The latest figures released by the European Commission show the knock-on consequences of declining sheep numbers.

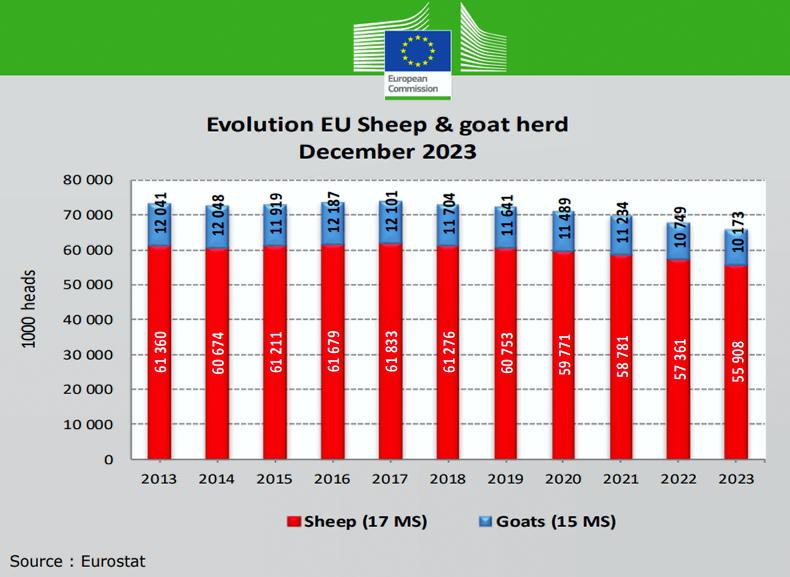

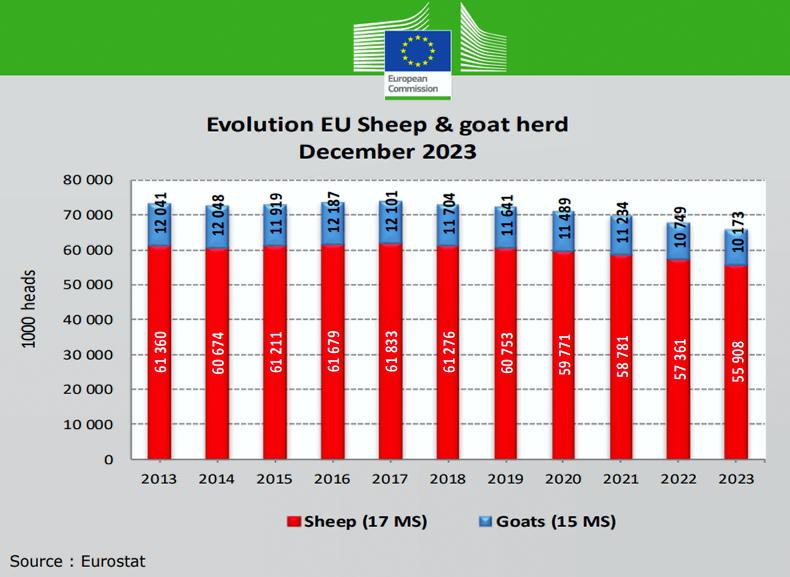

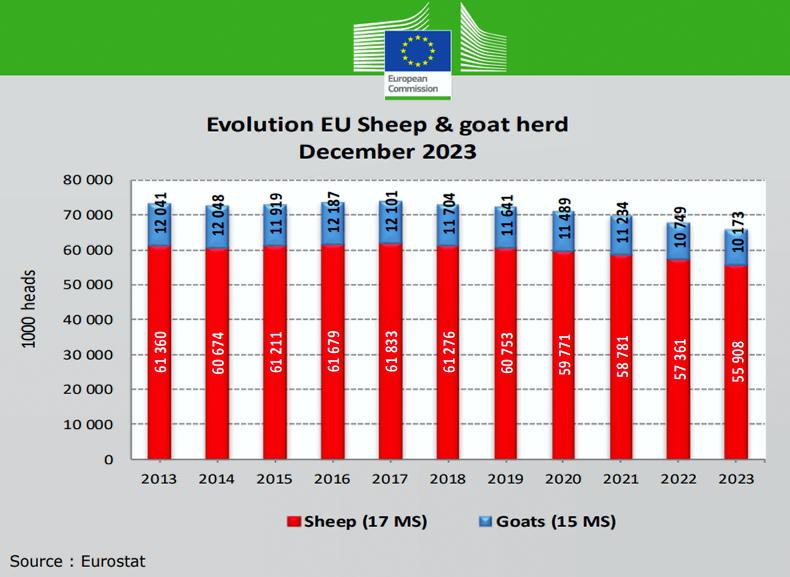

The number of sheep in the EU flock fell by some 1.45m head in 2023, with the total size of the flock standing at 55.9m head.

A significant percentage of the reduction has occurred in recent years, as demonstrated in the bar chart showing sheep and goat numbers over the last decade.

European Commission figures show a sharp decline in the EU's sheep flock over the last five years.

