The coronation of King Charles III this weekend may not be top priority for Irish farmers as they struggle with a difficult spring, but it gives a boost to the market for many of the agri food products we export to Britain.

According to figures published by the Agriculture and Horticulture Development Board (AHDB) - the English levy board comparable to Bord Bia - there is a surge in demand for meat and dairy around special events.

Looking back a year ago to the platinum jubilee of Queen Elizabeth II, there was a 50% increase in retail burger sales during jubilee week compared with the same week in May 2021.

Demand also jumped 30% for sausage rolls and pork pie sales were up 30% for the celebrations.

Benefit

Dairy sales also benefited, with a 33% jump in demand, as an extra 724,000 litres of fresh cream were bought that week by British consumers, compared with the average week in 2022 and even cheese sales received a 2% boost.

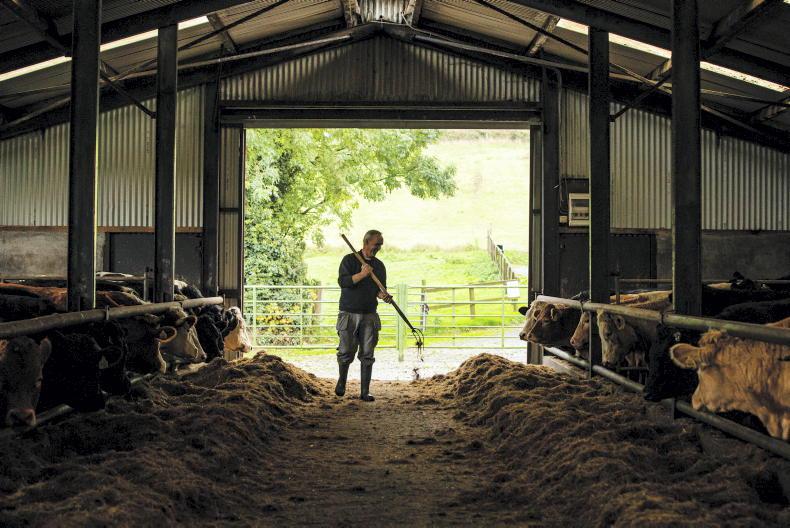

Lamb is synonymous Easter in the Christian calendar and Ramadan and Eid in the Muslim faith. \ Philip Doyle

There is no data on sheepmeat sales, but the ADHB is hoping that the fact that a roast rack of lamb is on the menu for the coronation dinner will bring a boost to sales.

Special occasions

While the coronation is a one-off event, special occasions are major drivers for agri food consumer demand.

Turkey is associated with Christmas, lamb with Easter and the Muslim festivals of Ramadan and Eid, while dairy products are central to many desserts.

Family celebrations or indeed any special occasion tends to drive demand for meat and dairy.

While this is welcome, farmers and the agri food industry cannot rely on special occasion demand alone, as it is the bread and butter of everyday demand that is the core demand.

In fact, these should be treated as bonus sales and it is no coincidence that farmgate prices tend to be at their strongest ahead of these special occasions.

Consumer trends

While we can be confident that meat and dairy products will remain central to dining on special occasions, there will be more competition for everyday meal choices.

Despite negative publicity, the vegan and vegetarian categories of consumer choice remain small.

Overall volume demand, particularly for beef and lamb, has been slipping in developed economies

However, there is no avoiding the avalanche of negative publicity around animal-based protein and when this is combined with the pressure of inflation on consumer budgets, it creates a threat to demand.

Overall volume demand, particularly for beef and lamb, has been slipping in developed economies.

This is probably caused by an element of people choosing to consume less because of environmental concerns and the fact that, as meat protein is relatively expensive, it is a more discretionary purchase.

The number of people consuming meat and dairy may remain fairly consistent, but the amount they consume tends to decline, particularly when the product is expensive.

Different picture

Of course, it is a different picture in the developing world, where meat and dairy products have been too expensive relative to consumer incomes.

As countries develop, so too does the demand for meat and dairy.

Nowhere illustrates this better than in China, where the volume of beef imported in 2012 was less than 60,000t, but this exploded to over 2m tonnes a decade later as the population became wealthier.

Read more

Beef Trends: could new king boost trade?

NI Trends: finished cattle prices holding firm; price boost for lambs

The coronation of King Charles III this weekend may not be top priority for Irish farmers as they struggle with a difficult spring, but it gives a boost to the market for many of the agri food products we export to Britain.

According to figures published by the Agriculture and Horticulture Development Board (AHDB) - the English levy board comparable to Bord Bia - there is a surge in demand for meat and dairy around special events.

Looking back a year ago to the platinum jubilee of Queen Elizabeth II, there was a 50% increase in retail burger sales during jubilee week compared with the same week in May 2021.

Demand also jumped 30% for sausage rolls and pork pie sales were up 30% for the celebrations.

Benefit

Dairy sales also benefited, with a 33% jump in demand, as an extra 724,000 litres of fresh cream were bought that week by British consumers, compared with the average week in 2022 and even cheese sales received a 2% boost.

Lamb is synonymous Easter in the Christian calendar and Ramadan and Eid in the Muslim faith. \ Philip Doyle

There is no data on sheepmeat sales, but the ADHB is hoping that the fact that a roast rack of lamb is on the menu for the coronation dinner will bring a boost to sales.

Special occasions

While the coronation is a one-off event, special occasions are major drivers for agri food consumer demand.

Turkey is associated with Christmas, lamb with Easter and the Muslim festivals of Ramadan and Eid, while dairy products are central to many desserts.

Family celebrations or indeed any special occasion tends to drive demand for meat and dairy.

While this is welcome, farmers and the agri food industry cannot rely on special occasion demand alone, as it is the bread and butter of everyday demand that is the core demand.

In fact, these should be treated as bonus sales and it is no coincidence that farmgate prices tend to be at their strongest ahead of these special occasions.

Consumer trends

While we can be confident that meat and dairy products will remain central to dining on special occasions, there will be more competition for everyday meal choices.

Despite negative publicity, the vegan and vegetarian categories of consumer choice remain small.

Overall volume demand, particularly for beef and lamb, has been slipping in developed economies

However, there is no avoiding the avalanche of negative publicity around animal-based protein and when this is combined with the pressure of inflation on consumer budgets, it creates a threat to demand.

Overall volume demand, particularly for beef and lamb, has been slipping in developed economies.

This is probably caused by an element of people choosing to consume less because of environmental concerns and the fact that, as meat protein is relatively expensive, it is a more discretionary purchase.

The number of people consuming meat and dairy may remain fairly consistent, but the amount they consume tends to decline, particularly when the product is expensive.

Different picture

Of course, it is a different picture in the developing world, where meat and dairy products have been too expensive relative to consumer incomes.

As countries develop, so too does the demand for meat and dairy.

Nowhere illustrates this better than in China, where the volume of beef imported in 2012 was less than 60,000t, but this exploded to over 2m tonnes a decade later as the population became wealthier.

Read more

Beef Trends: could new king boost trade?

NI Trends: finished cattle prices holding firm; price boost for lambs

SHARING OPTIONS