According to the joint Teagasc/Cork Institute of Technology report published this week, Irish dairy farmers are the most profitable in the EU, despite receiving the lowest milk price. The analysis of Ireland’s grass-based dairy model showed a net profit margin of 8c/l excluding owned labour. As Jack Kennedy reports, this compared to profit margins of 2-4c/l being returned within the main dairy producing regions of Europe.

Teagasc pinpoints efficiencies at farmer level as the source of Ireland’s competitive advantage. At 24c/l, production costs associated with the seasonal grass model, again excluding owned labour, were shown to be 6-14c/l lower than in other EU regions.

However, the exclusion of owned labour over inflates net margins in an Irish context. Given the scale and family farm structure, a much higher percentage of labour on Irish farmers would fall into the “owned labour” bracket. It raises the question as to whether a standardised cost for owned labour should be included in such comparative analysis. Last week, Teagasc identified owned labour as an integral measure of farm viability.

On top of this, the figures do not capture the extent to which farm income streams in other EU member states, particularly Germany, are bolstered by on-farm renewable schemes.

In addressing the low milk price returned to farmers, the report identifies the impact associated with a seasonal production model further along the supply chain. Utilisation of processing capacity in Ireland is 62% compared to 92% in other EU countries. This under-utilisation brings with it higher processing costs and lower product portfolios.

However, the report warns against moving away from the seasonal model. Shifting to a 50:50 spring/autumn calving system would reduce profitability by 1.6c/l or €128m when applied to the national milk pool. Significant improvement in utilisation would only be delivered through year-round calving. It’s a tribute to the co-op movement that sanity prevailed in building steel to facilitate efficient on-farm production rather than what happened in the UK where, in a lot of cases, heavy penalties were applied to grass-produced milk in the interests of flattening the curve and maximising steel utilisation.

While presenting the positives in terms of EU competitiveness, the report should trigger a discussion on the extent to which farmers have so far benefited from the recent wave of expansion. From the data presented, it is clear that a 53% increase in output of milk solids per farm, fuelled by a 28% increase in average herd size plus a 20% increase in milk solids per cow, has not translated into a pro rata increase in farm incomes. Over the past six years, total family farm income on dairy farms has generally ranged from €60,000 to €70,000 per annum. In 2019, family farm income from dairying was €1,000 less than in 2014. Currently the debate is focused on the most appropriate structures to fund future expansion, but it needs to extend much wider. We cannot ignore the extent to which dairy farmers are effectively running faster to stand still.

It is understandable that in a period of rapid growth, milk price comes under pressure. Capital for major expansion projects is required and the percentage of milk processed into value-added product declines. But as the rate of expansion begins to taper off, farmers now need to see a return on their investment being delivered through the milk price – both in terms of processing efficiencies and the ability to create added value. It is the extent to which processors can demonstrate this ability through milk price that should determine future growth.

Meanwhile, this week we publish the annual Irish Farmers Journal/KPMG milk price review and analysis. The commitment of each of the participating co-ops to milk price transparency should be recognised. The strength of the milk price review is its simplicity. It divides the amount of money paid for manufacturing milk, including direct conditional bonuses, by the volume of manufacturing milk supplied. The review this year reflects the price paid for approximately 85% of the total manufacturing milk pool.

Once again we see significant variation paid with the west Cork co-ops leading the field. Barryroe secures top spot for the second year in a row. The 2.85c/l (ex VAT) bonus paid by Kerry Group sees the processor move into the top three. As detailed in the summary table, there is variation in constituents of milk supplied across each of the processors. To reflect this, we will be seeking the support of processors to carry out future reviews on the basis of price paid per kilo of milk solids.

Ultimately it is down to each milk supplier to assess the performance of their processors, not just on the basis of milk price but also taking into account the strategic direction of the business, the range of services and supports provided and indeed the financial stability.

It is unfortunate that the processors with wafer thin operating margins and/or high debt levels do not participate in the milk price review. The co-op movement in general has proved a huge success in the dairy industry but the reluctance to be measured in terms of processing costs and even in some cases in milk price to farmers is regrettable to say the least.

How can agriculture meet the challenges of world trade and currency devaluation?

With the €1.8tn EU recovery fund signed off, a change of president in the US and the prospect of a COVID-19 vaccine, there is a feeling that the EU and indeed global economy can think about rebuilding. Throughout the worst of the pandemic, farmers along with frontline factory, delivery and retail workers bravely and successfully kept food on the shelves.

Yet this most vital service faces a further unprecedented threat as changes in the trading relationship with our main market in the UK are now less than 50 days away. What is worse, we still don’t know the terms under which we will then be trading.

While the UK remains our largest export market, we have made huge strides in the past decade developing other markets inside and outside the EU. Beef sales to the US will be close to 10,000t – double 2019 levels – and despite tariffs, dairy exports continue to grow not just to the US but other global markets.

