The price hikes in international dairy commodities over the last couple of weeks – followed by the significant price lift in powders in the Global Dairy Trade auction this week – have come at the right time for Irish milk suppliers.

As co-op boards meet to set June milk price over the next 10 days, they can do little else but pass back what the market is returning.

Negative market sentiment is often touted as a reason for holding or not responding on milk price. However, all indications suggest market sentiment is very positive.

The key drivers are a slowdown in milk supply in the US and southern European countries, where drought is causing problems. At the same time, demand is increasing as larger markets in the east begin to respond to the lifting of COVID-19 restrictions.

We must remember that farmgate March milk prices were pulled back more in anticipation of what might happen following COVID-19. It’s easy to lift price in November but milk suppliers need returns now when both supplies and outgoings are high.

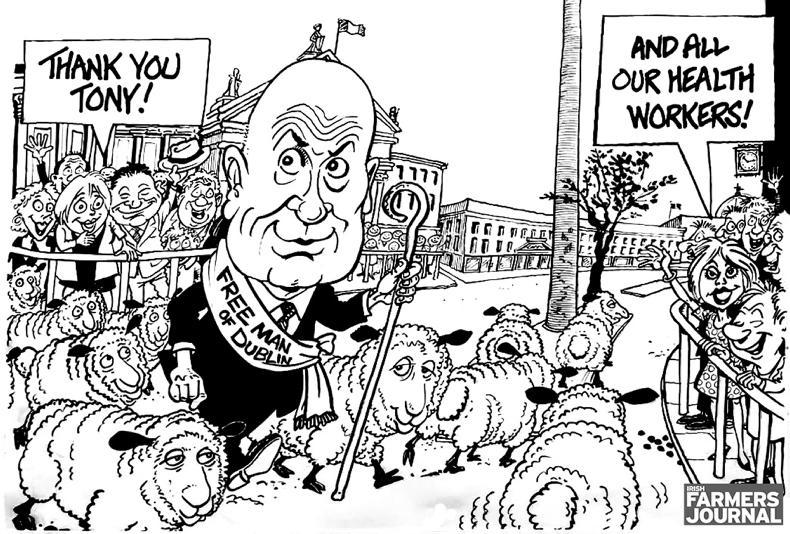

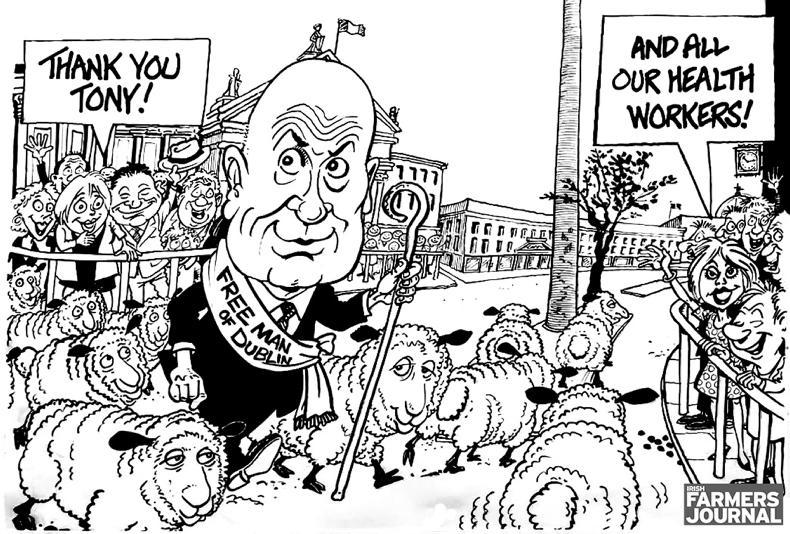

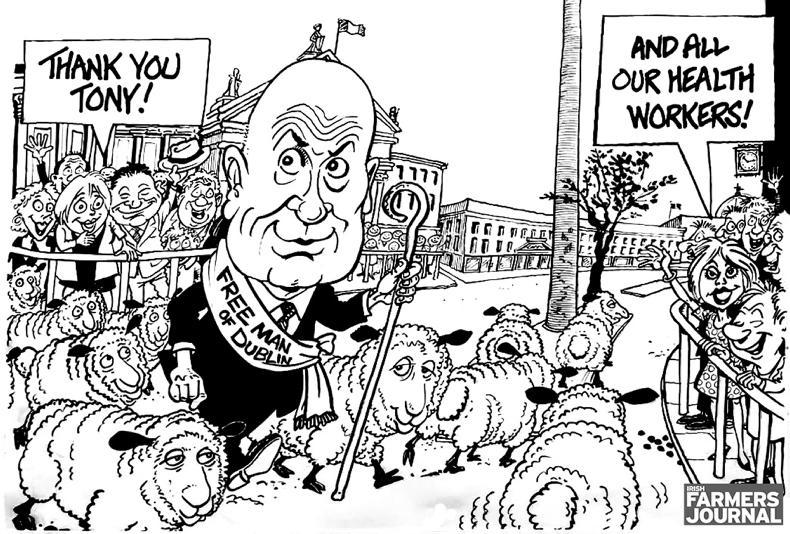

We must congratulate the industry – from truck drivers, farmers to dryer operators – for the successful continuation of the sector in the eye of the COVID-19 storm.

Meanwhile, the clarity and transparency in pricing of the commodity dairy market contrasts significantly with the liquid milk market, which continues to trap farmers in a pincer movement of low margins.

Large supermarket multiples and retailers forcing liquid milk processors to bid for short-term business means farmers ultimately lose out.

Some will say contract winning and losing is normal business, but ... using a high-value product as a loss leader is not what farmers want or need

The now-annual contract undercutting uncovered in this week's edition is symptomatic of what happens every year with contract winners and losers.

Some will say contract winning and losing is just normal business, but the fact of the matter is real lives and businesses are affected and without primary production, there is margin for nobody. Using a high-value nutritious product as a loss leader is not what farmers want or need.

Just across the Irish Sea, where this fresh or liquid market is much bigger, in many ways we see the same contract-type system has stimulated a dysfunctional sector where all power lies with the large supermarkets. There have been some moves towards aligned contracts and cost recognition of suppliers. Some might say these initiatives have been partially successful but many more say all they have done is divide the farming sector with huge differences in returns between farmers at the discretion of the processor.