There is now no country across the EU where production has significantly increased, with sizeable reductions occurring in the major sheep-producing nations such as Spain, France, Greece and Romania.

Numbers in Ireland have also declined in the last couple of seasons after a period of slight growth.

Factors

A multitude of factors is contributing to the decline in flock numbers. Higher input costs led to higher culling of ewes in countries such as Greece with a sizeable milking ewe flock.

Dairy numbers in France have rebounded following a period of decline, but meat flocks continue to record declining numbers.

High temperatures in Mediterranean countries is also said to have curtailed production in these areas, while numbers in the Netherlands and Belgium have been hit hard by the bluetongue virus.

Lower production

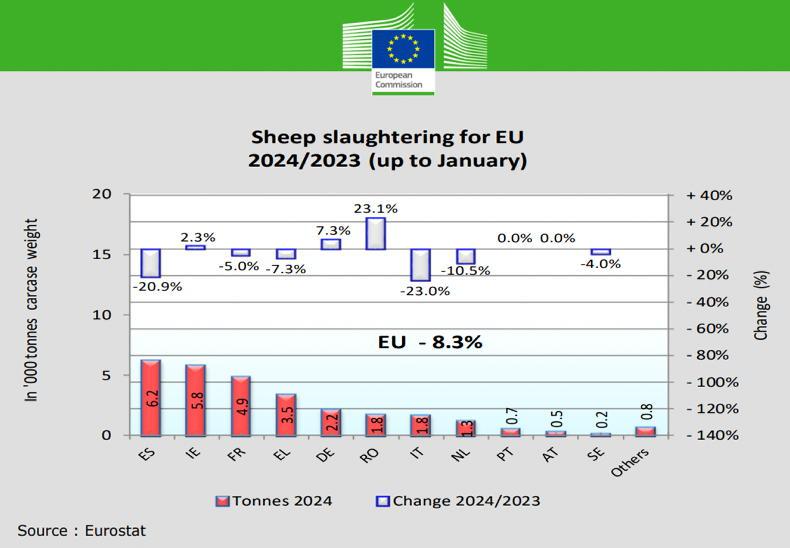

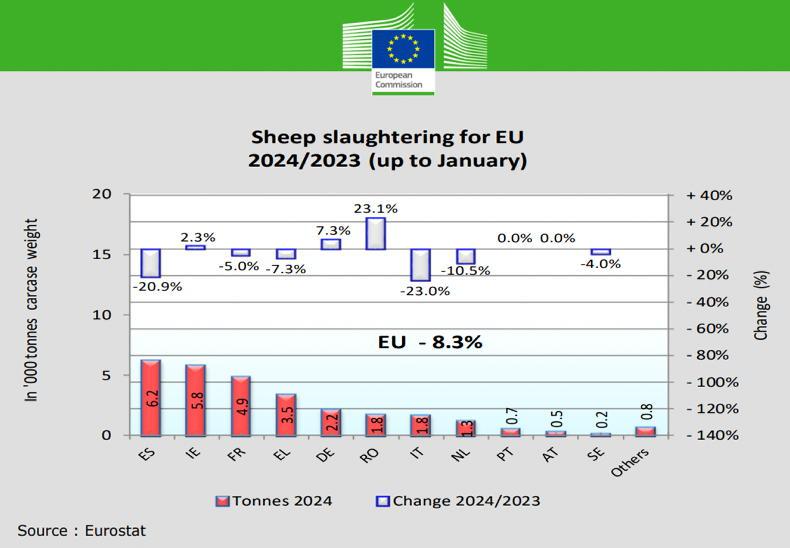

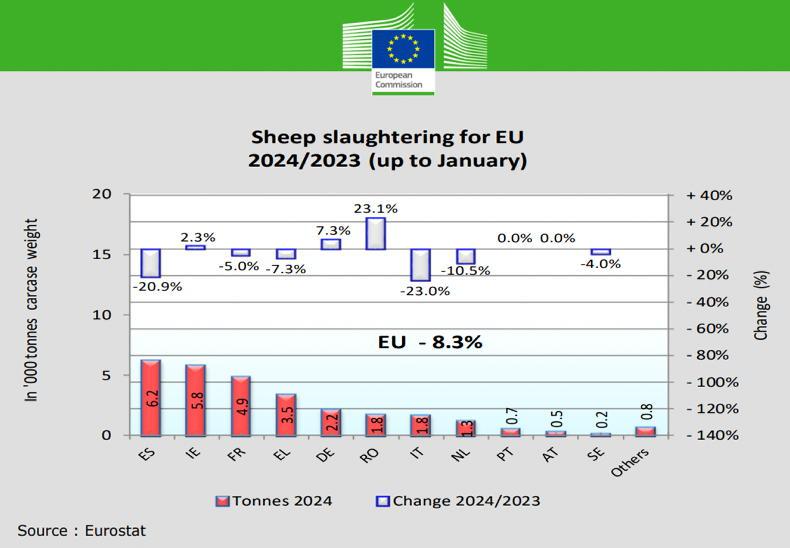

The contraction in the flock is feeding in to a continued decline in production, with volumes produced in January 2024 running 8.1% lower than in January 2023.