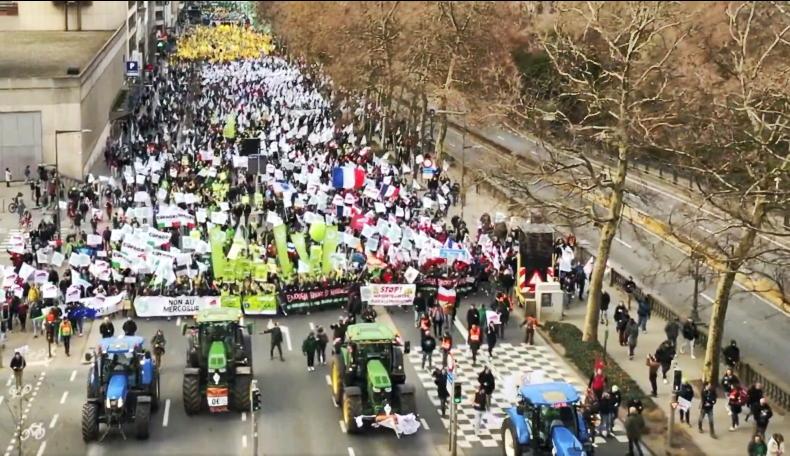

The EU has been the most active area of the world in recent years for pursuing trade deals. These are generally beneficial to the industrial economy but very often a threat to agriculture. As the EU becomes increasingly involved in global trade, the need for checks and balances becomes ever more important.

There is considerable disquiet at present among the major exporters of agricultural produce at the level of state aid given by the US to farmers ($33bn) because of the pandemic.

The other major threat to Irish and EU farmers is how other major exporters manage the value of their currencies. The value of Brazilian beef this week has reached the equivalent of €2.94/kg based on the present exchange rate of BRL6.36 to €1. However, if the rate of exchange had remained where it was on 1 January 2020 at BRL4.50 to €1, then the beef price currently being paid to Brazilian farmers would equate to €4.16/kg.

If the EU expects agriculture to adopt the farming practices in the Farm to Fork strategy, it must be prepared to invest through the just transition fund to support the loss of output. Similarly, if farmers are expected to compete against global competitors whose currency value collapses, then suitable currency protection measures have also to be developed by the EU to preserve something of a level playing field.

BEAM: flexibility required

Huge problems could lie ahead for farmers who fail to meet BEAM scheme conditions. Common sense needs to prevail to avoid farmers panic-selling in the first half of 2021 or having to pay back money to the Department of Agriculture. Nobody could have foreseen the disruption to mart sales when the scheme details were announced in July 2019. Surely with the Department of Agriculture having full access to herd profiles, a tool can be developed to inform farmers as to what they need to do in the coming months to avoid penalties.

Read more

Irish dairy farmers the most profitable in Europe, reports shows

Dairy markets: US milk supply on track to break 97bn litres for 2020

According to the joint Teagasc/Cork Institute of Technology report published this week, Irish dairy farmers are the most profitable in the EU, despite receiving the lowest milk price. The analysis of Ireland’s grass-based dairy model showed a net profit margin of 8c/l excluding owned labour. As Jack Kennedy reports, this compared to profit margins of 2-4c/l being returned within the main dairy producing regions of Europe.

Teagasc pinpoints efficiencies at farmer level as the source of Ireland’s competitive advantage. At 24c/l, production costs associated with the seasonal grass model, again excluding owned labour, were shown to be 6-14c/l lower than in other EU regions.

However, the exclusion of owned labour over inflates net margins in an Irish context. Given the scale and family farm structure, a much higher percentage of labour on Irish farmers would fall into the “owned labour” bracket. It raises the question as to whether a standardised cost for owned labour should be included in such comparative analysis. Last week, Teagasc identified owned labour as an integral measure of farm viability.

On top of this, the figures do not capture the extent to which farm income streams in other EU member states, particularly Germany, are bolstered by on-farm renewable schemes.

In addressing the low milk price returned to farmers, the report identifies the impact associated with a seasonal production model further along the supply chain. Utilisation of processing capacity in Ireland is 62% compared to 92% in other EU countries. This under-utilisation brings with it higher processing costs and lower product portfolios.

However, the report warns against moving away from the seasonal model. Shifting to a 50:50 spring/autumn calving system would reduce profitability by 1.6c/l or €128m when applied to the national milk pool. Significant improvement in utilisation would only be delivered through year-round calving. It’s a tribute to the co-op movement that sanity prevailed in building steel to facilitate efficient on-farm production rather than what happened in the UK where, in a lot of cases, heavy penalties were applied to grass-produced milk in the interests of flattening the curve and maximising steel utilisation.

