This week saw another 7.7% rise in the GDT at the latest auction in New Zealand. The benchmark dairy index has now risen a cumulative 27% since the start of August, albeit from a very weak base.

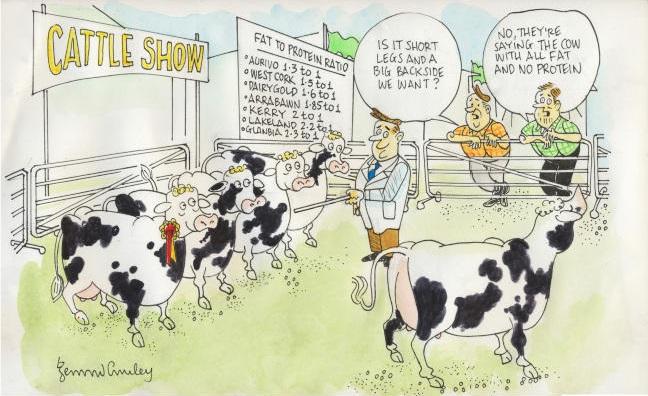

At the same time, there has been strong dairy commodity price growth in Europe, driven by buoyant fat demand. Butter prices are currently pushing close to $3,900/t this week and have now jumped 64% higher from where they were at the beginning of May. Even milk powders have shown gains, with the price of whole and skimmed milk powder up 44% and 20% respectively since May.

Undoubtedly there is some much needed positive momentum in dairy markets but questions remain around the sustainability of this rally.

On the supply side, European production has eased somewhat but, importantly, it remains strong in the key exporting regions like the Netherlands and Ireland.

In New Zealand, Fonterra has forecast a 3% decline in milk production this season but doubts are already beginning to emerge around this.

The fundamental issue for dairy markets remains demand. China is currently very active in the market – as can be seen from the recent GDT results – but this is as much to do with timing as anything else, as Chinese buyers like to time their purchasing with the beginning of the New Zealand milking season.

When this current surge in Chinese activity abates, serious questions remain as to where the buying demand will come from on world markets. At recent GDT events, buying activity from Middle Eastern and north African buyers has been almost non-existent. These oil economies, which are critical to the global dairy trade, are trying to tackle a host of challenges right now. In Nigeria, a country almost totally dependent on oil, the domestic currency has plummeted, almost pricing them out of markets.

Similarly in Egypt and Algeria, buying power is extremely challenged with local inflation running at double-digit figures. And behind all of this, we have more than 350,000t of skim milk powder sitting in intervention in Europe that will have to be released to the market eventually.

SHARING OPTIONS