The reduction in each country compared with 12 months previous is clear to be seen in the bar chart developed by the European Commission.

Production in the main EU sheepmeat-producing countries fell significantly in the last year.

This reduction is not all stemming from a fall in ewe numbers, but it has had a significant influence.

Other factors at play include lambs being finished at lower weights in Mediterranean countries due to tight feed supplies which has limited production potential.

The 8.1% fall in production in January is not expected to have continued since then, but industry forecasts predict production will fall anywhere from 1.5% to upwards of 3% in 2024.

When combined with lower import volumes, it translates into improved market performance.

We are already seeing the effects of such, with heavy lamb (>13kg) prices running over 16% higher year on year, while light lamb (<13kg) prices are running 14.5% higher.

The latest EU market update shows heavy lamb prices averaging at €8.86/kg, while light lamb farmgate returns are averaging at €8.11/kg. Farmgate returns in Ireland and the UK are running significantly ahead of the EU average, with these nations the only real source of significant volumes of sheepmeat for importing.

Import and export update

Tighter availability of sheepmeat imports is also underpinning the vibrant trade recorded in the first quarter of 2024.

The volume of sheepmeat imported in January 2024 was recorded at 11,802t, a 2% reduction on the previous year. The UK dominated import volumes at 7,238t (+1%), followed by New Zealand at 3,989t (-6%) and Australia at 200t (-49%).

There was no change in export volumes, which were recorded at 7,184t.

Saudi Arabia was the main destination accounting for 1,923t, up 22% on the previous year, while the UK was not far behind with exports of 1,773t, running 17% higher. Exports from Ireland contributed significantly to this figure.

Export volumes of 1,072t to Jordan reduced 25% on 2023 volumes, while exports to Israel dropped by 48% to 481t.

There was growth in exports to Switzerland (up 38% to 446t), while exports to Morocco grew from 6t to 244t and similarly exports to Qatar increased from 26t to 200t.

The latest figures released by the European Commission show the knock-on consequences of declining sheep numbers.

The number of sheep in the EU flock fell by some 1.45m head in 2023, with the total size of the flock standing at 55.9m head.

A significant percentage of the reduction has occurred in recent years, as demonstrated in the bar chart showing sheep and goat numbers over the last decade.

European Commission figures show a sharp decline in the EU's sheep flock over the last five years.

There is now no country across the EU where production has significantly increased, with sizeable reductions occurring in the major sheep-producing nations such as Spain, France, Greece and Romania.

Numbers in Ireland have also declined in the last couple of seasons after a period of slight growth.

Factors

A multitude of factors is contributing to the decline in flock numbers. Higher input costs led to higher culling of ewes in countries such as Greece with a sizeable milking ewe flock.

Dairy numbers in France have rebounded following a period of decline, but meat flocks continue to record declining numbers.

High temperatures in Mediterranean countries is also said to have curtailed production in these areas, while numbers in the Netherlands and Belgium have been hit hard by the bluetongue virus.

Lower production

The contraction in the flock is feeding in to a continued decline in production, with volumes produced in January 2024 running 8.1% lower than in January 2023.

The reduction in each country compared with 12 months previous is clear to be seen in the bar chart developed by the European Commission.

Production in the main EU sheepmeat-producing countries fell significantly in the last year.

This reduction is not all stemming from a fall in ewe numbers, but it has had a significant influence.

Other factors at play include lambs being finished at lower weights in Mediterranean countries due to tight feed supplies which has limited production potential.

The 8.1% fall in production in January is not expected to have continued since then, but industry forecasts predict production will fall anywhere from 1.5% to upwards of 3% in 2024.

When combined with lower import volumes, it translates into improved market performance.

We are already seeing the effects of such, with heavy lamb (>13kg) prices running over 16% higher year on year, while light lamb (<13kg) prices are running 14.5% higher.

The latest EU market update shows heavy lamb prices averaging at €8.86/kg, while light lamb farmgate returns are averaging at €8.11/kg. Farmgate returns in Ireland and the UK are running significantly ahead of the EU average, with these nations the only real source of significant volumes of sheepmeat for importing.

Import and export update

Tighter availability of sheepmeat imports is also underpinning the vibrant trade recorded in the first quarter of 2024.

The volume of sheepmeat imported in January 2024 was recorded at 11,802t, a 2% reduction on the previous year. The UK dominated import volumes at 7,238t (+1%), followed by New Zealand at 3,989t (-6%) and Australia at 200t (-49%).

There was no change in export volumes, which were recorded at 7,184t.

Saudi Arabia was the main destination accounting for 1,923t, up 22% on the previous year, while the UK was not far behind with exports of 1,773t, running 17% higher. Exports from Ireland contributed significantly to this figure.

Export volumes of 1,072t to Jordan reduced 25% on 2023 volumes, while exports to Israel dropped by 48% to 481t.

There was growth in exports to Switzerland (up 38% to 446t), while exports to Morocco grew from 6t to 244t and similarly exports to Qatar increased from 26t to 200t.

SHARING OPTIONS