International analysts suggest milk prices are likely to fall to 45-50c/l across Europe over the next three to four months as continued pressure on dairy commodities hits farmgate returns.

With most Irish processors currently working off a base of 57-58c/l, a drop of 8-13c/l would represent a 14-22% cut in milk prices.

Market analysts pointed out that dairy commodities such as butter and skim milk powder (SMP) prices have fallen by around 40% on international markets since last June and that a “downward correction” in farmgate milk prices was therefore inevitable.

However, Rabobank dairy analyst Richard Scheper predicted that milk prices are likely to rebound through the second half of the year.

Reduced demand

Scheper blamed weaker dairy commodity prices on reduced demand rather than increased supply.

“It is not that the market will be overwhelmed with milk, the challenges will be primarily on the demand side,” he told the Irish Farmers Journal this week.

Dairy commodity markets have been hit by a combination of factors since last summer. Buyers have been burned off by extremely strong prices, while inflation has dampened demand. These challenges have been compounded by slower than expected activity from Chinese buyers.

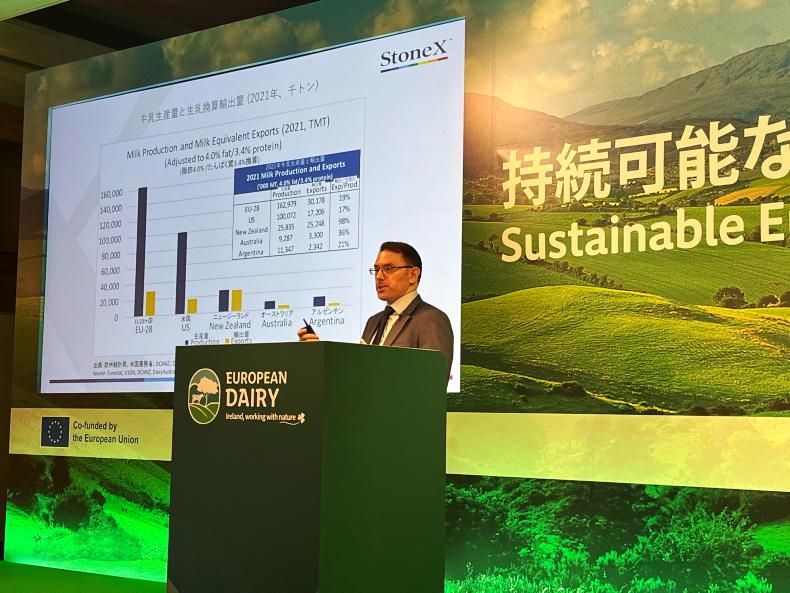

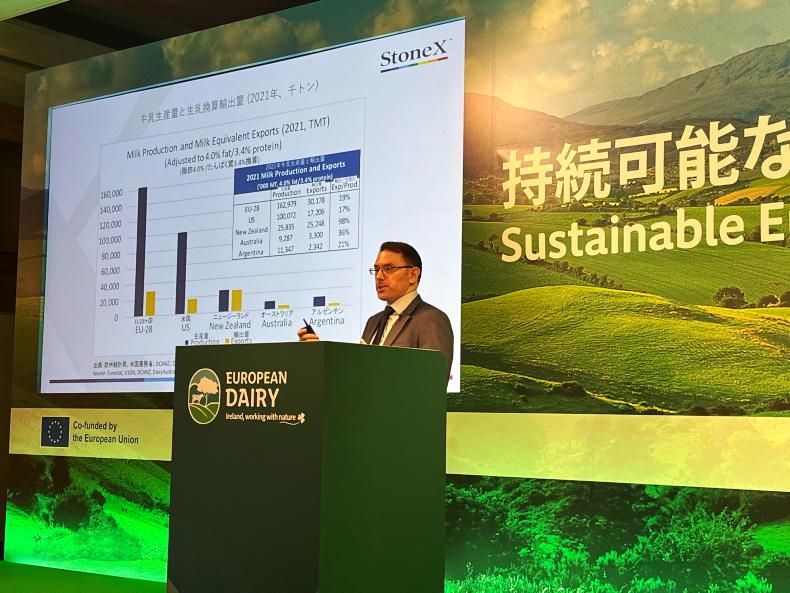

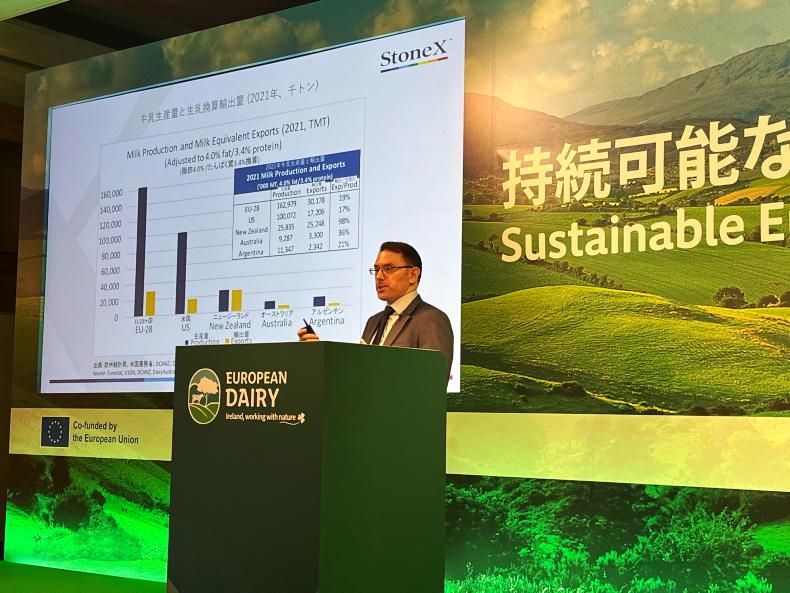

John Lancaster of StoneX Financial Europe SA pointed out that butter prices fell from a high of €7,478/t last June to €4,440/t last week. This is a drop of 41%. He said SMP has fallen by a similar level over the last few months to reach €2,450/t, while whole milk powder and cheese prices are also well back.

