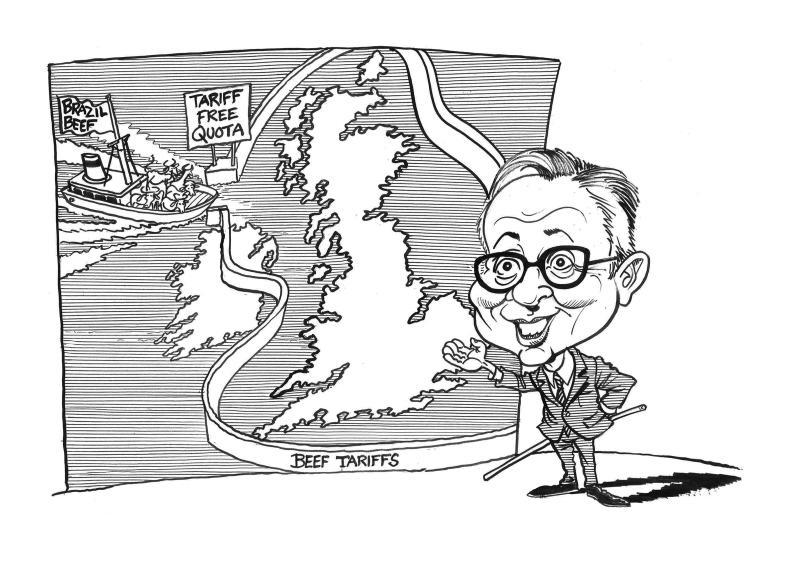

As David Wright reports, documents obtained by the Irish Farmers Journal show that in the event of a no-deal Brexit, the UK will throw its doors open to South American beef imports.

While UK environment, food and rural affairs secretary Michael Gove has this week reassured UK farmers that tariffs will be imposed to protect domestic prices, the Irish Farmers Journal understands that in order to curb food price inflation, a zero tariff rate quota will be granted for beef imports.

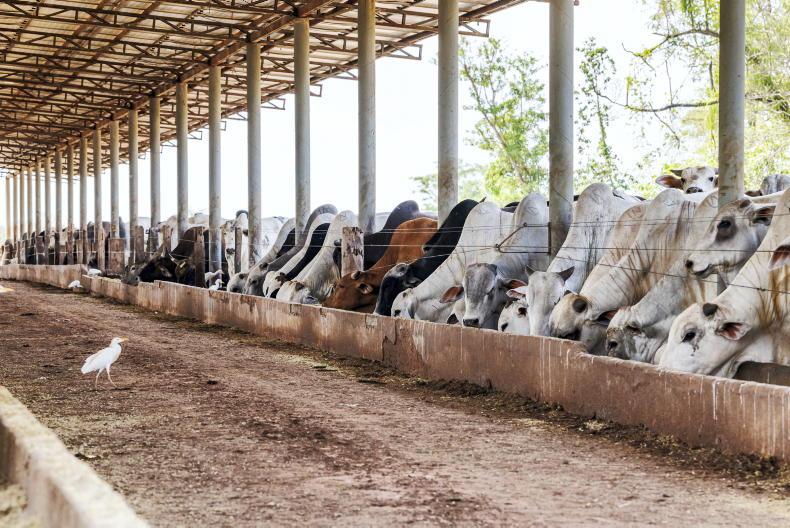

This will open up the UK market to major beef exporters such as Australia, Brazil, Argentina, Uruguay and Paraguay – all regions where the current beef price is half the European average.

There is no sugar-coating the message in relation to the impact that such a move would have on the Irish beef sector and indeed rural Ireland.

In the absence of swift intervention by the EU to the UK throwing its beef market open, rural Ireland would find itself effectively waking up to a national emergency on 30 March – priced out of a market that is consuming five times more Irish beef than the Irish market itself.

When British retailers had access to South American beef in 2006/2007, they were returning the equivalent of €2.80/kg for Irish product.

There has never been more of a need for farmers to come together with one voice and send a signal to Government and the EU

Comments by Gove that British farmers – and by association Irish farmers – would be protected from cheap South American imports on the basis of standards is a sleight of hand.

Reassurances around maintaining equivalent standards are meaningless where there is clearly such a large economic incentive for both retailers and processors to reduce reliance on domestic and Irish product.

In 2018, the EU imported 258,000t carcase-weight equivalent (CWE) from Brazil, Argentina and Uruguay, all deemed of a satisfactory standard for the EU, so it will be perfectly adequate for the UK.

There is the hope that the resurgence of South American beef into the British market will be gradual. However, despite public assurances, there is no doubt that retailers and processors are well advanced in their preparations to exploit any move by the UK to open up the market to cheaper imports.

In many ways, the move by Gove this week merely reaffirms what most had suspected – that gaining access to cheap food and curbing food inflation would trump the need to protect British farmers and traditional supply routes.

It would be naive to think that margin-hungry retailers and processors have been sitting on their hands over the past two years and not preparing for a tariff-free landscape. They will explain their commercial decision as giving consumers choice – and operating to EU standards addresses any safety concerns.

