Japan is the world’s third largest economy behind the USA and China, worth $4.4 trillion. It is also a huge net importer of agricultural produce as just over 12% of its land is arable and suitable for food production. Therefore, the prospect of a Free Trade Agreement between the EU and Japan should excite large agri food exporting countries like Ireland.

Being one of the world’s wealthiest nations with relatively low agricultural capacity relative to its population, means that it protects its agriculture to a level that is among the highest in the world. Tariffs have varied depending on the availability of domestic supply with butter being a particularly good example. If sufficient supplies of Japanese production are available, tariffs can go as high as 200% though these can equally be reduced at times when international supply is required to satisfy consumer demand.

Pigmeat

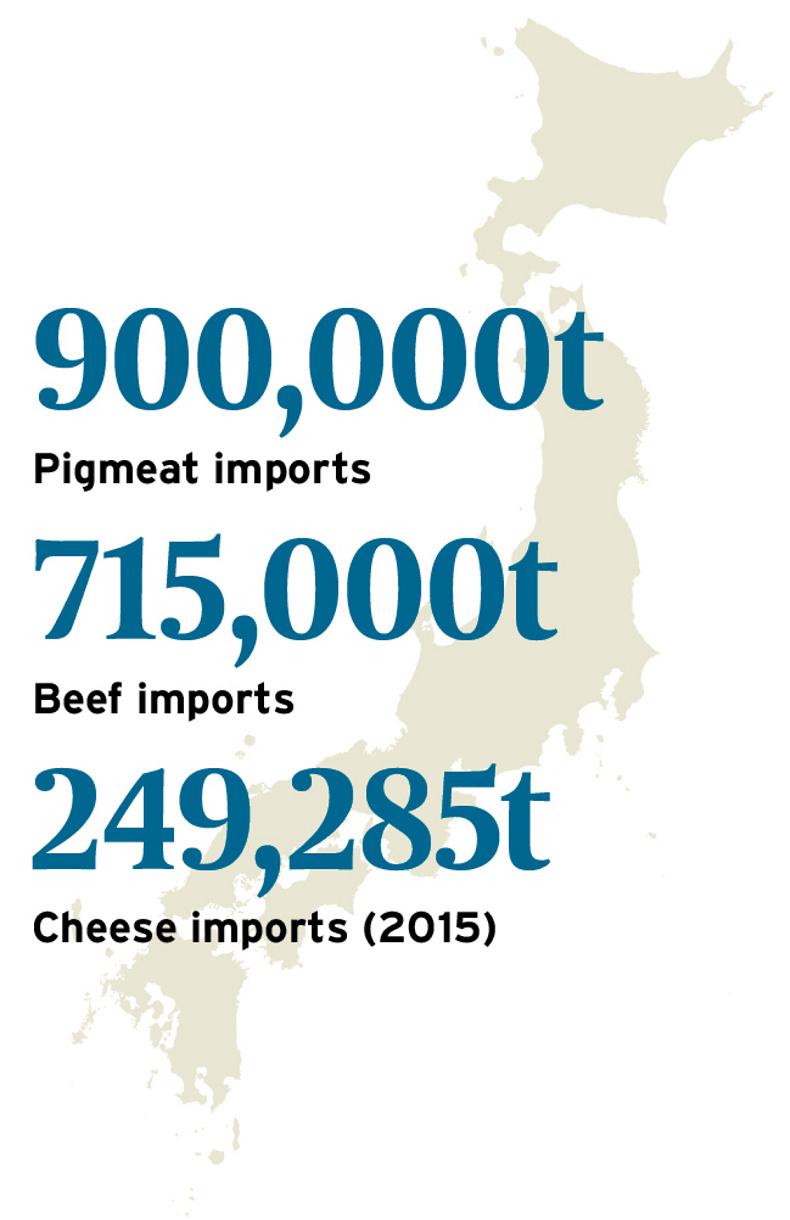

China’s insatiable demand for proteins meant it took over as the world’s top importer of pigmeat last year but up until that point it was Japan that was the world’s top pigmeat importer. Japanese pigmeat imports were just under 900,000t in 2016 according to Bord Bia and this makes up half of consumption in Japan. Falling domestic production has been an issue with less than 5,000 pig farms in 2016 compared with over 83,000 in 1985.

Pig prices in Japan are around the equivalent of €3.73/kg which is dramatically higher than the €1.65/kg Irish price at present. The Japanese market for pigmeat is like all other categories heavily protected by import tariffs. The big suppliers are the USA, Canada, Germany and Mexico with Ireland currently supplying just 2,000 tonnes in the first quarter of 2017 which is actually double the level for the same period in 2016.

Tariffs are variable on pigmeat and often products are combined to maximise tariff efficiency. For example, a popular combination is loins combined with pork bellies which attracts a tariff the equivalent of €4.14/kg. Obviously a reduction in this tariff would make Japan a much more attractive option to Irish and EU exporters.

Beef

Japan has been the second largest importer of beef in the world after the USA although as with pigmeat, China will move into second spot in 2017. According to USDA and Meat and Livestock Australia data, the US and Australia dominate Japanese beef imports, accounting for 87% between them. Overall according to USDA, Japan imported 715,000t of beef in 2016, of which 297,000t came from the USA and 276,000t came from Australia.

Ireland secured approval to export beef to Japan at the end of 2013, having been out of the market for several years because of BSE. It is currently seeking approval for under-30-month beef which excludes cow mountain chain, for which Japan was historically a valuable market. In 2016, Ireland exported 1,322t of mainly offal to Japan, which makes Japan one of Ireland’s lower volume export destinations. Removal of tariffs either wholly or even partially would improve this performance.

For Scotland and Northern Ireland, Japan is out of reach at present but this may be about to change. An inward visit by Japanese inspectors will take place early in July to the UK and this is the first step in getting the UK approved to supply Japan again.

Dairy

According to Bord Bia, 2016 was a good year for dairy sales to Japan with volume up 23% on 2015 to 5,570t worth €17m. Cheese is the main dairy product exported from Ireland to Japan, representing 85% of all dairy exports, up 38% on the previous year.

This reflects the growing westernisation of the Japanese diet and demand for pizzas. Japan has the highest cheese price in the world at the equivalent of €24/kg, compared with the global average of €8.80/kg (Euromonitor).

Like other agricultural products, cheese attracts a tariff of 35% to 40% and again a FTA that tackles this makes it a more attractive market for Irish and EU exporters.

Conclusion

The Japanese market feels seriously underdeveloped from an Irish perspective with high tariffs the major barrier to entry. A FTA will address this and in turn create a real market opportunity across all commodities though China will remain the Asian market with most potential.

SHARING OPTIONS