The latest data published by the Agriculture and Horticulture Development Board (AHDB) shows UK exports of fresh or frozen lamb were recorded at 5,600t for the month of August.

This is a 10%, or 600t, reduction on August 2021 levels and is also marginally lower than July 2022, with exports falling by 3% or 200t.

AHDB dairy and livestock analyst Freya Shuttleworth reports that fresh carcases and half carcases were the primary product exported in August, accounting for 79% of total volumes.

Exports to France, the UK’s main market for sheepmeat, reduced by 6% to 2,600t on July 2022 levels. There were also declines noted in exports to Belgium, Ireland and the Netherlands.

In contrast, export volumes to Germany and Italy recorded significant growth on the previous month. Germany imported 1,300t of UK fresh or frozen lamb, equating to an increase of 13% on the previous month.

UK export volumes of lamb by key destination.

Looking at the bar chart detailing export volumes by destination, one would expect export volumes to have increased significantly in September 2022.

Data also published this week by the AHDB puts question marks on this statement, with UK sheepmeat production recorded at 21,400t in September, a reduction of 11% compared with September 2021.

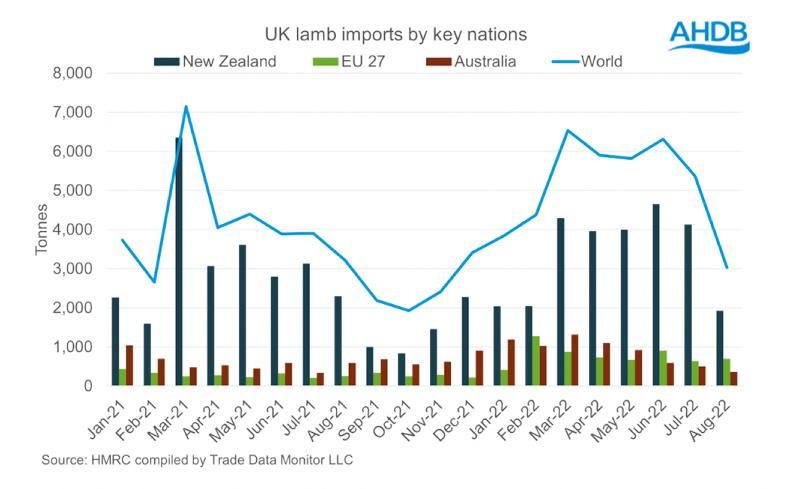

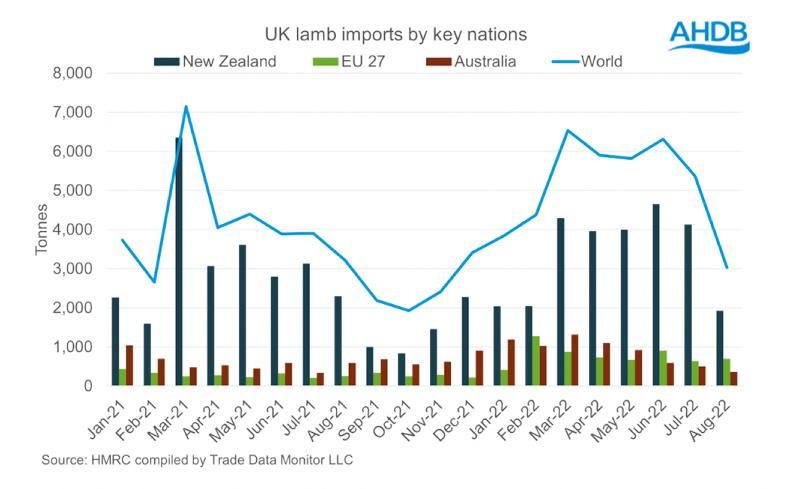

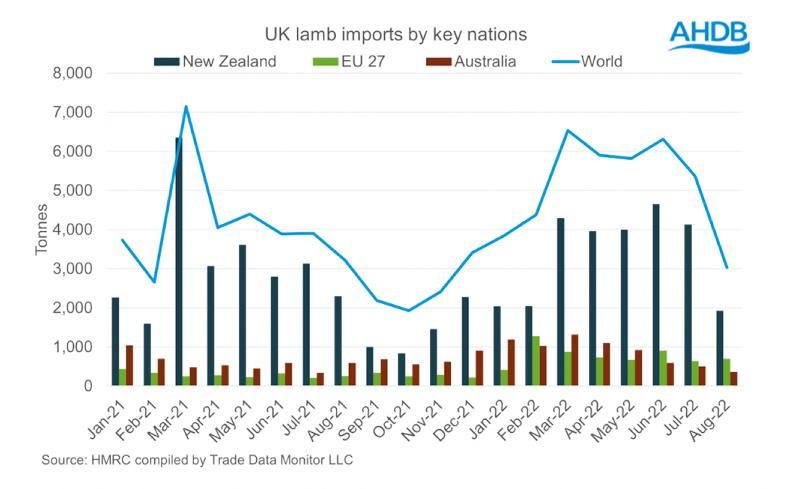

Lamb imports

The volume of fresh or frozen lamb imported by the UK was recorded at 3,000t in August. This represents a reduction of 43% on July 2022 volumes.

This reduction exceeds the normal seasonal decline and is underpinned by higher volumes of sheepmeat imported from New Zealand in the previous months.

UK import volumes of lamb by key provider

This is reflected in the ‘UK lamb imports by key nations’ bar chart. It shows that in August, imports from New Zealand more than halved, reducing by 2,200t to 1,900t.

Imports from Australia also reduced significantly, albeit with lower volumes involved. Imports reduced by 29% on July levels to 360t and are running 39% lower year on year.

In contrast, imports from the EU were 9% higher in August compared with levels recorded in July.

The 12% increase to reach 700t is reported by the AHDB as being attributed to higher volumes of Irish lamb entering the market, with 670t originating from Ireland.

Year-to-date imports from the EU are running 440t higher and this is again largely attributed to higher volumes of Irish sheepmeat.