Interestingly, greater access to the UK market is also likely to see the big global players looking at processors such as the ABP Food Group as potential acquisition targets.

The group’s processing capacity in Ireland and the UK and deep links with British retailers would make them an ideal launch-pad from which to quickly access high-volume and value customers with a blended offering of UK, Irish and Brazilian product.

We all hope that threats of a tariff-free beef quota, which the UK knows would devastate the Irish beef sector, is a negotiating tactic aimed at turning up the heat on the EU.

However, the risks for Ireland are too high to continue to hope for the best. There has never been more of a need for farmers to come together with one voice and send a strong signal to Government and the EU that they will not allow themselves to become pawns in a highly volatile and politically charged negotiation process.

Irish farmers need to become more than passive bystanders.

The British government is well aware of the consequences for Ireland of granting tariff-free access for beef into the British market – and the consequences for its domestic producers who will also be undermined.

In this light, it is difficult to interpret this week’s move as anything other than a threat that the UK government will wipe out the Irish beef industry unless they get a Brexit deal.

Politicians and those representing farmers should be focused on one thing only for the next five weeks: making sure the Government and Brussels deliver on their commitment to protect farm incomes whatever the outcome of Brexit.

In a week where we learn that our most lucrative beef market could be flooded with cheap South American imports, it is a shame that the political debate has been focused on who agreed what 10 years ago in relation to movement restrictions.

Farmers deserve better from all sides.

Dairy: price increases a boost in busy few months

The fact that milk product prices are increasing alongside positive global dairy trade auctions is another positive for dairy farmers during this peak of workload. Financial results from Kerry and Glanbia this week reinforce their positions as well-invested global dairy businesses.

The benefit for dairy farmers will be the positive predictions on milk prices, which should go some way to reducing the feed bills from the last two years. A strong first half year on milk prices for dairy farmers goes a long way given the seasonal production profile.

What a difference a year makes, especially on those farms in the southeast. Last year, by the end of February, we had frozen and snow-covered fields. Now we have paddocks where grass is literally growing out over the ditches. On a lot of eastern farms that were badly drought-affected, there has been more grass grown in December, January and February than in the total period from June to September last year. Once again, it reinforces the impact weather can have on our farmers and the knock-on consequences.

We bemoan the bad weather, so we should welcome the feed bounty on farms and the opportunity for farmers to reduce feed costs significantly.

BETTER farms: costs become clear

Also this week, Matthew Halpin reports on the costs incurred on the Teagasc/Irish Farmers Journal BETTER farms last year. 2018 was extremely difficult on Irish beef farms. The full extent of the damage has only begun to hit home as farmers completed their annual e-Profit Monitors over the last six weeks.

A breakdown of costs shows that feed costs across all 26 monitor farms went up by 68% on average. Looking deeper, feed costs in the south and southeast rose by 168% and 106%, respectively, while the northwest only experienced a 25% hike.

Other costs such as contractors and fertiliser rose by 56% and 32%, respectively. The power of this programme is in the information that it provides farmers and while many will have known that costs were higher, few would have projected the extent of the increase.

Calf exports: solutions needed for French bottleneck

As Amy Forde and Darren Carty report, the Department of Agriculture had been confident that Irish Ferries would change its sailing schedule to allow staggered sailings of the WB Yeats.

However, the company is sticking to its advertised schedule, which puts excessive pressure on the limited lairages at Cherbourg for calves to rest.

This limited lairage will have serious consequences here, with exporters facing delays and being unable to move calves when we enter the peak trade from mid-March.

Sheep: bizarre double standards on EID tagging

Confirmation from the Department of Agriculture that factories and marts will not be obliged to install systems capable of reading EID tags in sheep seems bizarre.

On one hand, farmers will be forced to tag all sheep with EID, at an estimated cost of €20m per year. On the other, the potential benefits of reduced farmer labour and increased traceability could be lost if the entire supply chain refuse to participate.

In cases where marts or factories do not install EID systems, farmers will still have to fill out dispatch documents by hand.

As David Wright reports, documents obtained by the Irish Farmers Journal show that in the event of a no-deal Brexit, the UK will throw its doors open to South American beef imports.

While UK environment, food and rural affairs secretary Michael Gove has this week reassured UK farmers that tariffs will be imposed to protect domestic prices, the Irish Farmers Journal understands that in order to curb food price inflation, a zero tariff rate quota will be granted for beef imports.

This will open up the UK market to major beef exporters such as Australia, Brazil, Argentina, Uruguay and Paraguay – all regions where the current beef price is half the European average.

There is no sugar-coating the message in relation to the impact that such a move would have on the Irish beef sector and indeed rural Ireland.

In the absence of swift intervention by the EU to the UK throwing its beef market open, rural Ireland would find itself effectively waking up to a national emergency on 30 March – priced out of a market that is consuming five times more Irish beef than the Irish market itself.

When British retailers had access to South American beef in 2006/2007, they were returning the equivalent of €2.80/kg for Irish product.

There has never been more of a need for farmers to come together with one voice and send a signal to Government and the EU

Comments by Gove that British farmers – and by association Irish farmers – would be protected from cheap South American imports on the basis of standards is a sleight of hand.