Either way, it is way past time to call a stop to this annual contract undercutting. Instead of continuing to facilitate retailers to destruct value by competing with each other in a race to the bottom on price, farmers must now stand together and take back control.

Dairygold scheme

It is interesting to see Dairygold relaunch a voluntary scheme to gather funding for members. For these high-growth dairy companies that have large capital investment requirements, it certainly gives the co-op more financing options and obviously brings in shareholders with skin in the game. From a co-op perspective, it makes great sense.

We should, however, stand back and look at the industry from a national perspective. Should every co-op continue to invest as a sole entity? While supplier surveys may offer cover and justification to co-op management, as farmers and milk suppliers, we should ask whether individual co-op investment is still the way to grow the sector rather than some plan or national vision for joined-up thinking on the next wave of investment.

Also this week, we see a 5c/litre difference in European milk prices. If we are led to believe Irish processing costs are twice what some of the global players can achieve, then very quickly Irish milk suppliers will lose any low-feed-cost advantages.

A future growth strategy that brings higher production costs, high processing charges and does not deliver added value in the market will quickly erode farm profitability.

Growth for the stake of growing is not a solid strategy for the future of the industry.

\ Jim Cogan

Sheep: big contrast in meat and wool

As Phelim O’Neill reports, retail sales of sheepmeat weathered the storm at the outset of the pandemic and have since performed relatively positively and compensated for any shortcomings from the shutdown in the food-service trade.

Add tighter supplies into the mix and farmers find themselves in an unusual position of prices strengthening at the start of July. It is important to point out that these prices are at least what is required to give farmers any potential of generating a worthwhile margin for their efforts.

However, they come at a good time and should insert some confidence into the sector ahead of breeding sales, which are just a few weeks away.

\ Philip Doyle

Longer term, sheep farmers will judge the new Government on the success of getting sheepmeat moving into the Chinese market. From a standing start, the market is now Australia’s and New Zealand’s main export outlet, accounting for a multiple of total Irish exports.

Sheep farmers need to see progress on this front. Trade negotiations with the US have been at a standstill and also need to be progressed.

