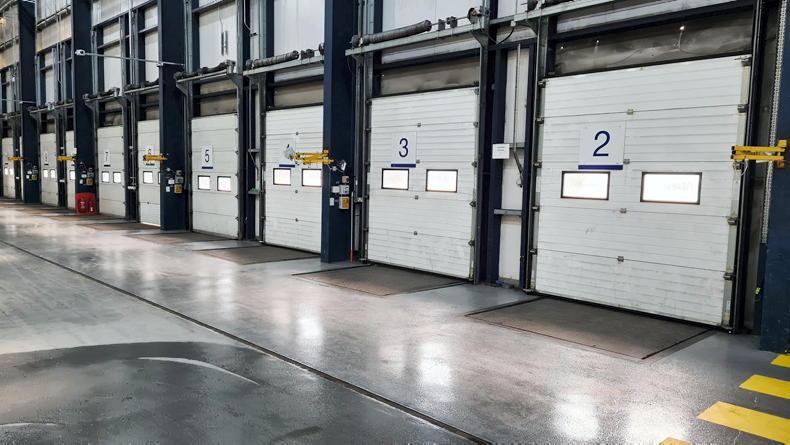

With all deadlines missed, talks continue between the EU and UK to decide just how traumatic the UK’s departure from the EU customs union and single market will be. At a minimum, rules for trading will revert to what they were before the single market was set up in 1993. This means veterinary certification for all products of animal origin and customs declarations.

Deal still means red tape

This means a dramatic increase in the red tape on agricultural exports leaving Ireland for Britain or even using Britain as a landbridge to enter the rest of the EU. The industry in Ireland knows what is required as all sectors export to a greater or lesser extent to markets outside the EU at present. What will be different is the level of administration that has to be done for each delivery. Currently Irish exporters don’t have enough shipping capacity on the direct route to the continent but this may come when the need is confirmed. All of this red tape adds cost to the supply chain and that inevitably leaves less money for farmers – typically 10-12c/kg less for beef and 1.2c/l for milk.

Market devaluation inevitable

Even if there is a deal, the UK will inevitably leverage its need to import food to the value of €100m every day. This is an attractive proposition to the major meat exporters in South America, and talks are already under way with the US, New Zealand and Australia. The UK government’s negotiating strategy recognises that Australia and New Zealand have a competitive advantage over UK farmers which is likely to lead to shrinkage in the sector. We can only imagine the extent it will squeeze Irish exports to the UK, reducing the value of the market and inevitably farmgate prices.

Ministers McConalogue and Coveney have expressed their ambition to keep Irish produce on British shelves come what may

The best possible deal now available is still a bad deal for Irish farmers in the medium and longer term, but no deal is worse. If there is no deal, Irish agriculture faces tariffs that would make the big exports of beef, cheese and butter to Britain unaffordable as they would carry an import tax load of €1.1bn, with other sectors bringing the total import tax bill up to €1.5bn. Ministers McConalogue and Coveney have expressed their ambition to keep Irish produce on British shelves come what may, and doing so will require an expensive tariff equalisation scheme.

No plan B for beef

All sectors apart from beef may in time be able to diversify into different products or other markets. The first choice market for Irish beef is the UK, the second choice the rest of the EU. If shut out of the UK market, a tsunami of Irish beef will hit the EU 27 market, which is oversupplied by 16% because of the UK’s departure. When it comes to the tariff load in a no-deal Brexit, 20 out of the 27 EU members would be relatively unaffected. However, if Irish beef is priced out of the UK market by import tax, every EU state will feel the impact of oversupply of beef.

EU toolbox

The EU speaks of the toolbox of measures it has used in the past to protect farm incomes at times of crisis, from BSE through foot-and-mouth disease and more recently the Russian embargo in 2014. However, it has never experienced a crisis like 250,000t of Irish beef looking for a home in an oversupplied EU market.

Tariff equalisation would work, but it would put unsustainable strain on Irish and EU finances in the long term. However politically unacceptable it might be, there is also the option of closing the EU market to imports until stability is restored.

The UK meat industry letter to the DEFRA minister this week clearly signals that England and Wales are in no position to service meat exports due to a scarcity of vets

There is a minor consolation in that trade will be able to continue cross-border on the island of Ireland. And if the NI meat processing industry’s import of carcases from Britain is disrupted there may be some opportunities for southern cattle and even beef carcases to go North. The UK meat industry letter to the DEFRA minister this week clearly signals that England and Wales are in no position to service meat exports due to a scarcity of vets. The number of veterinary certificates was originally estimated at 300,000 annually but one of the large processing groups has said it needs up to 100,000 certificates for its business alone.

Bad deal or no deal

The options for the future trading relationship between Ireland and Britain is either a bad deal or no deal which would be even worse. Ministers McConalogue and Coveney have expressed their commitment again to support farmers in their interviews on pages 22 and 23. This support will cost the Government money, the amount and timing will be determined by having a deal that allows business continue wrapped in red tape or no deal which creates an unbearable tax burden.

SHARING OPTIONS