The latest data published by the Agriculture and Horticulture Development Board (AHDB) shows UK exports of fresh or frozen lamb were recorded at 5,600t for the month of August.

This is a 10%, or 600t, reduction on August 2021 levels and is also marginally lower than July 2022, with exports falling by 3% or 200t.

AHDB dairy and livestock analyst Freya Shuttleworth reports that fresh carcases and half carcases were the primary product exported in August, accounting for 79% of total volumes.

Exports to France, the UK’s main market for sheepmeat, reduced by 6% to 2,600t on July 2022 levels. There were also declines noted in exports to Belgium, Ireland and the Netherlands.

In contrast, export volumes to Germany and Italy recorded significant growth on the previous month. Germany imported 1,300t of UK fresh or frozen lamb, equating to an increase of 13% on the previous month.

UK export volumes of lamb by key destination.

Looking at the bar chart detailing export volumes by destination, one would expect export volumes to have increased significantly in September 2022.

Data also published this week by the AHDB puts question marks on this statement, with UK sheepmeat production recorded at 21,400t in September, a reduction of 11% compared with September 2021.

Lamb imports

The volume of fresh or frozen lamb imported by the UK was recorded at 3,000t in August. This represents a reduction of 43% on July 2022 volumes.

This reduction exceeds the normal seasonal decline and is underpinned by higher volumes of sheepmeat imported from New Zealand in the previous months.

UK import volumes of lamb by key provider

This is reflected in the ‘UK lamb imports by key nations’ bar chart. It shows that in August, imports from New Zealand more than halved, reducing by 2,200t to 1,900t.

Imports from Australia also reduced significantly, albeit with lower volumes involved. Imports reduced by 29% on July levels to 360t and are running 39% lower year on year.

In contrast, imports from the EU were 9% higher in August compared with levels recorded in July.

The 12% increase to reach 700t is reported by the AHDB as being attributed to higher volumes of Irish lamb entering the market, with 670t originating from Ireland.

Year-to-date imports from the EU are running 440t higher and this is again largely attributed to higher volumes of Irish sheepmeat.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: