In terms of agricultural innovation, Israel could be a role model for the world. Beginning half a century before its independence in 1948, the country has had to feed an ever-growing population which now reaches almost 9m.

Approximately one-quarter the size of Ireland in area, it is more difficult given that its geographical landscape comprises semi-arid land, combined with declining natural freshwater resources.

Thanks to a culture of agricultural research and development promoted by the government, along with innovative farmers, Israel has cultivated an ecosystem of agricultural innovation.

Over the last decade, Israel has produced a high number of new, technologically innovative companies which address global agricultural issues, such as food insecurity and safety, labour shortages and environmental strains.

Scientists closely collaborate with farmers to invent cutting-edge collaborations, such as heat-tolerant tomatoes, drought-resistant cucumber seeds, and ultra-efficient drip irrigation.

Israel has also achieved water self-sufficiency through a combination of education, policies, pricing and technologies.

Israel has always answered its own agricultural challenges, and in the process has created a large produce export industry.

But the real comparative advantage of this small country with its proven agricultural know-how lies in exporting technology, often tested first by Israel’s own farmers. Thanks to the combination of long-term experience and the expertise of the broader high-tech ecosystem, Israel is becoming a global leader in agritech.

More and more countries around the world are reaching their limits and face threats similar to those Israel has overcome

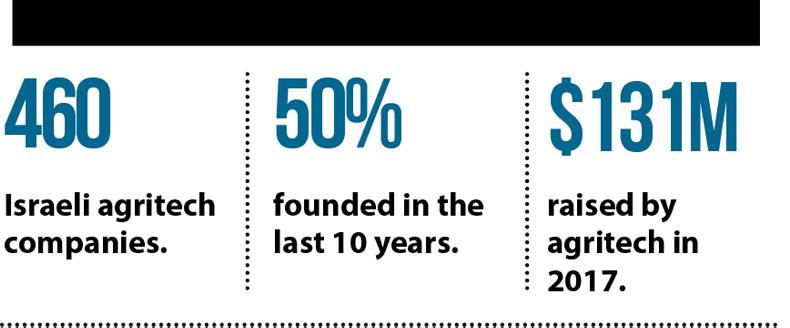

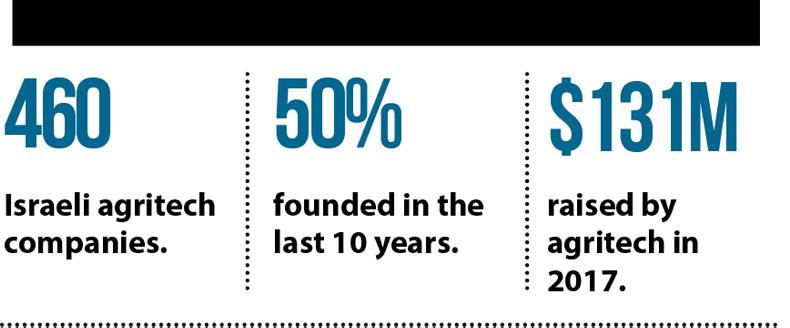

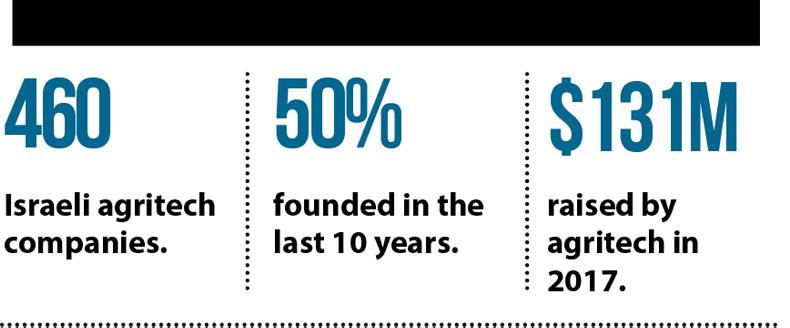

According to Start-Up Nation Central, an NGO dedicated to the Israel innovation ecosystem, there are over 460 Israeli agritech companies, with more than 25% of them founded in the last five years, and 50% founded in the last 10 years. It is no surprise that investors want in. Over the past four years, more than $400m has been invested in agritech with the majority of investment rounds in seed-stage. The entire sector raised $97m in 2016, 3% of global funding in agritech. Investments for the first nine months of 2017 totalled $131m, 35% more than the full year 2016.

By comparison, investments in American agritech amounted to 58% ($1.87bn).

While the American sector’s share of global venture captial overshadows that of Israel, when we consider population sizes, on a per-capita basis, Israel is miles ahead. In 2016, American agritech raised $5.80 per capita; its Israeli counterpart raised almost double. Israel’s agritech sector, though small in absolute figures, consistently attracts investor activity in higher intensity per capita than the US. It therefore appears that not only does Israeli agritech innovation command investor confidence, but it does so at a greater level. Israeli agritech has proven particularly strong in on-farm technologies, solutions that interact with the farmer.