While presenting the positives in terms of EU competitiveness, the report should trigger a discussion on the extent to which farmers have so far benefited from the recent wave of expansion. From the data presented, it is clear that a 53% increase in output of milk solids per farm, fuelled by a 28% increase in average herd size plus a 20% increase in milk solids per cow, has not translated into a pro rata increase in farm incomes. Over the past six years, total family farm income on dairy farms has generally ranged from €60,000 to €70,000 per annum. In 2019, family farm income from dairying was €1,000 less than in 2014. Currently the debate is focused on the most appropriate structures to fund future expansion, but it needs to extend much wider. We cannot ignore the extent to which dairy farmers are effectively running faster to stand still.

It is understandable that in a period of rapid growth, milk price comes under pressure. Capital for major expansion projects is required and the percentage of milk processed into value-added product declines. But as the rate of expansion begins to taper off, farmers now need to see a return on their investment being delivered through the milk price – both in terms of processing efficiencies and the ability to create added value. It is the extent to which processors can demonstrate this ability through milk price that should determine future growth.

Meanwhile, this week we publish the annual Irish Farmers Journal/KPMG milk price review and analysis. The commitment of each of the participating co-ops to milk price transparency should be recognised. The strength of the milk price review is its simplicity. It divides the amount of money paid for manufacturing milk, including direct conditional bonuses, by the volume of manufacturing milk supplied. The review this year reflects the price paid for approximately 85% of the total manufacturing milk pool.

Once again we see significant variation paid with the west Cork co-ops leading the field. Barryroe secures top spot for the second year in a row. The 2.85c/l (ex VAT) bonus paid by Kerry Group sees the processor move into the top three. As detailed in the summary table, there is variation in constituents of milk supplied across each of the processors. To reflect this, we will be seeking the support of processors to carry out future reviews on the basis of price paid per kilo of milk solids.

Ultimately it is down to each milk supplier to assess the performance of their processors, not just on the basis of milk price but also taking into account the strategic direction of the business, the range of services and supports provided and indeed the financial stability.

It is unfortunate that the processors with wafer thin operating margins and/or high debt levels do not participate in the milk price review. The co-op movement in general has proved a huge success in the dairy industry but the reluctance to be measured in terms of processing costs and even in some cases in milk price to farmers is regrettable to say the least.

How can agriculture meet the challenges of world trade and currency devaluation?

With the €1.8tn EU recovery fund signed off, a change of president in the US and the prospect of a COVID-19 vaccine, there is a feeling that the EU and indeed global economy can think about rebuilding. Throughout the worst of the pandemic, farmers along with frontline factory, delivery and retail workers bravely and successfully kept food on the shelves.

Yet this most vital service faces a further unprecedented threat as changes in the trading relationship with our main market in the UK are now less than 50 days away. What is worse, we still don’t know the terms under which we will then be trading.

While the UK remains our largest export market, we have made huge strides in the past decade developing other markets inside and outside the EU. Beef sales to the US will be close to 10,000t – double 2019 levels – and despite tariffs, dairy exports continue to grow not just to the US but other global markets.

The EU has been the most active area of the world in recent years for pursuing trade deals. These are generally beneficial to the industrial economy but very often a threat to agriculture. As the EU becomes increasingly involved in global trade, the need for checks and balances becomes ever more important.

There is considerable disquiet at present among the major exporters of agricultural produce at the level of state aid given by the US to farmers ($33bn) because of the pandemic.

The other major threat to Irish and EU farmers is how other major exporters manage the value of their currencies. The value of Brazilian beef this week has reached the equivalent of €2.94/kg based on the present exchange rate of BRL6.36 to €1. However, if the rate of exchange had remained where it was on 1 January 2020 at BRL4.50 to €1, then the beef price currently being paid to Brazilian farmers would equate to €4.16/kg.

If the EU expects agriculture to adopt the farming practices in the Farm to Fork strategy, it must be prepared to invest through the just transition fund to support the loss of output. Similarly, if farmers are expected to compete against global competitors whose currency value collapses, then suitable currency protection measures have also to be developed by the EU to preserve something of a level playing field.

BEAM: flexibility required

Huge problems could lie ahead for farmers who fail to meet BEAM scheme conditions. Common sense needs to prevail to avoid farmers panic-selling in the first half of 2021 or having to pay back money to the Department of Agriculture. Nobody could have foreseen the disruption to mart sales when the scheme details were announced in July 2019. Surely with the Department of Agriculture having full access to herd profiles, a tool can be developed to inform farmers as to what they need to do in the coming months to avoid penalties.

Read more

Irish dairy farmers the most profitable in Europe, reports shows

Dairy markets: US milk supply on track to break 97bn litres for 2020

SHARING OPTIONS