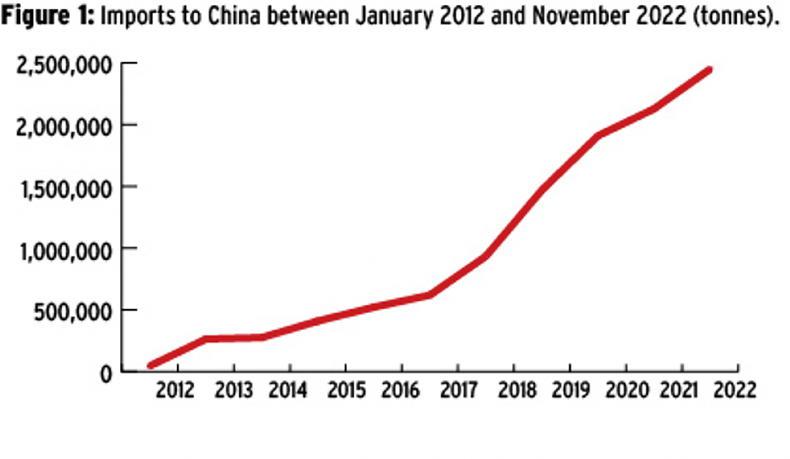

The resumption of beef exports to China is good news for Irish beef producers and exporters. It has been the world’s fastest ever growing market for beef imports over the past decade, jumping from a modest 70,000t of beef in 2012 to 2.4m tonnes in 2022, with rapid year-on-year growth, as shown in Figure 1.

It is a market more than twice the size of the second largest importer, the US, which imported 1.1m tonnes in 2022 (USDA).

China opened to Irish beef exports in 2018, and had been shaping up to be a substantial export market for Irish beef, having taken 6,500t in the first five months of 2020 before the suspension. On a trade mission to China in November 2019, then Bord Bia chief executive Tara McCarthy estimated that China would generate potential volumes in the order of 25,000t to 30,000t.

China’s suppliers

The growth in demand from China for beef over the past decade has coincided with the expansion of Brazil’s beef exports, which have increased by over 1m tonnes since 2012. Between January and November 2022, it supplied just under 1m tonnes, or 40%, of all beef that China imported.

Argentina is the next largest supplier on 446,000t, followed by Uruguay on 163,000t.

While these South American countries have 70% of the market, from an Irish perspective, the most interesting development has been the growth in US supplies to China.

In the first five months of 2020, Ireland exported more beef to China than the US, but the Phase 1 trade agreement between the US and China led to US beef exports taking off at the time Ireland had to leave the market.

Between January and November this year, China imported 163,000t of beef from the US.

Prospects for Irish exports

While much has happened since May 2020, the reality is that China’s demand for beef has grown by a further 500,000t.

Ireland only has approval for frozen boneless beef, but this was the basis for growing the business before and it can be again.

There are specification issues, but these were managed before and another advantage that Ireland has is that most major beef exporting factories are approved for China.

Beef factories are expressing caution ahead of the reopening and managing expectations by highlighting the volume of supply from lower cost producing countries than Ireland.

However, there has never been a market that has shown such growth in demand for beef imports over a prolonged period.

If Irish beef exports are to meaningfully diversify markets beyond the UK and EU, then China has to be the best prospect there is for growth.

The target of 25,000t to 30,000t highlighted by Bord Bia at the end of 2019 still seems reasonable – if not this year, then within the next couple of years.

SHARING OPTIONS