The power of the consumer was the topic for one of the keynote presentations at the World Meat Congress in Texas. Jeff Fromm, a marketing specialist who assists companies with brand establishment and enhancement and also looks at emerging consumer trends, gave a very interesting presentation on “tomorrow’s consumer”.

Fromm explained that the millennial generation were born between 1979 and 1995 and are now becoming the largest and most important consumer spending generation on the planet.

Generation Z were born between 1996 and 2000 and these consumers are the most digitally connected ever. They may not know it but social media dictates a lot about how this generation form opinions and make consumer spending decisions.

Pester power is getting stronger where young people make decisions on household purchases. These are not spur of the moment purchases, but rather researched comparisons through digital media. In a lot of cases, parents trust this process. Tomorrow’s consumers require the story to go along with the food and its production – health and welfare is important to them.

Gene editing – future uses

Gene editing or genomic engineering is where DNA is inserted, deleted, modified or replaced in the genome of a living animal. Genomic editing alters the DNA sequence of an animal or plant and its possibilities are endless for the agricultural industry.

Alison Van Eenennaam, animal scientist at the University of California, gave some examples of how this technology could be used in the future to breed disease-resistant animals. PRRS (Porcine Reproductive and Respiratory Syndrome) is a disease which costs European pig producers €1.2bn annually. Genus has been able to breed PRRS-resistant pigs.

It’s a similar story with TB, where gene editing can be used to decrease susceptibility to TB in cattle. It also has a role in production-related items, eg introducing a polled gene into breeds of cattle that are not traditionally polled.

While the possibilities might be endless, there are some important ethical decisions to be made around this technology and whether today’s consumer deems it acceptable. The USA is adopting a cautious approach in this regard.

Alternative meats

The term flexitarian was discussed. This is a consumer who sways back and forth from a plant-based diet to a meat-based diet. While the threat from the meat-free sector is currently quite small, it should not be underestimated.

Industry speakers said that the meat industry needs to make more of its strengths, which include its health benefits, the natural/non-processed nature of prime meat cuts, and its ability to deliver in terms of satisfaction or taste. The industry needs to meet this challenge head on and stand firm on the positive aspects of a meat-based diet.

The detractors to this diet are a lot more social media savvy than our meat industry but we must rise to this challenge and make sure that everybody from farm to fork conveys this positive message.

Talk of Trump’s trade war

Day one of the World Meat Congress was overshadowed by US President Donald Trump’s announcement of trade sanctions on Canada, Mexico and the EU. It was quite ironic that for the first session, one hour after the tariff announcement the theme was “trusting in trade”, addressed by representatives from Mexico, EU and USA.

The sanctions were put in place to protect national security. According to the US government, they will ensure that American steel and alloy companies remain in business to provide materials of national importance (eg tanks) and other materials if the US found itself at war in the future. The EU shipped €5.3bn of steel products and €1bn of aluminium products to America in 2017.

European Commission president Jean-Claude Juncker said the EU would move ahead with €6.5bn of tariffs on American goods, which will include 25% tariffs on denim, bourbon whiskey, cranberries and peanut butter. A 10-page list of products has been drafted by the EU where tariffs will be imposed.

The Corn Growers Association released a statement during the conference saying that farm incomes are already on the floor and this uncertainty will impact every sector of the agricultural economy. Corn growers are currently planting crops and they don’t know who will be there to buy these at harvest. The National Cattlemens Association also expressed deep concern around any potential disruption in trade.The US exports €2bn in beef to Mexico and Canada, and these are extremely important markets for US beef. Any disruption in trade will hit producers hard.

A trade war between America and the EU is bad news for a country like Ireland that is highly dependent on international trade. While tariffs on steel and aluminium will have minimal impact on Ireland, anything that affects global trade will have a trickle-down effect. The only positive would be if, for example, a country like China increased tariffs on American beef or pork, it could create an opportunity for Irish producers to get their product into China.

