The average UK deadweight price reported for hoggets is running 51%, or £2.67/kg (€3.11/kg), higher than the corresponding period in 2023.

The latest hogget price reported by the Agriculture Horticulture Development Board (AHDB) for the week ending 16 March 2024 was £7.90/kg, or the equivalent of €9.21/kg at Friday afternoon’s exchange rate of 85.8p to the euro.

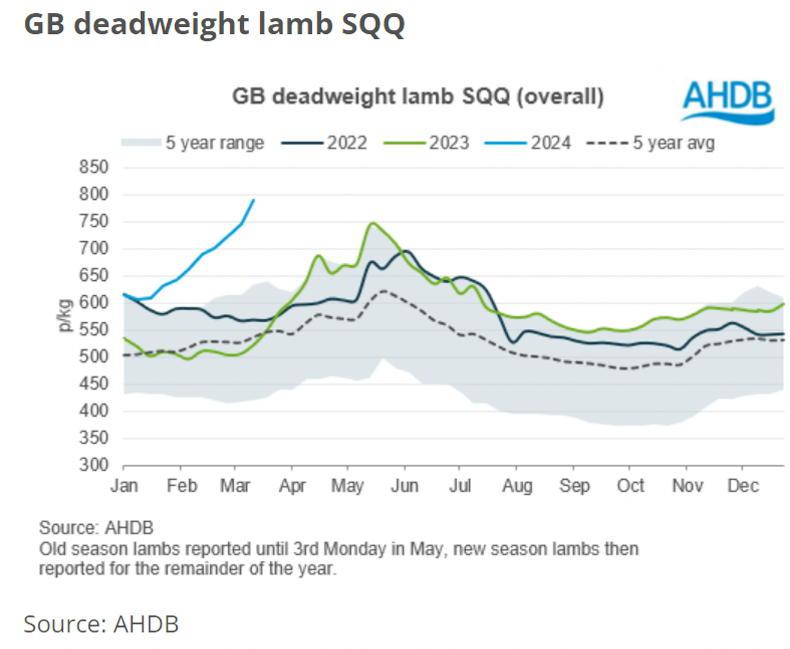

This represents an increase of 46p/kg on the previous week, with this week’s prices continuing to gain upward momentum and rising north of £8/kg (€9.33/kg). The sharp upward momentum shown in the deadweight lamb SQQ chart is being underpinned by a multitude of factors.

The AHDB reports that the 2024 sheep kill is running in excess of 100,000 lower year-to-date, while consumption trends are higher, sheepmeat exports are strong and imports of sheepmeat are lower than anticipated.

Production trends

UK sheepmeat production has been running significantly lower since the turn of the year. Estimated throughput of 2.27m head up to the week ending 16 March represents a reduction of just over 105,000 head according to AHDB’s Red Meat analyst Isabelle Shohet.

The greatest reduction occurred in February, with throughput falling by 77,000 head compared to January, or a fall of 8% to 909,000 head.

UK sheep prices are currently running 51% higher than in 2023, with year-to-date prices averaging £1.74/kg higher.

The adult sheep kill also reduced by 9,000 head in February and contributed to February 2024 being labelled as the lowest sheep kill since February 2020.

The drop in throughput led to UK sheepmeat production of 21,500t in February falling by 1,700t compared to January 2024.

The significant fall in production tallies with AHDB’s lamb outlook for 2024, which predicts that there will be a 10% or 430,000 head reduction in the hogget carryover.

If this materialises, then hogget throughput will continue to run significantly lower in the coming months.

Imports and exports

The AHDB reports that the UK sheep sector continues to benefit from a renewed focus on sheepmeat exports, and lower than anticipated imports. Sheepmeat exports for January 2024 were recorded at 6,800t, representing an increase of 820t on December 2023 levels.

This is listed as the strongest start to exports since 2020, with export volumes to France especially strong and running 1,000t higher in January. This has occurred despite the price differential between UK sheepmeat and that offered in export markets narrowing since January.

The 3,900t of sheepmeat imported from New Zealand in January 2024 is running higher than 12 months earlier. However, this is largely due to export volumes running lower in Q1 2023 due to Cyclone Gabrielle, with the sheep sector anticipating higher import volumes.

A combination of factors are again highlighted as slowing imports. Low lamb prices and improved forage availability in New Zealand is said to be encouraging producers to feed lambs to heavier weights in a bid to compensate for the lower farmgate returns.

There is also a large differential between Australian and UK sheepmeat prices, which would assume there would be a greater focus on targeting the UK sheepmeat market.

While tonnages imported increased by 190t to 860t, the AHDB says industry commentary suggest Australian exporters are focusing on other closer nations, adding that southern hemisphere exports to the UK may be marred by ongoing shipping issues in the Suez Canal.

