From an agricultural perspective, Budget 2019 can be best summed up as a small step in the right direction. As is par for the course, there were winners and losers in a budget clearly targeted at starting to address the challenges faced by those in the low-income sectors.

The increase in ANC funding of €23m has been welcomed, coming on top of a €25m increase last year. This brings the total allocation for the scheme back to pre-recession levels at €250m. As Odile Evans reports, Minister for Agriculture Michael Creed is again considering skewing this payment towards those on the hills, providing a much-needed boost to the hill sheep sector.

The introduction of a targeted payment for the suckler herd has been met with a mixed reaction. With an annual budget of just €20m, farmers participating in what will be the new Beef Environmental Efficiency Programme (BEEP) will receive a payment of €40 per cow, significantly less than the €200 that had been called for by the IFA.

However, as Adam Woods reports, the scheme appears relatively straightforward with participating farmers only required to provide weight data on cows and calves. Gathering such information has proved difficult on suckler farms with physical performance data currently being recorded on less than 2% of cows and calves in the national suckler herd.

It is a trend that has negatively affected the rate of genetic improvement for two of the key profit-driving traits at farm level: growth rate and cow efficiency. While weighing animals has proved contentious in the past, the linking of such payments to measures that will help drive efficiencies at farm level is a positive step by the Department of Agriculture.

Key to the success of the scheme will be the rollout of a national cattle-weighing programme. While it won’t be without its complications, the fact that farmers will be allowed to use their own weighing scales should reduce complexity and costs. For those without on-farm weighing facilities, the network of livestock marts would appear ideally positioned to provide an on-farm weighing service with staff trained in handling livestock.

The decision to introduce a targeted payment for the suckler herd is an important signal to the sector

Beyond the mechanics of the scheme, the decision by the Government to introduce a targeted payment for the suckler herd is an important signal to the sector. While the €20m allocated to the scheme is disappointing, the fact that the Government has recognised the need to target payments at the low-income sector is significant in the context of the upcoming CAP reform.

For the dairy and tillage sectors, the budget proved underwhelming in terms of new measures. It is disappointing that despite being announced in 2017, the full details of the low-cost loan scheme have yet to be finalised – a fact that Minister Creed acknowledges in our interview.

It had been widely anticipated that an income deposit scheme would be introduced to take account of increased volatility in farm incomes. Failure to implement such a scheme, which would have come at minimal cost to the Exchequer, is a missed opportunity by the Government to provide the tools necessary to help farmers compete in global markets.

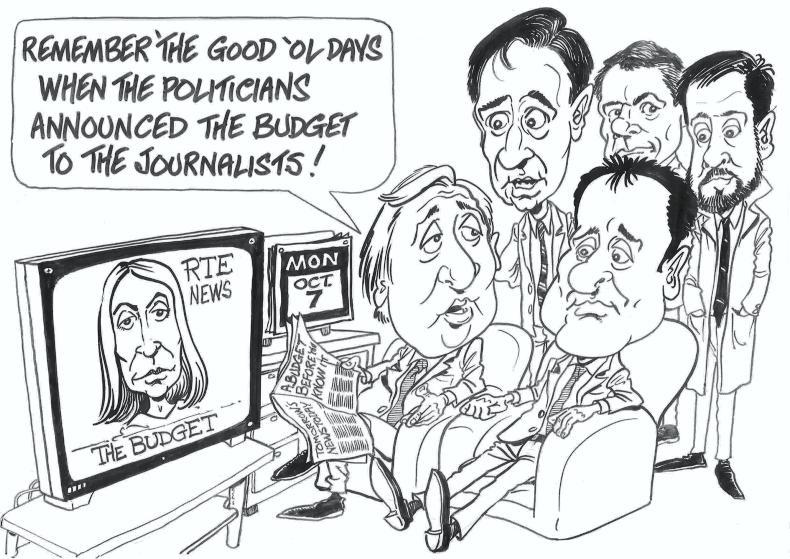

Also this week, Colm McCarthy gives a wider assessment of the budget. There is no doubt that the unexpected influx of corporation tax receipts, caused by unrepeatable changes to accounting rules, has allowed the Government gloss over significant budget overshoots, most noticeably in the health service.

Worryingly, we have seen Government spending increase by 25% over the past five years, five times faster than growth in the benchmark consumer price index (CPI). With a large proportion of the recent surge in corporation tax revenues, which have more than doubled over the past five years, now apportioned to day-to-day spending rather than being targeted towards capital investments, McCarthy highlights the extent of the bet the Government is placing on economic forecasts being delivered.

It is a strategy that is not without its risks given our acute exposure to the global tax environment.

Climate change: need to intensify sustainable food production

Elsewhere this week, Thomas Hubert details the findings of a report on global warming published by the International Panel of Climate Change (IPCC).