Top quotes

“In a large survey of US millennials, 69% would rather lose their sense of smell than their mobile phone which doesn’t bode well for food producers” – Dan Halstrom, USA Meat Export Federation president.“Global social media usage has increased by 72% in the last four years, with the biggest growth in Asian regions. Ninety per cent of US millennial consumers are influenced by social media in daily purchases” – Dan Halstom, USA Meat Export Federation president.“The world will have 41 megacities by 2030 and 60% of the world’s population will live in Asia. China will build a megacity with over 10 million people every year for the next 10 years.”“The Chinese market has been a slow burner. South America owns this market with cheap grass-fed beef. We simply can’t compete in price terms. There may be an opportunity to grow grain fed beef demand” – Joel Haggard , USA Meat Export Federation.“We have seen Asian restaurants invest heavily in lighting because of consumers taking photos of food before eating. If the food looks good, it drives footfall; it’s quite simple” – Takemichi Yamashoji, USA Meat Exporters Federation.“65% of the general public want to know more about their food and where it came from. They want to know animal welfare standards, disease history and rearing system. The food industry needs this data for tomorrow’s consumer” – Roxi Beck, The Food Integrity Center.“From my very humble viewpoint, the consumer of the future is hyper-influenceable and not at all loyal” – Pol Morgas, Spain Federation of Meat Industry.

The power of the consumer was the topic for one of the keynote presentations at the World Meat Congress in Texas. Jeff Fromm, a marketing specialist who assists companies with brand establishment and enhancement and also looks at emerging consumer trends, gave a very interesting presentation on “tomorrow’s consumer”.

Fromm explained that the millennial generation were born between 1979 and 1995 and are now becoming the largest and most important consumer spending generation on the planet.

Generation Z were born between 1996 and 2000 and these consumers are the most digitally connected ever. They may not know it but social media dictates a lot about how this generation form opinions and make consumer spending decisions.

Pester power is getting stronger where young people make decisions on household purchases. These are not spur of the moment purchases, but rather researched comparisons through digital media. In a lot of cases, parents trust this process. Tomorrow’s consumers require the story to go along with the food and its production – health and welfare is important to them.

Gene editing – future uses

Gene editing or genomic engineering is where DNA is inserted, deleted, modified or replaced in the genome of a living animal. Genomic editing alters the DNA sequence of an animal or plant and its possibilities are endless for the agricultural industry.

Alison Van Eenennaam, animal scientist at the University of California, gave some examples of how this technology could be used in the future to breed disease-resistant animals. PRRS (Porcine Reproductive and Respiratory Syndrome) is a disease which costs European pig producers €1.2bn annually. Genus has been able to breed PRRS-resistant pigs.

It’s a similar story with TB, where gene editing can be used to decrease susceptibility to TB in cattle. It also has a role in production-related items, eg introducing a polled gene into breeds of cattle that are not traditionally polled.

While the possibilities might be endless, there are some important ethical decisions to be made around this technology and whether today’s consumer deems it acceptable. The USA is adopting a cautious approach in this regard.

Alternative meats

The term flexitarian was discussed. This is a consumer who sways back and forth from a plant-based diet to a meat-based diet. While the threat from the meat-free sector is currently quite small, it should not be underestimated.

Industry speakers said that the meat industry needs to make more of its strengths, which include its health benefits, the natural/non-processed nature of prime meat cuts, and its ability to deliver in terms of satisfaction or taste. The industry needs to meet this challenge head on and stand firm on the positive aspects of a meat-based diet.

The detractors to this diet are a lot more social media savvy than our meat industry but we must rise to this challenge and make sure that everybody from farm to fork conveys this positive message.

Talk of Trump’s trade war

Day one of the World Meat Congress was overshadowed by US President Donald Trump’s announcement of trade sanctions on Canada, Mexico and the EU. It was quite ironic that for the first session, one hour after the tariff announcement the theme was “trusting in trade”, addressed by representatives from Mexico, EU and USA.

The sanctions were put in place to protect national security. According to the US government, they will ensure that American steel and alloy companies remain in business to provide materials of national importance (eg tanks) and other materials if the US found itself at war in the future. The EU shipped €5.3bn of steel products and €1bn of aluminium products to America in 2017.

