The Australian dairy industry is at a crossroads. It is an industry in decline, with national milk production now at 8.8bn litres, down by more than 10% since 2008-09. The number of dairy farmers has also decreased from 8,000 to just over 5,000 over the same period. The underlying trend has continued towards fewer farms, larger herds and increasing levels of milk production per farm. The drop in milk production has been blamed on the recent closure of Fonterra’s factory in southwest Victoria.

Australia is a significant exporter of dairy products and in 2018-19 exported 35% of milk produced, worth $3.2bn

The dairy industry is Australia’s fourth largest rural industry. Based on farmgate value of production alone, the dairy industry generated AU$4.4bn in 2018-19. The dairy industry also acts as a major source of employment across regional areas. It is estimated that approximately 46,200 people are directly employed on dairy farms and by dairy companies.

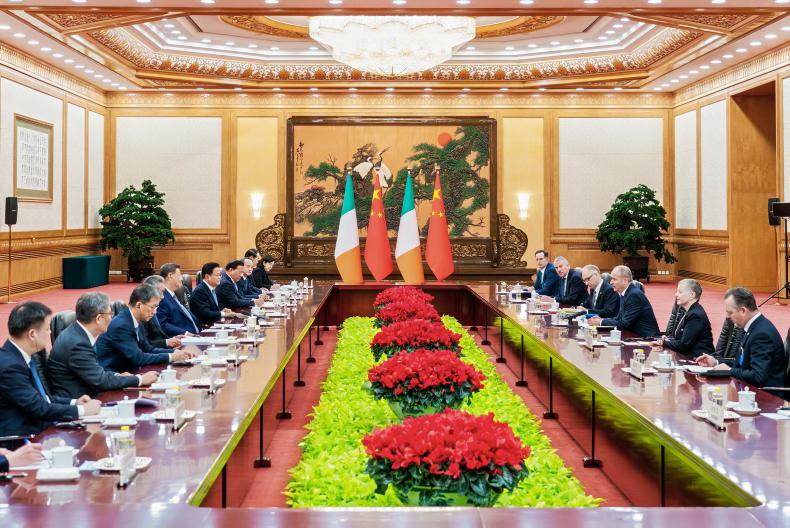

Australia is a significant exporter of dairy products and in 2018-19 exported 35% of milk produced, worth $3.2bn. One of the fastest-growing export markets by volume for Australia has been China and exports to Asia now account for close to 85% of total exports.

Background

Prior to 2000, the Australian dairy industry was heavily regulated, by both state and federal governments. Price controls, subsidies and quotas were applied and provided a level of income protection for dairy farmers. In 2000, the Australian dairy industry was deregulated and existing protections were largely eliminated and, despite programmes intended to ease the transition, many dairy farming operations became unviable without price protections in place.

Milk price halved immediately and Australia’s share in global dairy trade has fallen from 16% in the 1990s to just 6% last year.

In Victoria, the largest producer of milk with lower costs of production because of its more temperate climate relative to other parts, the dairy industry began focusing more on value added export markets

Dairying became more centralised into fewer, but more intensive, dairy regions. States where farms primarily supplied drinking milk to domestic markets saw significant numbers of farms exiting the market. In Victoria, the largest producer of milk with lower costs of production because of its more temperate climate relative to other parts, the dairy industry began focusing more on value added export markets.

The fall of Murray Goldburn, which was the country’s largest processor and last remaining farmer-owned co-op from 2016 to 2018, was a further blow to producers and resulted in a price shock that many farmers are still recovering from.

There is a lot of discussion currently about the proposed new mandatory code, which aims to protect producers from a similar event happening again.

Challenges

Australia is a large country with a variety of climates. The 2018-19 period proved to be challenging for the dairy industry, with milk production contracting by 5.7%.

With drought affecting multiple dairy-producing regions, farmers have had to contend with poor pasture growth, high feed prices and reduced water allocations. This saw the cost of production grow significantly across all regions and contributed to the decline in milk production. Under these conditions, many farmers opted to milk a lesser portion of the herd, de-stock or even exit the industry.