Limited resources

Since about two-thirds of the country is desert, Israel’s agriculture sector has had to cope with a limited amount of natural resources, growing more with less. More and more countries around the world are reaching their limits and face threats similar to those Israel has overcome. This is where smart farming technologies (data-driven solutions and high-performance hardware for increased resource efficiency and crop yield) are important.

Israeli innovators have developed artificial intelligence (AI)-based ground robots that pollinate tomatoes in greenhouses—keeping a record of treated plants—while self-sterilising and cleaning to prevent crop disease.

The sector also makes use of machine vision in robotic harvesters, which can identify crop ripeness, and be used for pruning, pollination, and monitoring. Israeli robotics are also enhancing post-harvest handling through automation of sorting, picking, packing, and quality control. One Israeli company specialises in hardware-independent robotic vision and automation for high-versatility production lines.

Its robotic system learns and mimics human or robot performance, removing the need to reprogram robots for different tasks. A small percentage of the companies in the sector focus on livestock, such as one company that offers robotic milking systems.

More than half of these companies innovate in plant breeding or genetics, modifying traditional breeding methods and deriving new genetic analysis. Some of these companies offer platforms for gene discovery, analytics, selection, and editing, while others focus on biological inputs and treatments.

Among the Israeli agritech industry’s non-GMO solutions, one innovative company encourages selective breeding by focusing on plant roots, promoting only the high-performing, abiotic stress-tolerant plants in a group. Other bio-solutions include nanoparticle-based methods of transporting and delivering agrochemicals through plants, and mycorrhizal inoculants for improving 90% of all plant species’ uptake of soil nutrients, thereby reducing fertiliser amounts and increasing crop yield, among others.

Companies are also seeking to reduce the dependence of an ever-growing population on traditional meat sources by developing sustainable alternative sources of protein. There are nine Israeli alternative protein companies, six of which were founded in the last three years. These companies innovate in one of three protein sources: plants, insects or cultured meats.

The Israeli companies developing plant-based protein – eg from seaweed, chickpeas – are the best funded in Israeli alternative protein. Among the insect-based protein offerings in Israel, one company has developed a technology for establishing commercial grasshopper farms that leave a minimal water footprint and create almost no waste.

Another alternative protein group of companies, crossing into foodtech, grows meat in cell cultures. It is currently developing poultry and bovine meat using regenerative technology.

Israeli agritech offers technologies to boost and enhance food safety. There are 20 Israeli companies that innovate in food-production tracking, quality monitoring, contaminant detection and sterilisation, as well as post-harvest technologies that ensure produce quality in packaging and storage.

One company has devised a pocket-sized micro-spectrometer that instantly reads produce quality, ripeness, spoilage and contamination, and reports nutrient analysis for animal feed. Another company has developed a low-power radio-transmission technology for breast-cancer screening, which it now applies also to monitoring for food safety, including dairy-contaminant detection at farms.

Israel’s population and land size is small relative to the US, China, and India, yet the country has produced an agritech sector that ranks among the top five countries in number of deals. It also receives a disproportionately large share of global agritech funding, especially in on-farm technologies and smart farming. With a significant pool of highly skilled yet affordable labour, and an influx of expertise and technological innovation from academia and the high-tech ecosystem, there is still plenty of room to grow. As global agriculture challenges become ever pressing, farmers and agribusinesses around the world are turning to Israeli agritech for collaboration. Investors, too, are realising the promise of deal flow, and the field is not yet crowded.

Further details about Israel’s agricultural sector can be obtained from the commercial office at the Embassy of Israel in Dublin. Tel: 01-230 9415 or email trade@dublin.mfa.gov.il

The information used in this article was supplied by Start-Up Nation Central, an Israeli NGO that promotes technology and innovation.

Read more

Long read: clever startup companies in an old dairy shed

In terms of agricultural innovation, Israel could be a role model for the world. Beginning half a century before its independence in 1948, the country has had to feed an ever-growing population which now reaches almost 9m.

Approximately one-quarter the size of Ireland in area, it is more difficult given that its geographical landscape comprises semi-arid land, combined with declining natural freshwater resources.

Thanks to a culture of agricultural research and development promoted by the government, along with innovative farmers, Israel has cultivated an ecosystem of agricultural innovation.

Over the last decade, Israel has produced a high number of new, technologically innovative companies which address global agricultural issues, such as food insecurity and safety, labour shortages and environmental strains.

Scientists closely collaborate with farmers to invent cutting-edge collaborations, such as heat-tolerant tomatoes, drought-resistant cucumber seeds, and ultra-efficient drip irrigation.

Israel has also achieved water self-sufficiency through a combination of education, policies, pricing and technologies.

Israel has always answered its own agricultural challenges, and in the process has created a large produce export industry.

But the real comparative advantage of this small country with its proven agricultural know-how lies in exporting technology, often tested first by Israel’s own farmers. Thanks to the combination of long-term experience and the expertise of the broader high-tech ecosystem, Israel is becoming a global leader in agritech.