The consequences of failing to keep global warming below 1.5°C above pre-industrial levels grab headlines. What was not highlighted was the need identified to intensify food production where it is most sustainable to allow for land to be diverted into energy production.

So, we are facing into a situation where, on one side, the UN predicts that by 2050 food production will have to increase by 70% to meet a rising population and, on the other, the IPCC identifies the need to divert up to 700m ha (80 times the size of Ireland) into energy production to tackle climate change.

Surely such a scenario has to be viewed as a catalyst by governments to support the further development of sustainable food production. As one of the most sustainable food producers in the world, Ireland should be at the top of the queue. Instead, we see calls to restrict production, based on national targets that in no way take into account the world in which we are living. Clearly an urgent rethink is needed.

Speaking at the global conference on sustainability in Kilkenny this week, Justin Sherrard of Rabobank summed it up perfectly when he said: “Getting rid of livestock farms was an intellectually lazy way of addressing climage change.”

Fungicide: chlorothalonil loss not fully appreciated

Last week we highlighted the serious impact that the loss of chlorothalonil, an extremely important fungicide active, would have on the tillage sector. Given the response we have received to the piece, it was clearly an issue that had not been fully understood at EU level.

There is an opportunity for Minister for Agriculture Michael Creed to bring the issue on to the political agenda at the meeting of the Council of EU agriculture ministers in Brussels on Monday.

The risk to the Irish tillage sector and indeed the livestock and drinks sector is too significant to allow this pass under the radar.

Greenfield farm: drought costs becoming clear

The effects of the drought cost €125,000 (€380/cow) to the Greenfield Farm in Kilkenny.

While the weather forecast suggests we will have exceptional rainfall over the next number of days, farmers in the east are still coming to terms with the cost of the drought.

The €125,000 cost (€380/cow) to the Greenfield Farm in Kilkenny shows the swing in costs that can occur at farm level. Thankfully, milk price only dipped 10% this year but that, combined with exceptionally high feeding costs, will make margins very thin – if not nonexistent – on family run dairy farms in the east of the country this year.

It is the transparency that demonstration farms allow that makes them so beneficial to the sector. The fact that the farm has to dip into financial reserves to pay these feed bills shows the benefit of having a reserve fund for startup or vulnerable farms that might not yet have reached a critical level of production.

It’s a crucial lesson and maybe some innovative budget measure could have better helped foster this type of a tool that dairy farmers could use. The dairy sector is in a better cashflow situation than many other agri sectors given the monthly milk cheque but the extent of the increased costs this year are quite exceptional.

We should qualify that traditionally this part of country is very dry and the prolonged drought from June to mid-September was exceptional by any means.

The clear lesson is farmers must manage and adjust financial budgets as the years develop, often driven by weather events.

Winter feed: act early on fodder

While growth and grazing conditions have reduced in recent days, the weather over the past six to eight weeks has helped alleviated fodder issues on many farms. However, this should not distract from the need to carry out a fodder budget. Even a 10-15% deficit can be a real problem if action is not taken early.

From an agricultural perspective, Budget 2019 can be best summed up as a small step in the right direction. As is par for the course, there were winners and losers in a budget clearly targeted at starting to address the challenges faced by those in the low-income sectors.

The increase in ANC funding of €23m has been welcomed, coming on top of a €25m increase last year. This brings the total allocation for the scheme back to pre-recession levels at €250m. As Odile Evans reports, Minister for Agriculture Michael Creed is again considering skewing this payment towards those on the hills, providing a much-needed boost to the hill sheep sector.

The introduction of a targeted payment for the suckler herd has been met with a mixed reaction. With an annual budget of just €20m, farmers participating in what will be the new Beef Environmental Efficiency Programme (BEEP) will receive a payment of €40 per cow, significantly less than the €200 that had been called for by the IFA.

However, as Adam Woods reports, the scheme appears relatively straightforward with participating farmers only required to provide weight data on cows and calves. Gathering such information has proved difficult on suckler farms with physical performance data currently being recorded on less than 2% of cows and calves in the national suckler herd.

It is a trend that has negatively affected the rate of genetic improvement for two of the key profit-driving traits at farm level: growth rate and cow efficiency. While weighing animals has proved contentious in the past, the linking of such payments to measures that will help drive efficiencies at farm level is a positive step by the Department of Agriculture.

Key to the success of the scheme will be the rollout of a national cattle-weighing programme. While it won’t be without its complications, the fact that farmers will be allowed to use their own weighing scales should reduce complexity and costs. For those without on-farm weighing facilities, the network of livestock marts would appear ideally positioned to provide an on-farm weighing service with staff trained in handling livestock.