Retail sales

The 21,441t of lamb sold through retail in the 12 weeks to 18 February 2024 equates to an increase of 5.6% on the corresponding period in 2023 according to Kantar data. Sales were helped by sheepmeat promotions during Christmas and Valentine’s Day.

This is evident in the average price paid for leg roasting joints falling by 1.7% year-on-year, despite the higher farmgate values. Not all price increases were absorbed, with shoulder roasting joints increasing by the greatest average figure of 10.6% over the 12-week period.

A cut in promotions has not seen sales figures stall, with volumes trading remaining ahead of 2023. Shohet says: “after a year of cutting back and checking prices, we see consumers turning to lamb for a treat, with an increase in instances of consumers picking lamb because of taste.

As we look forward to a period of celebration with Easter and Eid-al-Fitr in the next few weeks, we anticipate lamb will continue to see robust volume sales, with many retailers already advertising promotional offers on lamb in a bid to win the big Easter shop”.

The average UK deadweight price reported for hoggets is running 51%, or £2.67/kg (€3.11/kg), higher than the corresponding period in 2023.

The latest hogget price reported by the Agriculture Horticulture Development Board (AHDB) for the week ending 16 March 2024 was £7.90/kg, or the equivalent of €9.21/kg at Friday afternoon’s exchange rate of 85.8p to the euro.

This represents an increase of 46p/kg on the previous week, with this week’s prices continuing to gain upward momentum and rising north of £8/kg (€9.33/kg). The sharp upward momentum shown in the deadweight lamb SQQ chart is being underpinned by a multitude of factors.

The AHDB reports that the 2024 sheep kill is running in excess of 100,000 lower year-to-date, while consumption trends are higher, sheepmeat exports are strong and imports of sheepmeat are lower than anticipated.

Production trends

UK sheepmeat production has been running significantly lower since the turn of the year. Estimated throughput of 2.27m head up to the week ending 16 March represents a reduction of just over 105,000 head according to AHDB’s Red Meat analyst Isabelle Shohet.

The greatest reduction occurred in February, with throughput falling by 77,000 head compared to January, or a fall of 8% to 909,000 head.

UK sheep prices are currently running 51% higher than in 2023, with year-to-date prices averaging £1.74/kg higher.

The adult sheep kill also reduced by 9,000 head in February and contributed to February 2024 being labelled as the lowest sheep kill since February 2020.

The drop in throughput led to UK sheepmeat production of 21,500t in February falling by 1,700t compared to January 2024.

The significant fall in production tallies with AHDB’s lamb outlook for 2024, which predicts that there will be a 10% or 430,000 head reduction in the hogget carryover.

If this materialises, then hogget throughput will continue to run significantly lower in the coming months.

Imports and exports

The AHDB reports that the UK sheep sector continues to benefit from a renewed focus on sheepmeat exports, and lower than anticipated imports. Sheepmeat exports for January 2024 were recorded at 6,800t, representing an increase of 820t on December 2023 levels.

This is listed as the strongest start to exports since 2020, with export volumes to France especially strong and running 1,000t higher in January. This has occurred despite the price differential between UK sheepmeat and that offered in export markets narrowing since January.

The 3,900t of sheepmeat imported from New Zealand in January 2024 is running higher than 12 months earlier. However, this is largely due to export volumes running lower in Q1 2023 due to Cyclone Gabrielle, with the sheep sector anticipating higher import volumes.

A combination of factors are again highlighted as slowing imports. Low lamb prices and improved forage availability in New Zealand is said to be encouraging producers to feed lambs to heavier weights in a bid to compensate for the lower farmgate returns.

There is also a large differential between Australian and UK sheepmeat prices, which would assume there would be a greater focus on targeting the UK sheepmeat market.

While tonnages imported increased by 190t to 860t, the AHDB says industry commentary suggest Australian exporters are focusing on other closer nations, adding that southern hemisphere exports to the UK may be marred by ongoing shipping issues in the Suez Canal.

Retail sales

The 21,441t of lamb sold through retail in the 12 weeks to 18 February 2024 equates to an increase of 5.6% on the corresponding period in 2023 according to Kantar data. Sales were helped by sheepmeat promotions during Christmas and Valentine’s Day.

This is evident in the average price paid for leg roasting joints falling by 1.7% year-on-year, despite the higher farmgate values. Not all price increases were absorbed, with shoulder roasting joints increasing by the greatest average figure of 10.6% over the 12-week period.

A cut in promotions has not seen sales figures stall, with volumes trading remaining ahead of 2023. Shohet says: “after a year of cutting back and checking prices, we see consumers turning to lamb for a treat, with an increase in instances of consumers picking lamb because of taste.

As we look forward to a period of celebration with Easter and Eid-al-Fitr in the next few weeks, we anticipate lamb will continue to see robust volume sales, with many retailers already advertising promotional offers on lamb in a bid to win the big Easter shop”.

SHARING OPTIONS