The rapid need to reduce global emissions has seen governments taking different approaches, from legislating for emissions reductions to staunchly rejecting any level of change.

As we transform our lives and businesses, there is a growing sense that it will be financial systems and not necessarily governments that hold the real power in accelerating change.

In this week's edition, Anne Finnegan examines the recently published Collar FAIRR Protein Index, produced by an investor network that manages $45tn in assets. Their combined activity has tremendous power in determining the future direction of businesses. The report highlights that protein businesses which do not decarbonise have limited prospects from an investment perspective. Their message and that of others in the financial system will permeate down through domestic banks into small businesses.

Simply put, the financial system will become a much greater driving force for emissions reductions, biodiversity improvements and a range of sustainability metrics than any government policy. Unless governments and policymakers take action and put in place a clear policy framework to determine emissions reductions, the fate of livestock production will be determined by investors, in offices far removed from the reality of farming.

Glanbia: a vote of trust in board and management

Glanbia Co-op shareholders will vote on Friday 17 December.

If the views expressed by the majority of farmers and IFA dairy chair Stephen Arthur on an IFA webinar this week reflect those of all Glanbia Co-op shareholders, then the proposals to be voted on this Friday will be passed.

The increased flexibility to adjust margins is a major incentive for dairy farmers. While stopping short of any commitments on future milk price, the co-op board and management have fuelled a belief among farmers that a major upward adjustment on milk price performance is coming should the deal go ahead – before trading bonuses are included.

Concerns around selling down the co-op’s shareholding in the plc to generate a future mergers and acquisitions fund remain. The price tag associated with losing the Glanbia brand has also surfaced. Management stresses their expertise regarding M&A activity while the board reassures shareholders any acquisition will only be considered if it meets key thresholds.

Friday’s vote is a vote of trust in the capacity of the board and management to develop a good business and execute a successful acquisition strategy. The extent to which this trust exists will be reflected in the outcome of the vote for each resolution. Many shareholders seem in favour of many of the resolutions, but not all.

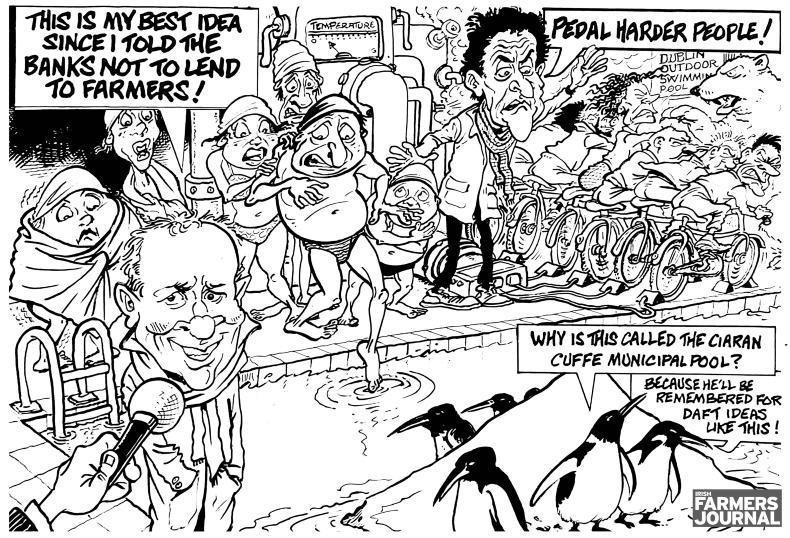

This week's cartoon:

\ Jim Cogan

Increased flexibility makes nitrates plan more palatable

The final version of the Nitrates Action Plan, published this week and sent to Brussels for approval, is the culmination of over 12 months of consultation between the relevant government departments, farmers and interested individuals.

While the process came in for criticism, the final text is a lot more palatable than some initial proposals. However, the devil is in the detail and the most damning aspect of this review may not be published this week; instead it will emerge when Teagasc publishes its review into slurry excretion rates for cows and cattle.

If, as expected, these are revised upwards, it could mean tens of thousands of farmers will have to construct additional slurry storage to remain compliant.

Is there a plan to support farmers to adjust to the new rules? When the Nitrates Directive was introduced in 2006, Government supported farmers with 60% to 70% grant aid for housing and slurry storage.

The rapid need to reduce global emissions has seen governments taking different approaches, from legislating for emissions reductions to staunchly rejecting any level of change.

As we transform our lives and businesses, there is a growing sense that it will be financial systems and not necessarily governments that hold the real power in accelerating change.

In this week's edition, Anne Finnegan examines the recently published Collar FAIRR Protein Index, produced by an investor network that manages $45tn in assets. Their combined activity has tremendous power in determining the future direction of businesses. The report highlights that protein businesses which do not decarbonise have limited prospects from an investment perspective. Their message and that of others in the financial system will permeate down through domestic banks into small businesses.

Simply put, the financial system will become a much greater driving force for emissions reductions, biodiversity improvements and a range of sustainability metrics than any government policy. Unless governments and policymakers take action and put in place a clear policy framework to determine emissions reductions, the fate of livestock production will be determined by investors, in offices far removed from the reality of farming.

Glanbia: a vote of trust in board and management

Glanbia Co-op shareholders will vote on Friday 17 December.

If the views expressed by the majority of farmers and IFA dairy chair Stephen Arthur on an IFA webinar this week reflect those of all Glanbia Co-op shareholders, then the proposals to be voted on this Friday will be passed.

The increased flexibility to adjust margins is a major incentive for dairy farmers. While stopping short of any commitments on future milk price, the co-op board and management have fuelled a belief among farmers that a major upward adjustment on milk price performance is coming should the deal go ahead – before trading bonuses are included.

Concerns around selling down the co-op’s shareholding in the plc to generate a future mergers and acquisitions fund remain. The price tag associated with losing the Glanbia brand has also surfaced. Management stresses their expertise regarding M&A activity while the board reassures shareholders any acquisition will only be considered if it meets key thresholds.

Friday’s vote is a vote of trust in the capacity of the board and management to develop a good business and execute a successful acquisition strategy. The extent to which this trust exists will be reflected in the outcome of the vote for each resolution. Many shareholders seem in favour of many of the resolutions, but not all.

This week's cartoon:

\ Jim Cogan

Increased flexibility makes nitrates plan more palatable

The final version of the Nitrates Action Plan, published this week and sent to Brussels for approval, is the culmination of over 12 months of consultation between the relevant government departments, farmers and interested individuals.

While the process came in for criticism, the final text is a lot more palatable than some initial proposals. However, the devil is in the detail and the most damning aspect of this review may not be published this week; instead it will emerge when Teagasc publishes its review into slurry excretion rates for cows and cattle.

If, as expected, these are revised upwards, it could mean tens of thousands of farmers will have to construct additional slurry storage to remain compliant.

Is there a plan to support farmers to adjust to the new rules? When the Nitrates Directive was introduced in 2006, Government supported farmers with 60% to 70% grant aid for housing and slurry storage.

SHARING OPTIONS