For several decades, Europe and the US - either jointly or individually with the other's support - have dominated global politics and trade.

In more recent years, there has been an alternative grouping of resource-powerful emerging economies including Brazil, Russia, India and China (BRIC).

The Russian invasion of Ukraine has met with a united US and European response, including the UK, which has been at loggerheads with the EU at times over Brexit.

Elsewhere, the response to the invasion has been muted, with many African countries neutral or even somewhat sympathetic to Russia.

It was also striking last week to note that Brazil’s President Lula, on his state visit to China, was offering to work with China to try to secure peace in Ukraine.

It was also notable that Russia’s Foreign Minister Sergey Lavrov visited Brazil and met with his counterpart and the president, who were looking to secure continued Russian fertiliser supplies and more access to the Russian market for Brazil’s agri exports.

International relations

The current Brazilian government has a much more outward looking perspective than its predecessor under President Bolsonaro.

The outreach to China, and a lesser extent Russia, has irritated the US, but it is clear that Brazil is seeking to firmly establish a niche in the world, forming international relationships that are independent of the US.

As well as sounds about mediating in Ukraine, it was also interesting that China and Brazil are looking at how trade between them could move away from being based on the US dollar, which is the accepted international currency for trade.

Trade fit

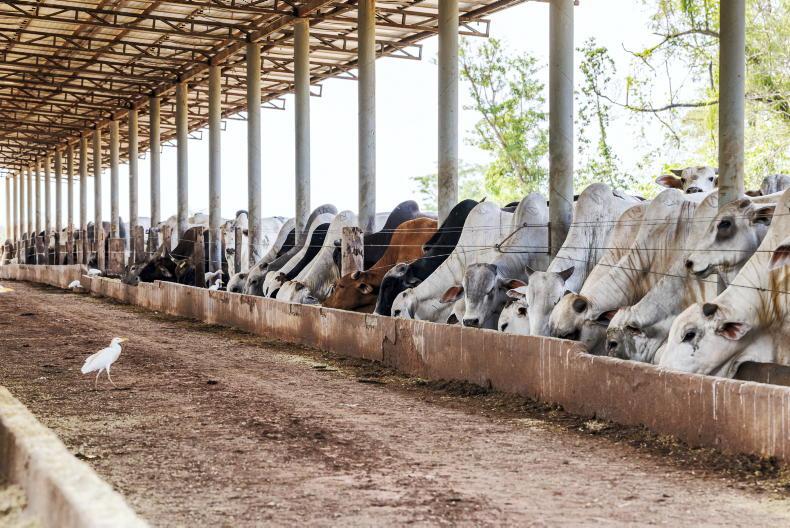

Brazil and China are a natural fit when it comes to trade. China is the world's biggest importer of all types of meat in which Brazil is the world's biggest exporter.

China is a high-tech economy, with an established pattern of investing overseas to secure strategic supplies of goods that China requires to import.

This has brought Chinese investment to many African countries and with Brazil holding the door open, we can expect Chinese investment in Brazil and their South American neighbours to increase in the years ahead.

Does this matter to Irish farmers?

At one level, not really. When price and quality are equal, countries export to their closest markets for cultural and convenience reasons.

That means that Britain will always be Ireland’s preferred market for exports and it will require an extra incentive to send exports further.

When it comes to supplying China or the US, volumes will be smaller and it will tend to be for niche products.

There will be exceptions, such as during the African swine fever outbreak in China when a dramatic drop in product led to a doubling of Irish pigmeat exports to that market.

Similarly, China’s demand for beef imports has grown so dramatically over the past decade that it could accommodate all the product offered.

That is expected to slow down, but while Brazil will continue to be the main supplier of beef imported by China, there will be an opportunity for Ireland to build a substantial market as well.

Read more

European Parliament votes to ban beef linked to deforestation

First steps for Irish beef in China

China’s beef imports to stagnate this year

For several decades, Europe and the US - either jointly or individually with the other's support - have dominated global politics and trade.

In more recent years, there has been an alternative grouping of resource-powerful emerging economies including Brazil, Russia, India and China (BRIC).

The Russian invasion of Ukraine has met with a united US and European response, including the UK, which has been at loggerheads with the EU at times over Brexit.

Elsewhere, the response to the invasion has been muted, with many African countries neutral or even somewhat sympathetic to Russia.

It was also striking last week to note that Brazil’s President Lula, on his state visit to China, was offering to work with China to try to secure peace in Ukraine.

It was also notable that Russia’s Foreign Minister Sergey Lavrov visited Brazil and met with his counterpart and the president, who were looking to secure continued Russian fertiliser supplies and more access to the Russian market for Brazil’s agri exports.

International relations

The current Brazilian government has a much more outward looking perspective than its predecessor under President Bolsonaro.

The outreach to China, and a lesser extent Russia, has irritated the US, but it is clear that Brazil is seeking to firmly establish a niche in the world, forming international relationships that are independent of the US.

As well as sounds about mediating in Ukraine, it was also interesting that China and Brazil are looking at how trade between them could move away from being based on the US dollar, which is the accepted international currency for trade.

Trade fit

Brazil and China are a natural fit when it comes to trade. China is the world's biggest importer of all types of meat in which Brazil is the world's biggest exporter.

China is a high-tech economy, with an established pattern of investing overseas to secure strategic supplies of goods that China requires to import.

This has brought Chinese investment to many African countries and with Brazil holding the door open, we can expect Chinese investment in Brazil and their South American neighbours to increase in the years ahead.

Does this matter to Irish farmers?

At one level, not really. When price and quality are equal, countries export to their closest markets for cultural and convenience reasons.

That means that Britain will always be Ireland’s preferred market for exports and it will require an extra incentive to send exports further.

When it comes to supplying China or the US, volumes will be smaller and it will tend to be for niche products.

There will be exceptions, such as during the African swine fever outbreak in China when a dramatic drop in product led to a doubling of Irish pigmeat exports to that market.

Similarly, China’s demand for beef imports has grown so dramatically over the past decade that it could accommodate all the product offered.

That is expected to slow down, but while Brazil will continue to be the main supplier of beef imported by China, there will be an opportunity for Ireland to build a substantial market as well.

Read more

European Parliament votes to ban beef linked to deforestation

First steps for Irish beef in China

China’s beef imports to stagnate this year

SHARING OPTIONS