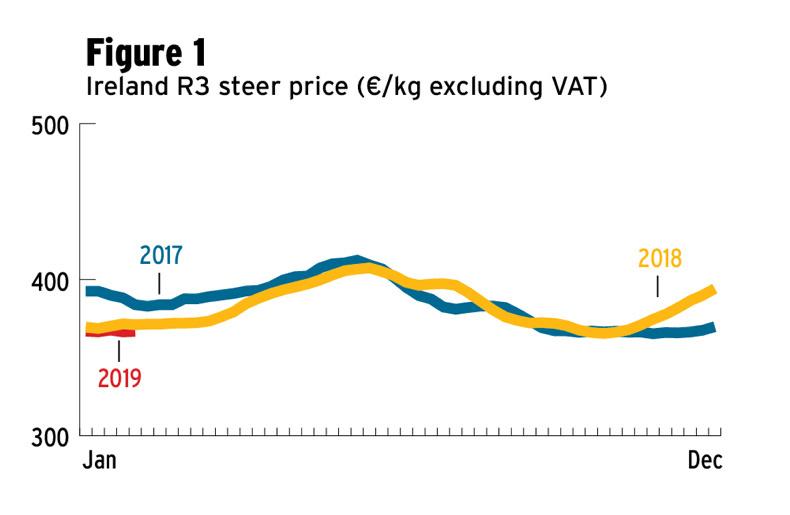

To-date during 2019, Irish cattle prices have fallen behind last year’s levels, with average returns for R grade steers declining by 6% or 24c/kg deadweight.

This dramatic decrease is particularly disturbing for beef producers on account of significant market uncertainty surrounding Brexit alongside the higher cost of feed and other inputs.

Base quotes for R grade steers and heifers have remained static since last September, at €3.75 and €3.85/kg respectively. As a result, the average price paid for R3 steers remained very close to its current level of €3.67/kg (excluding VAT).

EU trade

Throughout this period, the European beef sector was impacted by higher stocks of domestic beef on the market, as production rose by 1.7% across the EU28.

Meanwhile, imports of beef into Europe, predominantly from South America, rose by 10% in 2018, while exports of European beef into International markets recorded a 5% decline.

These three important factors of higher EU production, rising imports and reduced exports collectively resulted in an additional 188,000t of beef in the supply chain last year – equivalent to 2.6% of total EU beef consumption (European Commission data).

More positively, beef consumption is estimated to have risen by 1.4% across the EU member states, reflecting the improving economic environment across the Eurozone, resulting in higher consumer spending power.

Britain

By comparison, UK cattle prices have begun to recover in recent weeks following regular declines throughout the autumn months.

Most recently, R3 steers in Britain are averaging £3.59/kg, which is equivalent to €4.08/kg (excluding VAT).

Across continental Europe, where most Irish beef is exported, after the UK, cattle prices are also behind last year’s levels. R-grade young bull prices are currently €3.83/kg in France, €3.81/kg in Germany, €4.10/kg in Italy and €3.78/kg in Spain, while the weighted average price of R3 young bulls across continental Europe stands at €3.72/kg (excluding VAT).

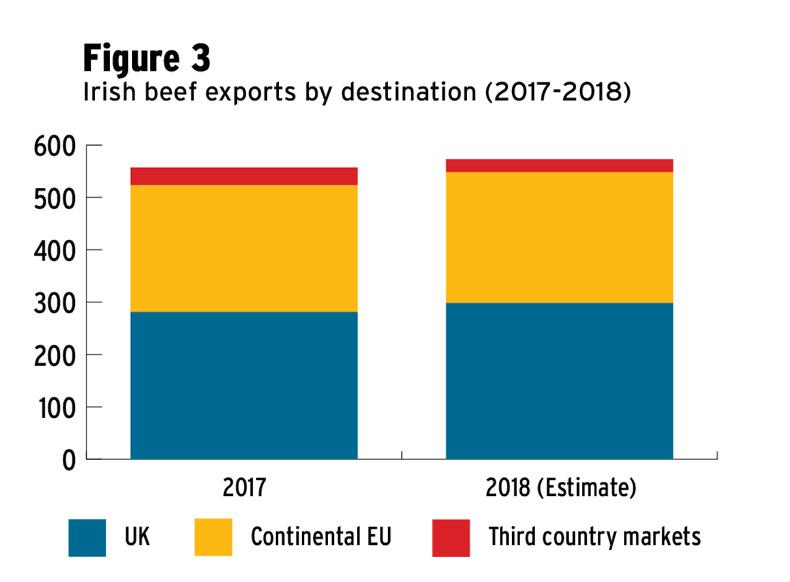

Exports of Irish beef increased by 3% in volume during 2018 to 573,000t, with an overall value of €2.5bn, which was just 1% higher than the previous year. Similar to recent years, the UK market accounted for 52% of Irish beef exports, or 298,000t.

In terms of market channels, the retail sector accounted for an estimated 46% of Irish volumes in the UK.

Manufacturing companies accounted for a further 32% of Irish exports there, and the quick-service restaurant chains (eg McDonald’s, Burger King) were particularly dominant within this.

Both the British retail and quick-service customers have a large demand for fresh, Quality-Assured forequarter beef for their mince and burger offerings.

As a result, almost two-thirds of Irish beef exports to the UK are comprised of forequarter cuts and VLs (visual lean/manufacturing meat), because it represents the single most attractive destination for a large volume of this category of product.

Continental exports

Irish beef exports into continental Europe also grew by 3% to reach 250,000t, thereby making up 44% of total exports for 2018.

Irish exports continued to gain market share in certain countries, such as Germany (+10% to 27,000t), the Netherlands (+11% to 54,000t) and Italy (+6% to 35,000t).

However, the drought conditions which prevailed across much of Europe last autumn, resulting in higher culling rates, impacted on the performance of Irish beef across several other markets, including Sweden (-10% to 31,000t), Denmark (-5% to 7,000t) and France (-3% to 61,000t).

Meanwhile, exports of Irish beef to international markets declined by more than 25% to just 25,000t, and therefore represented just 4% of Irish beef exports.

In markets such as the Philippines and Hong Kong, where Irish beef had performed strongly in 2017, there was a prevalent supply of more competitively priced beef from Australia and South America.

The opening of the Chinese market to Irish beef was important in terms of the future potential of that market and as a signal to other customers in the region.

However, Irish exports reached just over 1,000t from market opening in June until the year end. As yet, there are just six Irish beef plants approved and access is limited to frozen boneless cuts, coming from <30 month cattle and TB-free herds.

Supplies to tighten

Notwithstanding the significant uncertainty surrounding the political negotiations with regard to the British market, there is potential for some recovery across key destinations for Irish beef over the coming months as the supply/demand situation returns to a more normal balance.

For the year, European beef production is forecast to contract by 1.7%. Importantly, beef output volumes are predicted to decline by -3.7% in France, -2.9% in Germany and -2.3% in the UK in 2019.

Globally, the supply of beef available on world markets is expected to remain static as some production increases in the US and South America are likely to be offset by decreases coming from both Australia and India.

Meanwhile, global import demand looks set to grow by +3.6%, according to GIRA analysis, driven by increases in major markets such as China (+10%), Japan (+7%) and the US (+2.4%).

SHARING OPTIONS