Exports of live cattle from Ireland performed strongly in 2018, rising by 31% to 246,000 head. That followed a 28% increase the previous year. The increase will be welcomed by farmers as live exports ultimately provide competition to the beef plants and offer an outlet for live cattle. Within the overall figure there were increases to some markets and decreases in others.

The standout development was a rise in exports of calves and weanlings to continental EU markets. Cattle exports to the UK fell and so too exports to non-EU markets. Calf exports rose by 55%, weanling exports by 14% and exports of stores by 6%. Exports of finished cattle fell by 18%, reflecting the drop in cattle going to the UK.

For 2019, calf exporters are hopeful of another year of good demand from continental veal farms. That would be welcome, given the higher calf numbers expected this year.

Spain drives increase

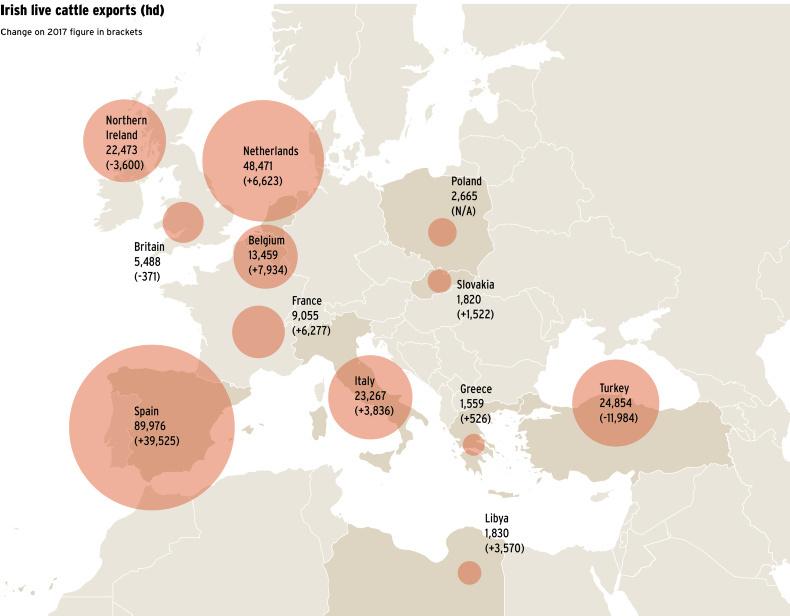

Live exports to EU markets accounted for around 80% of the 246,000 head exported in 2018. The 31% increase in live exports was also dominated by increased numbers travelling to EU markets with Spain, Belgium, the Netherlands, Italy and France the main markets to record significantly higher imports.

Calves were the main category of stock exported to EU markets, with total calf exports rising by 55,000 head to reach 158,000, the highest level since 2010. Spain was the main driver of this increase, with exports there increasing from 27,949 head to reach 71,907.

The next largest increase was recorded by Belgium, which recorded calf exports some 9,164 head higher at 13,346 head. The Dutch market has been the mainstay for calf exports in recent years, with numbers exported rising by 6,910 to 48,284, while France and Italy took 12,682 and 8,469 head respectively.

Weanling exports

There was a mixed performance in weanling exports. Spain’s weanling imports increased 10,293 head to reach 12,548 head but this was made up mainly of Friesian and dairy crossbred animals falling into the weanling category, as opposed to suckler-bred weanlings. Italy’s activity in weanling markets continues to wane, with weanling exports reducing 1,012 head to 5,027.

Half of this shortfall was compensated for by slightly higher exports of store cattle but, all in all, total exports to Italy were low at 23,267 head.

Closer to home live exports to Northern Ireland continue to disappoint, with total live exports falling from 26,073 head to 22,473 head and just 7,735 head travelling north for direct slaughter. This is a long way off the level of over 50,000 head exported annually just a few years ago.

Other notable changes in 2018 were 2,493 head exported to Poland. This was from a standing start with zero exports previously, while exports to Slovakia increased from 298 head to 1,820 head.

Exports to Britain fell by over 600 head to 5,228 with fewer dairy females said to be travelling across the channel in 2018.

Export prospects

Export prospects for calves are largely positive, with EU veal markets recording steady performance while higher cull cow slaughterings in 2018 are expected to tighten the availability of calves. The last couple of years have seen uncertainty surrounding the transport of high numbers of calves and 2019 will be no different.

There are question marks over lairage facilities in France to allow calves to rest but this can be overcome by sailings taking place on alternate days which will hopefully materialise during peak throughput. There are some commentators pointing towards a reduction in calf prices which should strengthen exporter prospects.

Forecasts for weanlings are uncertain, with the Italian market likely to remain under pressure, while exports to Northern Ireland will continue to be stifled by labelling regulations and could be further affected by Brexit.

Turkey has a big deficit in domestic production of beef and other meats and is therefore a huge importer of all types of livestock. For example, the country was predicted to import up to 1m head of cattle in 2018. However, for currency reasons, Irish cattle have become too expensive for Turkish buyers. They switched from Irish and EU suppliers to South American. Unfortunately, there is no immediate prospect of that trend reversing.

Exports from Ireland to Turkey began in 2016 after restrictions were placed on cattle from France because of Bluetongue disease. Irish exports increased from almost 20,000 head in 2016 to 24,854 head in 2017 with most of these centrally purchased by the state-owned Milk and Meat Board.

Exports continued in the spring of 2018 but then ground to a halt when the Turkish lira weakened against the euro. The total for 2018 stalled at 12,870. The Brazilian real fell against the US dollar, making Brazilian cattle significantly cheaper for Turkish buyers. They can buy bulls from Brazil at $3.50/kg (€3.07/kg) liveweight delivered to Turkey, which no Irish exporter could compete with.

Before Turkey suspended imports, demand was for young Irish bulls for finishing. These had to be under 12 months of age, less than 300kg in weight and had to undergo a 21-day quarantine period before export, which included vaccination and blood testing requirements. A number of consignments of finished bulls and breeding heifers were also exported.

Libya is a mid-sized market for live cattle, currently importing some 150,000 head per year, with Spain the dominant supplier. Exports of Irish cattle there increased in 2018 to close to 6,000 head and there is cautious optimism for a further increase in 2019. The political conflict of recent years has made trade with Libya especially difficult. However, stability is returning and economic growth is expected in 2019. So, all going well, Irish exports could double in 2019.

To date, import demand is mainly for bulls for immediate slaughter and that trend is expected to continue in 2019. However, there is also import demand for finishing bulls and breeding stock.

All recent export orders have been secured by Cork firm Curzon Livestock and it will be active in 2019. Supreme Livestock has also exported there.

The Department of Agriculture has ongoing contact with the veterinary authorities in Libya. Revised veterinary certificates were agreed in November 2018, lifting the maximum age for bulls from 24 to 30 months. This is expected to increase the selection of Friesian bulls available for export. A new certificate for breeding animals was also agreed. Fattening and slaughter bulls must originate from herds free of IBR and Johne’s diseases.

Ireland has veterinary protocols in place with Egypt but currently no exports are going there. Egypt is similar in size to the Libyan market at about 140,000 head per year - but demand is for competitively priced stock. There are no signs of significant exports of Irish cattle to Egypt happening.

Last year, 620 Irish cattle went to Morocco. Further small shipments are possible in 2019. Discussions are taking place between Irish and Algerian veterinary authorities on export certification. This is a relatively small market for live cattle and no Irish cattle are currently going there.

SHARING OPTIONS