In contrast, the wool trade has been decimated by the coronavirus. In truth, the pandemic is a heavy blow for an industry that has been on its knees for quite some time. It is unfortunately another worrying sign of a society that talks so much about environmental sustainability, food safety and food security but yet is not willing to pay for it.

Irish Farmers Journal: sign up to our Daily edition

The Irish Farmers Journal has launched a daily edition which is now available to our print readers via text message from Monday to Friday.

To get it, simply text your unique code (printed on the back page of Irish Country Living) to 087 361 1578. The Daily will deliver to your phone the latest news, market analysis, price trends and technical advice and will include podcast and video.

The team is delighted to bring this new product to market at a time when the Irish Farmers Journal is recording the largest print circulation growth in the history of the paper. We are incredibly humbled by the extent to which a growing number of readers are turning to the Irish Farmers Journal and view it as a strong endorsement of our strategy to continue to invest in producing high-quality content that is valued and trusted.

If you have any feedback, email me at jmccarthy@farmersjournal.ie Thank you for your support.

China: Derwin’s new role a boost for agriculture

The nomination of Ann Derwin to replace Eoin O’Leary as Ireland’s next ambassador to China is hugely positive. A qualified vet and former chief economist within the Department of Agriculture, Derwin brings the skill set and capacity necessary to further develop Ireland’s agri-food exports into the Chinese market.

Currently suspended due to an atypical BSE case, Bord Bia forecasts that the Chinese market could become the fifth largest for Irish beef. China is our second largest market for pork and dairy, behind the UK. Ensuring it continues to develop, particularly for beef, will be essential in minimising the impact of a no-deal Brexit.

Politics: focusing on the challenges ahead

Minister Barry Cowen addressing the Dáil.

Minister for Agriculture Barry Cowen has found himself in the spotlight for a drink-driving offence in 2016. It is a regrettable turn of events for a minister who was no doubt riding high on the wave of positivity to his ministerial appointment.

Across the sector, many view him as a highly competent politician with the capacity to ensure the interests of farmers and the wider sector are well represented around the Cabinet and in Brussels. It is right that he has been held accountable. Having apologised, farmers will be hoping he can get back to focusing his political skills on dealing with the challenges that lie ahead for the sector.

The price hikes in international dairy commodities over the last couple of weeks – followed by the significant price lift in powders in the Global Dairy Trade auction this week – have come at the right time for Irish milk suppliers.

As co-op boards meet to set June milk price over the next 10 days, they can do little else but pass back what the market is returning.

Negative market sentiment is often touted as a reason for holding or not responding on milk price. However, all indications suggest market sentiment is very positive.

The key drivers are a slowdown in milk supply in the US and southern European countries, where drought is causing problems. At the same time, demand is increasing as larger markets in the east begin to respond to the lifting of COVID-19 restrictions.

We must remember that farmgate March milk prices were pulled back more in anticipation of what might happen following COVID-19. It’s easy to lift price in November but milk suppliers need returns now when both supplies and outgoings are high.

We must congratulate the industry – from truck drivers, farmers to dryer operators – for the successful continuation of the sector in the eye of the COVID-19 storm.

Meanwhile, the clarity and transparency in pricing of the commodity dairy market contrasts significantly with the liquid milk market, which continues to trap farmers in a pincer movement of low margins.

Large supermarket multiples and retailers forcing liquid milk processors to bid for short-term business means farmers ultimately lose out.

Some will say contract winning and losing is normal business, but ... using a high-value product as a loss leader is not what farmers want or need

The now-annual contract undercutting uncovered in this week's edition is symptomatic of what happens every year with contract winners and losers.

Some will say contract winning and losing is just normal business, but the fact of the matter is real lives and businesses are affected and without primary production, there is margin for nobody. Using a high-value nutritious product as a loss leader is not what farmers want or need.

Just across the Irish Sea, where this fresh or liquid market is much bigger, in many ways we see the same contract-type system has stimulated a dysfunctional sector where all power lies with the large supermarkets. There have been some moves towards aligned contracts and cost recognition of suppliers. Some might say these initiatives have been partially successful but many more say all they have done is divide the farming sector with huge differences in returns between farmers at the discretion of the processor.