Finding, training and retaining quality staff is a huge problem for the industry. Due to the lack of enthusiasm and poor profitability, the numbers of young people entering the dairy industry is very low and this doesn’t bode well for the future of the industry.

Volatility in farmgate milk prices and farm incomes have affected farmer confidence and the industry’s ability to grow

Dairy Australia is running school programmes such as “Cows Create Careers” to show the opportunities and diversity of career pathways in dairy.

However, unlike in Ireland, the level of education among those entering the dairy sector is low and this impacts on technology adoption and engagement in the sector.

Volatility in farmgate milk prices and farm incomes have affected farmer confidence and the industry’s ability to grow.

Many farmers are focusing on cost control, refinancing and business consolidation for survival, rather than longer-term investments to improve efficiencies.

In many cases, farmers have culled extensively during recent years, taking advantage of higher beef prices to maintain cashflow. The cost of production is rising and not all due to weather struggles. Incentives from processors (volume incentives and incentives to calve out of season) are driving farmers towards unprofitable and unsustainable systems of milk production.

With all these factors at play, farmers face tremendous uncertainty over their future income. With the added uncertainty of weather and seasonal conditions, this makes it difficult for farming businesses to invest. However, while recent conditions have not been favourable, some analysts consider the prospects for Australia’s dairy sector to be good over the long term as the demand prospects for dairy remain strong, reflecting rising middle-class incomes and growing demand for dairy-based products such as baby formula. While on a tour to Australia as part of my Nuffield scholarship, I had the opportunity to spend time with Harper and Oonagh Kilpatrick, a couple from Co Down milking 800 cows in west Victoria.

Both are very active in the dairy industry and Oonagh is also policy councillor with United Dairy Farmers of Victoria (UDV).

Such a focus would also boost morale among farmers and increase engagement with the levy-funded bodies

They are frustrated with the lack of leadership in the industry at political level and also from farmer representation groups and feel there is a disconnect between Dairy Australia (levy body) and primary producers.

The view in the UDV is that greater levy funds should be allocated to advocacy and marketing rather than research, with the aim of tackling the falling consumer perception of dairy and to increase consumption.

Such a focus would also boost morale among farmers and increase engagement with the levy-funded bodies. Of the 5,200 dairy farmers in Australia, only 32.5% are members of Australian Dairy Farmers (ADF).

However, despite their frustrations and the decline in the industry they have observed over recent years, they feel there are very good opportunities in dairy farming in west Victoria for those that are grass-focused, cost-conscious and technically efficient.

Karina Pierce is a Nuffield scholar and former associate professor of dairy production at UCD and is now working with Enterprise Ireland.

Read more

Australian milk production returns to growth in January

Ireland produces more milk than Australia

The Australian dairy industry is at a crossroads. It is an industry in decline, with national milk production now at 8.8bn litres, down by more than 10% since 2008-09. The number of dairy farmers has also decreased from 8,000 to just over 5,000 over the same period. The underlying trend has continued towards fewer farms, larger herds and increasing levels of milk production per farm. The drop in milk production has been blamed on the recent closure of Fonterra’s factory in southwest Victoria.

Australia is a significant exporter of dairy products and in 2018-19 exported 35% of milk produced, worth $3.2bn

The dairy industry is Australia’s fourth largest rural industry. Based on farmgate value of production alone, the dairy industry generated AU$4.4bn in 2018-19. The dairy industry also acts as a major source of employment across regional areas. It is estimated that approximately 46,200 people are directly employed on dairy farms and by dairy companies.

Australia is a significant exporter of dairy products and in 2018-19 exported 35% of milk produced, worth $3.2bn. One of the fastest-growing export markets by volume for Australia has been China and exports to Asia now account for close to 85% of total exports.

Background

Prior to 2000, the Australian dairy industry was heavily regulated, by both state and federal governments. Price controls, subsidies and quotas were applied and provided a level of income protection for dairy farmers. In 2000, the Australian dairy industry was deregulated and existing protections were largely eliminated and, despite programmes intended to ease the transition, many dairy farming operations became unviable without price protections in place.