European Commission president Jean-Claude Juncker said the EU would move ahead with €6.5bn of tariffs on American goods, which will include 25% tariffs on denim, bourbon whiskey, cranberries and peanut butter. A 10-page list of products has been drafted by the EU where tariffs will be imposed.

The Corn Growers Association released a statement during the conference saying that farm incomes are already on the floor and this uncertainty will impact every sector of the agricultural economy. Corn growers are currently planting crops and they don’t know who will be there to buy these at harvest. The National Cattlemens Association also expressed deep concern around any potential disruption in trade.The US exports €2bn in beef to Mexico and Canada, and these are extremely important markets for US beef. Any disruption in trade will hit producers hard.

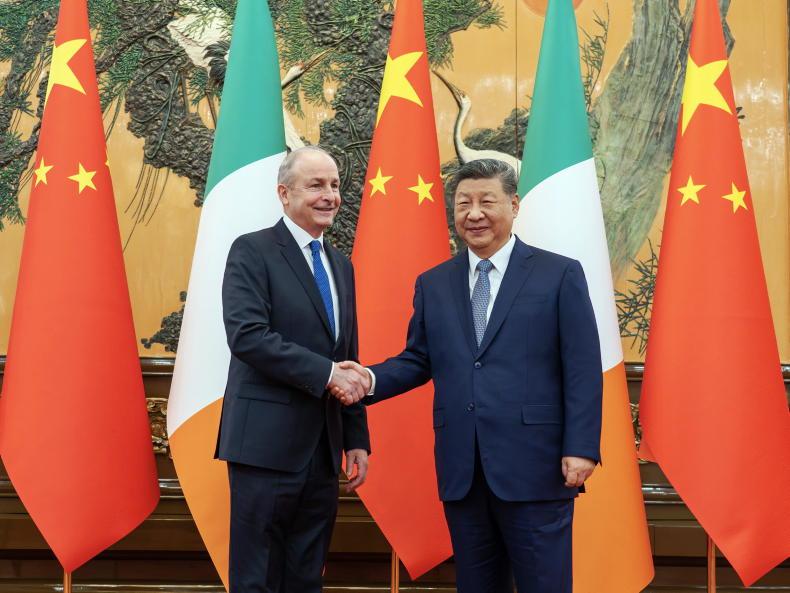

A trade war between America and the EU is bad news for a country like Ireland that is highly dependent on international trade. While tariffs on steel and aluminium will have minimal impact on Ireland, anything that affects global trade will have a trickle-down effect. The only positive would be if, for example, a country like China increased tariffs on American beef or pork, it could create an opportunity for Irish producers to get their product into China.

Top quotes

“In a large survey of US millennials, 69% would rather lose their sense of smell than their mobile phone which doesn’t bode well for food producers” – Dan Halstrom, USA Meat Export Federation president.“Global social media usage has increased by 72% in the last four years, with the biggest growth in Asian regions. Ninety per cent of US millennial consumers are influenced by social media in daily purchases” – Dan Halstom, USA Meat Export Federation president.“The world will have 41 megacities by 2030 and 60% of the world’s population will live in Asia. China will build a megacity with over 10 million people every year for the next 10 years.”“The Chinese market has been a slow burner. South America owns this market with cheap grass-fed beef. We simply can’t compete in price terms. There may be an opportunity to grow grain fed beef demand” – Joel Haggard , USA Meat Export Federation.“We have seen Asian restaurants invest heavily in lighting because of consumers taking photos of food before eating. If the food looks good, it drives footfall; it’s quite simple” – Takemichi Yamashoji, USA Meat Exporters Federation.“65% of the general public want to know more about their food and where it came from. They want to know animal welfare standards, disease history and rearing system. The food industry needs this data for tomorrow’s consumer” – Roxi Beck, The Food Integrity Center.“From my very humble viewpoint, the consumer of the future is hyper-influenceable and not at all loyal” – Pol Morgas, Spain Federation of Meat Industry.

SHARING OPTIONS