Either way, it is way past time to call a stop to this annual contract undercutting. Instead of continuing to facilitate retailers to destruct value by competing with each other in a race to the bottom on price, farmers must now stand together and take back control.

Dairygold scheme

It is interesting to see Dairygold relaunch a voluntary scheme to gather funding for members. For these high-growth dairy companies that have large capital investment requirements, it certainly gives the co-op more financing options and obviously brings in shareholders with skin in the game. From a co-op perspective, it makes great sense.

We should, however, stand back and look at the industry from a national perspective. Should every co-op continue to invest as a sole entity? While supplier surveys may offer cover and justification to co-op management, as farmers and milk suppliers, we should ask whether individual co-op investment is still the way to grow the sector rather than some plan or national vision for joined-up thinking on the next wave of investment.

Also this week, we see a 5c/litre difference in European milk prices. If we are led to believe Irish processing costs are twice what some of the global players can achieve, then very quickly Irish milk suppliers will lose any low-feed-cost advantages.

A future growth strategy that brings higher production costs, high processing charges and does not deliver added value in the market will quickly erode farm profitability.

Growth for the stake of growing is not a solid strategy for the future of the industry.

\ Jim Cogan

Sheep: big contrast in meat and wool

As Phelim O’Neill reports, retail sales of sheepmeat weathered the storm at the outset of the pandemic and have since performed relatively positively and compensated for any shortcomings from the shutdown in the food-service trade.

Add tighter supplies into the mix and farmers find themselves in an unusual position of prices strengthening at the start of July. It is important to point out that these prices are at least what is required to give farmers any potential of generating a worthwhile margin for their efforts.

However, they come at a good time and should insert some confidence into the sector ahead of breeding sales, which are just a few weeks away.

\ Philip Doyle

Longer term, sheep farmers will judge the new Government on the success of getting sheepmeat moving into the Chinese market. From a standing start, the market is now Australia’s and New Zealand’s main export outlet, accounting for a multiple of total Irish exports.

Sheep farmers need to see progress on this front. Trade negotiations with the US have been at a standstill and also need to be progressed.

In contrast, the wool trade has been decimated by the coronavirus. In truth, the pandemic is a heavy blow for an industry that has been on its knees for quite some time. It is unfortunately another worrying sign of a society that talks so much about environmental sustainability, food safety and food security but yet is not willing to pay for it.

Irish Farmers Journal: sign up to our Daily edition

The Irish Farmers Journal has launched a daily edition which is now available to our print readers via text message from Monday to Friday.

To get it, simply text your unique code (printed on the back page of Irish Country Living) to 087 361 1578. The Daily will deliver to your phone the latest news, market analysis, price trends and technical advice and will include podcast and video.

The team is delighted to bring this new product to market at a time when the Irish Farmers Journal is recording the largest print circulation growth in the history of the paper. We are incredibly humbled by the extent to which a growing number of readers are turning to the Irish Farmers Journal and view it as a strong endorsement of our strategy to continue to invest in producing high-quality content that is valued and trusted.

If you have any feedback, email me at jmccarthy@farmersjournal.ie Thank you for your support.

China: Derwin’s new role a boost for agriculture

The nomination of Ann Derwin to replace Eoin O’Leary as Ireland’s next ambassador to China is hugely positive. A qualified vet and former chief economist within the Department of Agriculture, Derwin brings the skill set and capacity necessary to further develop Ireland’s agri-food exports into the Chinese market.

Currently suspended due to an atypical BSE case, Bord Bia forecasts that the Chinese market could become the fifth largest for Irish beef. China is our second largest market for pork and dairy, behind the UK. Ensuring it continues to develop, particularly for beef, will be essential in minimising the impact of a no-deal Brexit.

Politics: focusing on the challenges ahead

Minister Barry Cowen addressing the Dáil.

Minister for Agriculture Barry Cowen has found himself in the spotlight for a drink-driving offence in 2016. It is a regrettable turn of events for a minister who was no doubt riding high on the wave of positivity to his ministerial appointment.

Across the sector, many view him as a highly competent politician with the capacity to ensure the interests of farmers and the wider sector are well represented around the Cabinet and in Brussels. It is right that he has been held accountable. Having apologised, farmers will be hoping he can get back to focusing his political skills on dealing with the challenges that lie ahead for the sector.

SHARING OPTIONS