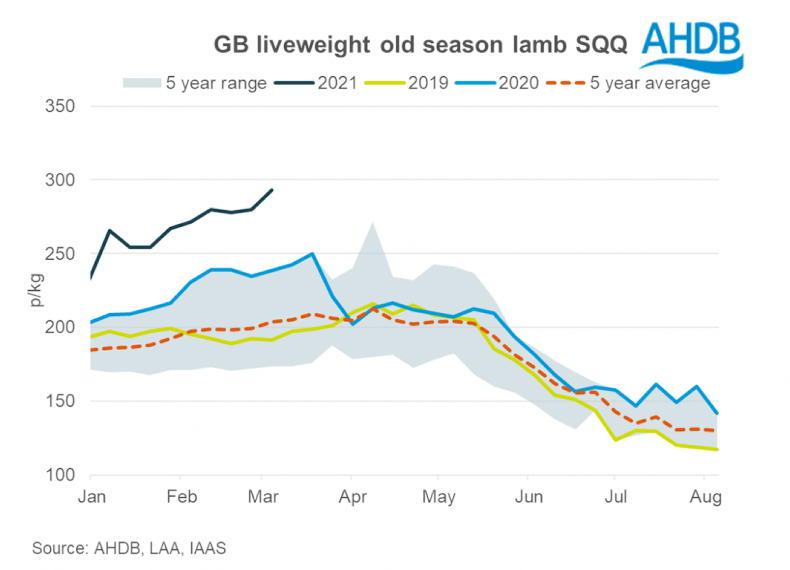

This is a substantial 88p/kg ahead of the five-year average price trend, as reflected in Figure 2.

Figure 2

Estimated throughputs at British abattoirs also increased, with throughput of 192,600 head increasing 10,400 head or 6% on the previous week and also running 5% lower than the corresponding week in 2020.

The SQQ for OSL on a deadweight basis increased by 1.4p/kg in the week ending 6 March 2021 to average £6.15/kg (€7.20/kg).

This fails to take into account further upward movement this week, with the deadweight SQQ recording similar movement to the SQQ liveweight price.

UK sheep farmers are in a similar position to their Irish counterparts, with producers with hoggets to sell enjoying unusually high farmgate prices for the time of year.

This is being fuelled by a numbers of factors, such as lower volumes of New Zealand sheepmeat in the market and reduced production across Europe.

Another major contributing factor is a significant tightening in the UK’s domestic production.

The latest Agriculture and Horticulture Development Board (AHDB) production update released on Thursday shows the number of hoggets slaughtered in February 2021, at 760,000 head, falling by 87,000 head (10%) on throughput levels recorded in January, with the kill down 8% on February 2020. This is detailed in Figure 1.

Figure 1

AHDB livestock analyst Charlie Reeve points out that throughput in February is running some 126,000 head lower than the five-year average.

Retaining sheep

With prices running at such a strong level, there has been a tendency to retain sheep to heavier weights before drafting and this is reflected in the average carcase weight of 20.3kg increasing by 0.3kg on January 2021 levels and 0.2kg on February 2020.

However, this only slightly compensated for the significant fall-off in throughput, with a total sheepmeat production figure of 18,000t for February running 1,300t behind January production figures and 1,800t lower than February 2020.

The production update says this is the lowest monthly production figure reported since May 2013.

January trade data ... should shed some light on how much the UK withdrawal from the EU affected the sheepmeat export trade to Europe

Charlie reports that January trade data will be available in the coming days and that this should shed some light on how much the UK withdrawal from the EU affected the sheepmeat export trade to Europe and also indicate what the availability of New Zealand sheepmeat during January was.

High prices

Supplies have stabilised for the first week of March, with a continued increase in price attracting marginally higher numbers on to the market.

For the week ending 10 March 2021, the AHDB estimated throughput of what is classified as old-season lamb (OSL) (hoggets) at British auction marts rising 2% or 1,800 head on the previous week to reach 106,000 head.

This remains 5% lower than the corresponding week in 2020.

As mentioned, prices continue on a sharp upward trajectory, with the standard quality quotation (SQQ) for OSL increasing 13p/kg on the previous week to average £2.93/kg (€3.44/kg).

This is a substantial 88p/kg ahead of the five-year average price trend, as reflected in Figure 2.

Figure 2

Estimated throughputs at British abattoirs also increased, with throughput of 192,600 head increasing 10,400 head or 6% on the previous week and also running 5% lower than the corresponding week in 2020.

The SQQ for OSL on a deadweight basis increased by 1.4p/kg in the week ending 6 March 2021 to average £6.15/kg (€7.20/kg).

This fails to take into account further upward movement this week, with the deadweight SQQ recording similar movement to the SQQ liveweight price.

SHARING OPTIONS