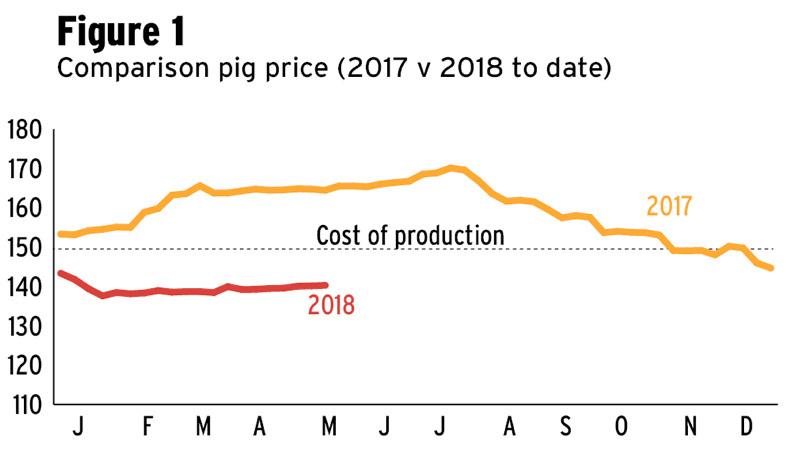

Following a strong performance in the pig sector in 2017, this year has proven to be far more challenging. The price per kilo of pigmeat is currently 140c/kg, 10c below the cost of production and down 30c on last year’s peak.

Tom Hogan, IFA pig chair, painted a grim picture of the current state of the sector. “Times are tough, make no mistake. While they are not as bad as they were in 2015, the short-term outlook is not great,” he said.

The sector is currently trapped between a rock and a hard place as decreased prices are being compounded by an increase in the cost of production.

An increase in worldwide production from all major pork producing countries in response to high global prices last year has resulted in a drop in price this year. Feed prices have also increased by about €25/t, translating to an increased cost of production of 4c/kg.

These two factors combined are seeing some farmers losing €10 on every pig.

“At the moment, there are not too many under serious threat. Due to the positive year we had last year, most have a cushion they can fall back on. As a pig farmer, the reality is that you need to set aside €40,000 to €50,000 as a rainy-day fund.”

Hogan sees a major problem developing if the present conditions continue into the autumn when pig markets traditionally tend to be tougher.

“Realistically, given the weather conditions we saw during spring, feed prices are unlikely to decrease. We need pig prices to improve but I would encourage guys to talk to their bank manager sooner rather than later. Ideally, there could be low interest loans put in place.”

Philip O’Brien Mitchelstown, Co Cork (2,000-sow unit)

“At a time of the year when we should have our highest prices we have our lowest.

“Things are not pretty. Even with home milling where our feed costs would be lower than guys using composite feeds, the price of all our ingredients have gone through the roof.”

Pig prices traditionally experience a price rise during the summer months as pork consumption increases with the arrival of barbeque season. However, O’Brien says producers are yet to see a rise in prices, which have been at a consistently low level since January.

While the immediate future is of concern, O’Brien also points out the uncertain long term future producer’s face.

“We’re subject to a huge amount of legislation when it comes to things like welfare. We are not against that but we need time as a sector to adjust to any rule changes.

“There is a lot of talk about the banning of tail docking and if that were to happen without the correct prior planning and a sufficiently long transition period then a lot of guys would have to exit.”

Gary Pepper Cootehill, Co Cavan (500-sow unit)

“The key to pig farming for me is efficiency. Our performance from eight years ago was in the top 10% and now that is the average – things are advancing so quickly.”

The benchmark for most pig producers is to produce 2.2t per sow per year and on Pepper’s farm they are producing 2.9t. Each sow is producing 32 pigs per year with 15 piglets born live per litter. Pepper says this performance is driven by high quality feed and facilities which translates to high welfare standards and productive pigs.

“At the moment I’m operating about 8c/kg under my break-even point of 150c/kg. While that might not seem like a lot it costs me €7,500 to €8,000 a month and we have been enduring these low prices for six months now.”

A home-milling facility was built on the farm in 2016 in an effort minimise external influences but feed still accounts for 70% of all costs. Since the turn of the year feed prices have risen by €15/t and with the mill using 400t/month, this has added €6,000 to the bill.

SHARING OPTIONS