More and more countries around the world are reaching their limits and face threats similar to those Israel has overcome

According to Start-Up Nation Central, an NGO dedicated to the Israel innovation ecosystem, there are over 460 Israeli agritech companies, with more than 25% of them founded in the last five years, and 50% founded in the last 10 years. It is no surprise that investors want in. Over the past four years, more than $400m has been invested in agritech with the majority of investment rounds in seed-stage. The entire sector raised $97m in 2016, 3% of global funding in agritech. Investments for the first nine months of 2017 totalled $131m, 35% more than the full year 2016.

By comparison, investments in American agritech amounted to 58% ($1.87bn).

While the American sector’s share of global venture captial overshadows that of Israel, when we consider population sizes, on a per-capita basis, Israel is miles ahead. In 2016, American agritech raised $5.80 per capita; its Israeli counterpart raised almost double. Israel’s agritech sector, though small in absolute figures, consistently attracts investor activity in higher intensity per capita than the US. It therefore appears that not only does Israeli agritech innovation command investor confidence, but it does so at a greater level. Israeli agritech has proven particularly strong in on-farm technologies, solutions that interact with the farmer.

Limited resources

Since about two-thirds of the country is desert, Israel’s agriculture sector has had to cope with a limited amount of natural resources, growing more with less. More and more countries around the world are reaching their limits and face threats similar to those Israel has overcome. This is where smart farming technologies (data-driven solutions and high-performance hardware for increased resource efficiency and crop yield) are important.

Israeli innovators have developed artificial intelligence (AI)-based ground robots that pollinate tomatoes in greenhouses—keeping a record of treated plants—while self-sterilising and cleaning to prevent crop disease.

The sector also makes use of machine vision in robotic harvesters, which can identify crop ripeness, and be used for pruning, pollination, and monitoring. Israeli robotics are also enhancing post-harvest handling through automation of sorting, picking, packing, and quality control. One Israeli company specialises in hardware-independent robotic vision and automation for high-versatility production lines.

Its robotic system learns and mimics human or robot performance, removing the need to reprogram robots for different tasks. A small percentage of the companies in the sector focus on livestock, such as one company that offers robotic milking systems.

More than half of these companies innovate in plant breeding or genetics, modifying traditional breeding methods and deriving new genetic analysis. Some of these companies offer platforms for gene discovery, analytics, selection, and editing, while others focus on biological inputs and treatments.

Among the Israeli agritech industry’s non-GMO solutions, one innovative company encourages selective breeding by focusing on plant roots, promoting only the high-performing, abiotic stress-tolerant plants in a group. Other bio-solutions include nanoparticle-based methods of transporting and delivering agrochemicals through plants, and mycorrhizal inoculants for improving 90% of all plant species’ uptake of soil nutrients, thereby reducing fertiliser amounts and increasing crop yield, among others.

Companies are also seeking to reduce the dependence of an ever-growing population on traditional meat sources by developing sustainable alternative sources of protein. There are nine Israeli alternative protein companies, six of which were founded in the last three years. These companies innovate in one of three protein sources: plants, insects or cultured meats.

The Israeli companies developing plant-based protein – eg from seaweed, chickpeas – are the best funded in Israeli alternative protein. Among the insect-based protein offerings in Israel, one company has developed a technology for establishing commercial grasshopper farms that leave a minimal water footprint and create almost no waste.

Another alternative protein group of companies, crossing into foodtech, grows meat in cell cultures. It is currently developing poultry and bovine meat using regenerative technology.

Israeli agritech offers technologies to boost and enhance food safety. There are 20 Israeli companies that innovate in food-production tracking, quality monitoring, contaminant detection and sterilisation, as well as post-harvest technologies that ensure produce quality in packaging and storage.

One company has devised a pocket-sized micro-spectrometer that instantly reads produce quality, ripeness, spoilage and contamination, and reports nutrient analysis for animal feed. Another company has developed a low-power radio-transmission technology for breast-cancer screening, which it now applies also to monitoring for food safety, including dairy-contaminant detection at farms.

Israel’s population and land size is small relative to the US, China, and India, yet the country has produced an agritech sector that ranks among the top five countries in number of deals. It also receives a disproportionately large share of global agritech funding, especially in on-farm technologies and smart farming. With a significant pool of highly skilled yet affordable labour, and an influx of expertise and technological innovation from academia and the high-tech ecosystem, there is still plenty of room to grow. As global agriculture challenges become ever pressing, farmers and agribusinesses around the world are turning to Israeli agritech for collaboration. Investors, too, are realising the promise of deal flow, and the field is not yet crowded.

Further details about Israel’s agricultural sector can be obtained from the commercial office at the Embassy of Israel in Dublin. Tel: 01-230 9415 or email trade@dublin.mfa.gov.il

The information used in this article was supplied by Start-Up Nation Central, an Israeli NGO that promotes technology and innovation.

Read more

Long read: clever startup companies in an old dairy shed

SHARING OPTIONS