Milk price halved immediately and Australia’s share in global dairy trade has fallen from 16% in the 1990s to just 6% last year.

In Victoria, the largest producer of milk with lower costs of production because of its more temperate climate relative to other parts, the dairy industry began focusing more on value added export markets

Dairying became more centralised into fewer, but more intensive, dairy regions. States where farms primarily supplied drinking milk to domestic markets saw significant numbers of farms exiting the market. In Victoria, the largest producer of milk with lower costs of production because of its more temperate climate relative to other parts, the dairy industry began focusing more on value added export markets.

The fall of Murray Goldburn, which was the country’s largest processor and last remaining farmer-owned co-op from 2016 to 2018, was a further blow to producers and resulted in a price shock that many farmers are still recovering from.

There is a lot of discussion currently about the proposed new mandatory code, which aims to protect producers from a similar event happening again.

Challenges

Australia is a large country with a variety of climates. The 2018-19 period proved to be challenging for the dairy industry, with milk production contracting by 5.7%.

With drought affecting multiple dairy-producing regions, farmers have had to contend with poor pasture growth, high feed prices and reduced water allocations. This saw the cost of production grow significantly across all regions and contributed to the decline in milk production. Under these conditions, many farmers opted to milk a lesser portion of the herd, de-stock or even exit the industry.

Finding, training and retaining quality staff is a huge problem for the industry. Due to the lack of enthusiasm and poor profitability, the numbers of young people entering the dairy industry is very low and this doesn’t bode well for the future of the industry.

Volatility in farmgate milk prices and farm incomes have affected farmer confidence and the industry’s ability to grow

Dairy Australia is running school programmes such as “Cows Create Careers” to show the opportunities and diversity of career pathways in dairy.

However, unlike in Ireland, the level of education among those entering the dairy sector is low and this impacts on technology adoption and engagement in the sector.

Volatility in farmgate milk prices and farm incomes have affected farmer confidence and the industry’s ability to grow.

Many farmers are focusing on cost control, refinancing and business consolidation for survival, rather than longer-term investments to improve efficiencies.

In many cases, farmers have culled extensively during recent years, taking advantage of higher beef prices to maintain cashflow. The cost of production is rising and not all due to weather struggles. Incentives from processors (volume incentives and incentives to calve out of season) are driving farmers towards unprofitable and unsustainable systems of milk production.

With all these factors at play, farmers face tremendous uncertainty over their future income. With the added uncertainty of weather and seasonal conditions, this makes it difficult for farming businesses to invest. However, while recent conditions have not been favourable, some analysts consider the prospects for Australia’s dairy sector to be good over the long term as the demand prospects for dairy remain strong, reflecting rising middle-class incomes and growing demand for dairy-based products such as baby formula. While on a tour to Australia as part of my Nuffield scholarship, I had the opportunity to spend time with Harper and Oonagh Kilpatrick, a couple from Co Down milking 800 cows in west Victoria.

Both are very active in the dairy industry and Oonagh is also policy councillor with United Dairy Farmers of Victoria (UDV).

Such a focus would also boost morale among farmers and increase engagement with the levy-funded bodies

They are frustrated with the lack of leadership in the industry at political level and also from farmer representation groups and feel there is a disconnect between Dairy Australia (levy body) and primary producers.

The view in the UDV is that greater levy funds should be allocated to advocacy and marketing rather than research, with the aim of tackling the falling consumer perception of dairy and to increase consumption.

Such a focus would also boost morale among farmers and increase engagement with the levy-funded bodies. Of the 5,200 dairy farmers in Australia, only 32.5% are members of Australian Dairy Farmers (ADF).

However, despite their frustrations and the decline in the industry they have observed over recent years, they feel there are very good opportunities in dairy farming in west Victoria for those that are grass-focused, cost-conscious and technically efficient.

Karina Pierce is a Nuffield scholar and former associate professor of dairy production at UCD and is now working with Enterprise Ireland.

Read more

Australian milk production returns to growth in January

Ireland produces more milk than Australia

SHARING OPTIONS