Reassurances around maintaining equivalent standards are meaningless where there is clearly such a large economic incentive for both retailers and processors to reduce reliance on domestic and Irish product.

In 2018, the EU imported 258,000t carcase-weight equivalent (CWE) from Brazil, Argentina and Uruguay, all deemed of a satisfactory standard for the EU, so it will be perfectly adequate for the UK.

There is the hope that the resurgence of South American beef into the British market will be gradual. However, despite public assurances, there is no doubt that retailers and processors are well advanced in their preparations to exploit any move by the UK to open up the market to cheaper imports.

In many ways, the move by Gove this week merely reaffirms what most had suspected – that gaining access to cheap food and curbing food inflation would trump the need to protect British farmers and traditional supply routes.

It would be naive to think that margin-hungry retailers and processors have been sitting on their hands over the past two years and not preparing for a tariff-free landscape. They will explain their commercial decision as giving consumers choice – and operating to EU standards addresses any safety concerns.

Interestingly, greater access to the UK market is also likely to see the big global players looking at processors such as the ABP Food Group as potential acquisition targets.

The group’s processing capacity in Ireland and the UK and deep links with British retailers would make them an ideal launch-pad from which to quickly access high-volume and value customers with a blended offering of UK, Irish and Brazilian product.

We all hope that threats of a tariff-free beef quota, which the UK knows would devastate the Irish beef sector, is a negotiating tactic aimed at turning up the heat on the EU.

However, the risks for Ireland are too high to continue to hope for the best. There has never been more of a need for farmers to come together with one voice and send a strong signal to Government and the EU that they will not allow themselves to become pawns in a highly volatile and politically charged negotiation process.

Irish farmers need to become more than passive bystanders.

The British government is well aware of the consequences for Ireland of granting tariff-free access for beef into the British market – and the consequences for its domestic producers who will also be undermined.

In this light, it is difficult to interpret this week’s move as anything other than a threat that the UK government will wipe out the Irish beef industry unless they get a Brexit deal.

Politicians and those representing farmers should be focused on one thing only for the next five weeks: making sure the Government and Brussels deliver on their commitment to protect farm incomes whatever the outcome of Brexit.

In a week where we learn that our most lucrative beef market could be flooded with cheap South American imports, it is a shame that the political debate has been focused on who agreed what 10 years ago in relation to movement restrictions.

Farmers deserve better from all sides.

Dairy: price increases a boost in busy few months

The fact that milk product prices are increasing alongside positive global dairy trade auctions is another positive for dairy farmers during this peak of workload. Financial results from Kerry and Glanbia this week reinforce their positions as well-invested global dairy businesses.

The benefit for dairy farmers will be the positive predictions on milk prices, which should go some way to reducing the feed bills from the last two years. A strong first half year on milk prices for dairy farmers goes a long way given the seasonal production profile.

What a difference a year makes, especially on those farms in the southeast. Last year, by the end of February, we had frozen and snow-covered fields. Now we have paddocks where grass is literally growing out over the ditches. On a lot of eastern farms that were badly drought-affected, there has been more grass grown in December, January and February than in the total period from June to September last year. Once again, it reinforces the impact weather can have on our farmers and the knock-on consequences.

We bemoan the bad weather, so we should welcome the feed bounty on farms and the opportunity for farmers to reduce feed costs significantly.

BETTER farms: costs become clear

Also this week, Matthew Halpin reports on the costs incurred on the Teagasc/Irish Farmers Journal BETTER farms last year. 2018 was extremely difficult on Irish beef farms. The full extent of the damage has only begun to hit home as farmers completed their annual e-Profit Monitors over the last six weeks.

A breakdown of costs shows that feed costs across all 26 monitor farms went up by 68% on average. Looking deeper, feed costs in the south and southeast rose by 168% and 106%, respectively, while the northwest only experienced a 25% hike.

Other costs such as contractors and fertiliser rose by 56% and 32%, respectively. The power of this programme is in the information that it provides farmers and while many will have known that costs were higher, few would have projected the extent of the increase.

Calf exports: solutions needed for French bottleneck

As Amy Forde and Darren Carty report, the Department of Agriculture had been confident that Irish Ferries would change its sailing schedule to allow staggered sailings of the WB Yeats.

However, the company is sticking to its advertised schedule, which puts excessive pressure on the limited lairages at Cherbourg for calves to rest.

This limited lairage will have serious consequences here, with exporters facing delays and being unable to move calves when we enter the peak trade from mid-March.

Sheep: bizarre double standards on EID tagging

Confirmation from the Department of Agriculture that factories and marts will not be obliged to install systems capable of reading EID tags in sheep seems bizarre.

On one hand, farmers will be forced to tag all sheep with EID, at an estimated cost of €20m per year. On the other, the potential benefits of reduced farmer labour and increased traceability could be lost if the entire supply chain refuse to participate.

In cases where marts or factories do not install EID systems, farmers will still have to fill out dispatch documents by hand.

SHARING OPTIONS