The decision to introduce a targeted payment for the suckler herd is an important signal to the sector

Beyond the mechanics of the scheme, the decision by the Government to introduce a targeted payment for the suckler herd is an important signal to the sector. While the €20m allocated to the scheme is disappointing, the fact that the Government has recognised the need to target payments at the low-income sector is significant in the context of the upcoming CAP reform.

For the dairy and tillage sectors, the budget proved underwhelming in terms of new measures. It is disappointing that despite being announced in 2017, the full details of the low-cost loan scheme have yet to be finalised – a fact that Minister Creed acknowledges in our interview.

It had been widely anticipated that an income deposit scheme would be introduced to take account of increased volatility in farm incomes. Failure to implement such a scheme, which would have come at minimal cost to the Exchequer, is a missed opportunity by the Government to provide the tools necessary to help farmers compete in global markets.

Also this week, Colm McCarthy gives a wider assessment of the budget. There is no doubt that the unexpected influx of corporation tax receipts, caused by unrepeatable changes to accounting rules, has allowed the Government gloss over significant budget overshoots, most noticeably in the health service.

Worryingly, we have seen Government spending increase by 25% over the past five years, five times faster than growth in the benchmark consumer price index (CPI). With a large proportion of the recent surge in corporation tax revenues, which have more than doubled over the past five years, now apportioned to day-to-day spending rather than being targeted towards capital investments, McCarthy highlights the extent of the bet the Government is placing on economic forecasts being delivered.

It is a strategy that is not without its risks given our acute exposure to the global tax environment.

Climate change: need to intensify sustainable food production

Elsewhere this week, Thomas Hubert details the findings of a report on global warming published by the International Panel of Climate Change (IPCC).

The consequences of failing to keep global warming below 1.5°C above pre-industrial levels grab headlines. What was not highlighted was the need identified to intensify food production where it is most sustainable to allow for land to be diverted into energy production.

So, we are facing into a situation where, on one side, the UN predicts that by 2050 food production will have to increase by 70% to meet a rising population and, on the other, the IPCC identifies the need to divert up to 700m ha (80 times the size of Ireland) into energy production to tackle climate change.

Surely such a scenario has to be viewed as a catalyst by governments to support the further development of sustainable food production. As one of the most sustainable food producers in the world, Ireland should be at the top of the queue. Instead, we see calls to restrict production, based on national targets that in no way take into account the world in which we are living. Clearly an urgent rethink is needed.

Speaking at the global conference on sustainability in Kilkenny this week, Justin Sherrard of Rabobank summed it up perfectly when he said: “Getting rid of livestock farms was an intellectually lazy way of addressing climage change.”

Fungicide: chlorothalonil loss not fully appreciated

Last week we highlighted the serious impact that the loss of chlorothalonil, an extremely important fungicide active, would have on the tillage sector. Given the response we have received to the piece, it was clearly an issue that had not been fully understood at EU level.

There is an opportunity for Minister for Agriculture Michael Creed to bring the issue on to the political agenda at the meeting of the Council of EU agriculture ministers in Brussels on Monday.

The risk to the Irish tillage sector and indeed the livestock and drinks sector is too significant to allow this pass under the radar.

Greenfield farm: drought costs becoming clear

The effects of the drought cost €125,000 (€380/cow) to the Greenfield Farm in Kilkenny.

While the weather forecast suggests we will have exceptional rainfall over the next number of days, farmers in the east are still coming to terms with the cost of the drought.

The €125,000 cost (€380/cow) to the Greenfield Farm in Kilkenny shows the swing in costs that can occur at farm level. Thankfully, milk price only dipped 10% this year but that, combined with exceptionally high feeding costs, will make margins very thin – if not nonexistent – on family run dairy farms in the east of the country this year.

It is the transparency that demonstration farms allow that makes them so beneficial to the sector. The fact that the farm has to dip into financial reserves to pay these feed bills shows the benefit of having a reserve fund for startup or vulnerable farms that might not yet have reached a critical level of production.

It’s a crucial lesson and maybe some innovative budget measure could have better helped foster this type of a tool that dairy farmers could use. The dairy sector is in a better cashflow situation than many other agri sectors given the monthly milk cheque but the extent of the increased costs this year are quite exceptional.

We should qualify that traditionally this part of country is very dry and the prolonged drought from June to mid-September was exceptional by any means.

The clear lesson is farmers must manage and adjust financial budgets as the years develop, often driven by weather events.

Winter feed: act early on fodder

While growth and grazing conditions have reduced in recent days, the weather over the past six to eight weeks has helped alleviated fodder issues on many farms. However, this should not distract from the need to carry out a fodder budget. Even a 10-15% deficit can be a real problem if action is not taken early.

SHARING OPTIONS