Worryingly for dairy farmers, Lancaster said that forward prices for March and April remained at reduced levels. Butter is at €4,400-4,500/t, with SMP at around €2,500/t and possibly rising to €2,650/t towards the end of the year.

EMEA head of dairy and food consulting at Stonex, John Lancaster.

“There is no good news from the markets in the short term or medium term,” Lancaster said.

“Commodities are back very significantly and this will have an impact on milk prices. This is already happening in Britain and it is very difficult to see a scenario where it won’t happen here as well,” Lancaster said.

Pace of price drop

Scheper said the pace of any price drop over the coming four months will vary depending on the processor, their product mix and length of forward contracts agreed with buyers such as retailers.

However, the Rabobank analyst believes prices are likely to rebound through the second half of the year.

“The short-term market sentiment is certainly bearish but not the long-term outlook. There is potential for a recovery in dairy prices during the second half of the year, but not to the levels we have seen last year,” he said.

Scheper pointed out that milk supplies remain finely balanced. He explained that a premium was paid in Europe last year because the market was “just shy of milk”.

Richard Scheper, dairy analyst, Rabobank. \ Donal O'Leary

“In contrast, there is currently a slight oversupply across Europe and dairy prices have moved closer to global levels,” the Rabobank analyst said.

However, Scheper predicted that this oversupply will rebalance itself during the second half of the year.

He said output in the EU and UK will be up around 0.6% in 2023, New Zealand is struggling through a sequence of unfavourable weather conditions, while output growth in the US will follow historic patterns and is expected to be around 1.4% for 2023.

Meanwhile, in other dairy sector news, AIB has indicated that lending for this year will be based on milk price below 50c/l.

“At AIB, we have revised our 12-month forward-looking budget price to sub-50c/l; however this will be kept under monthly review,” said Donal Whelton, head of agriculture at AIB.

International analysts suggest milk prices are likely to fall to 45-50c/l across Europe over the next three to four months as continued pressure on dairy commodities hits farmgate returns.

With most Irish processors currently working off a base of 57-58c/l, a drop of 8-13c/l would represent a 14-22% cut in milk prices.

Market analysts pointed out that dairy commodities such as butter and skim milk powder (SMP) prices have fallen by around 40% on international markets since last June and that a “downward correction” in farmgate milk prices was therefore inevitable.

However, Rabobank dairy analyst Richard Scheper predicted that milk prices are likely to rebound through the second half of the year.

Reduced demand

Scheper blamed weaker dairy commodity prices on reduced demand rather than increased supply.

“It is not that the market will be overwhelmed with milk, the challenges will be primarily on the demand side,” he told the Irish Farmers Journal this week.

Dairy commodity markets have been hit by a combination of factors since last summer. Buyers have been burned off by extremely strong prices, while inflation has dampened demand. These challenges have been compounded by slower than expected activity from Chinese buyers.

John Lancaster of StoneX Financial Europe SA pointed out that butter prices fell from a high of €7,478/t last June to €4,440/t last week. This is a drop of 41%. He said SMP has fallen by a similar level over the last few months to reach €2,450/t, while whole milk powder and cheese prices are also well back.

Worryingly for dairy farmers, Lancaster said that forward prices for March and April remained at reduced levels. Butter is at €4,400-4,500/t, with SMP at around €2,500/t and possibly rising to €2,650/t towards the end of the year.

EMEA head of dairy and food consulting at Stonex, John Lancaster.

“There is no good news from the markets in the short term or medium term,” Lancaster said.

“Commodities are back very significantly and this will have an impact on milk prices. This is already happening in Britain and it is very difficult to see a scenario where it won’t happen here as well,” Lancaster said.

Pace of price drop

Scheper said the pace of any price drop over the coming four months will vary depending on the processor, their product mix and length of forward contracts agreed with buyers such as retailers.

However, the Rabobank analyst believes prices are likely to rebound through the second half of the year.

“The short-term market sentiment is certainly bearish but not the long-term outlook. There is potential for a recovery in dairy prices during the second half of the year, but not to the levels we have seen last year,” he said.

Scheper pointed out that milk supplies remain finely balanced. He explained that a premium was paid in Europe last year because the market was “just shy of milk”.

Richard Scheper, dairy analyst, Rabobank. \ Donal O'Leary

“In contrast, there is currently a slight oversupply across Europe and dairy prices have moved closer to global levels,” the Rabobank analyst said.

However, Scheper predicted that this oversupply will rebalance itself during the second half of the year.

He said output in the EU and UK will be up around 0.6% in 2023, New Zealand is struggling through a sequence of unfavourable weather conditions, while output growth in the US will follow historic patterns and is expected to be around 1.4% for 2023.

Meanwhile, in other dairy sector news, AIB has indicated that lending for this year will be based on milk price below 50c/l.

“At AIB, we have revised our 12-month forward-looking budget price to sub-50c/l; however this will be kept under monthly review,” said Donal Whelton, head of agriculture at AIB.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: